54 // iberian.propery / 2017

dossier// ISSUE: TOP IBERIAN Investors

In 2016, the investor profilewasmore diversified, fromCore to Opportunistic,

also including Core Plus and Value-Added, and it has remained this way

in 2017, with extremely dynamic demand from a wide range of investors.

The country’s improved risk perception and yields with an extremely in-

teresting differential in comparison with other European markets, should

continue to draw increasing interest from Core investors in 2017. We note

that, while the prime yield in Lisbon offices (CBD) is 5%, in Madrid and

Barcelona it is 4%, in London (West End) it is 3.8% and in Paris (CBD) it is 3%.

On the other hand, compared with 2016, we expect a greater predomi-

nance of investors with an appetite for risk, along with a rise in rents (vs

yield reduction). Indeed, rental values, namely in the office sector, are

currently under great pressure due to extremely dynamic demand that

has, however, been hard to materialise due to a lack of available space.

Although yields are currently at record lows andmay still compress further

in some sectors, these are not expected to vary as much as rents.

At the same time, due to extremely lowyields, there is a greater propensity

for risk among investment funds with a traditionally Core profile in order to

guarantee their investors/ subscribers higher rates of return. The acquisition

of properties to regenerate for residential use, namely in Lisbon, has been

the target of these funds. However, this type of product is becoming scarce

and there is already some interest in acquiring land for new build projects.

Opportunistic buyers should be less active in 2017 since a substantial

quantity and volume of assets are not likely to enter themarket; a situation

that may change with the sale of Novo Banco, since this entity still owns

several sizeable assets and portfolioswhose disposalwas placed on hold.

On the contrary, greater momentum is expected on the sale side since

the products of some investment funds that entered at the beginning of

this cycle (Early Birds) are now in the final stage of their lifecycle.

Regarding the banking sector in Portugal, there is still a considerably high

volume of nonperforming loans (NPL) in real estate assets, despite the

gradual disposal of small portfolios. The value of assets held by banks is

estimated at about € 10.000million. Larger portfolios are expected to enter

themarket in 2017, resulting in the arrival of newplayers in this NPLsegment.

Core investors who are recently active in the Portuguese market include,

namely, CBREGI andREITs such asMerlin andTrajano, bothSpanish, and the

SouthAfricangroupLoadstone;whileOaktree, SignalandAnchorageCapital

standout among investorswithamoreValue-AddedandOpportunisticprofile.

Overall, investors don’t really have an Iberian strategy. At best, they target

countries in southern Europe. Only a small number of investors have a

joint strategy for Portugal and Spain, as is the case of SOCIMIs (Spanish

REITs) and some Spanish family offices.

In terms of REITs, it is expected that legislation enabling this investment

structure to operate in Portugal will be concluded this year, which may

bring a new dynamic to the market. However, and despite the interest

already shown by some investors to create andmanage these structures

in our country, it is uncertain whether there is sufficient product to create

REIT vehicles in Portugal since, by nature and legislative enforcement,

these vehicles invest in income assets (Core and Core Plus product). In

any case, the possible creation of a REIT in Portugal will not take place

before the end of the year.

Although it is currently difficult to determine the origin of investment

(frequently associated with the domicile of the structure/ vehicle), we

foresee that, overall, investment in 2017 will, like in 2016, originate mostly

fromEurope, but with the entry of new investors fromdifferent geographies

such as South Africa and the Middle East.

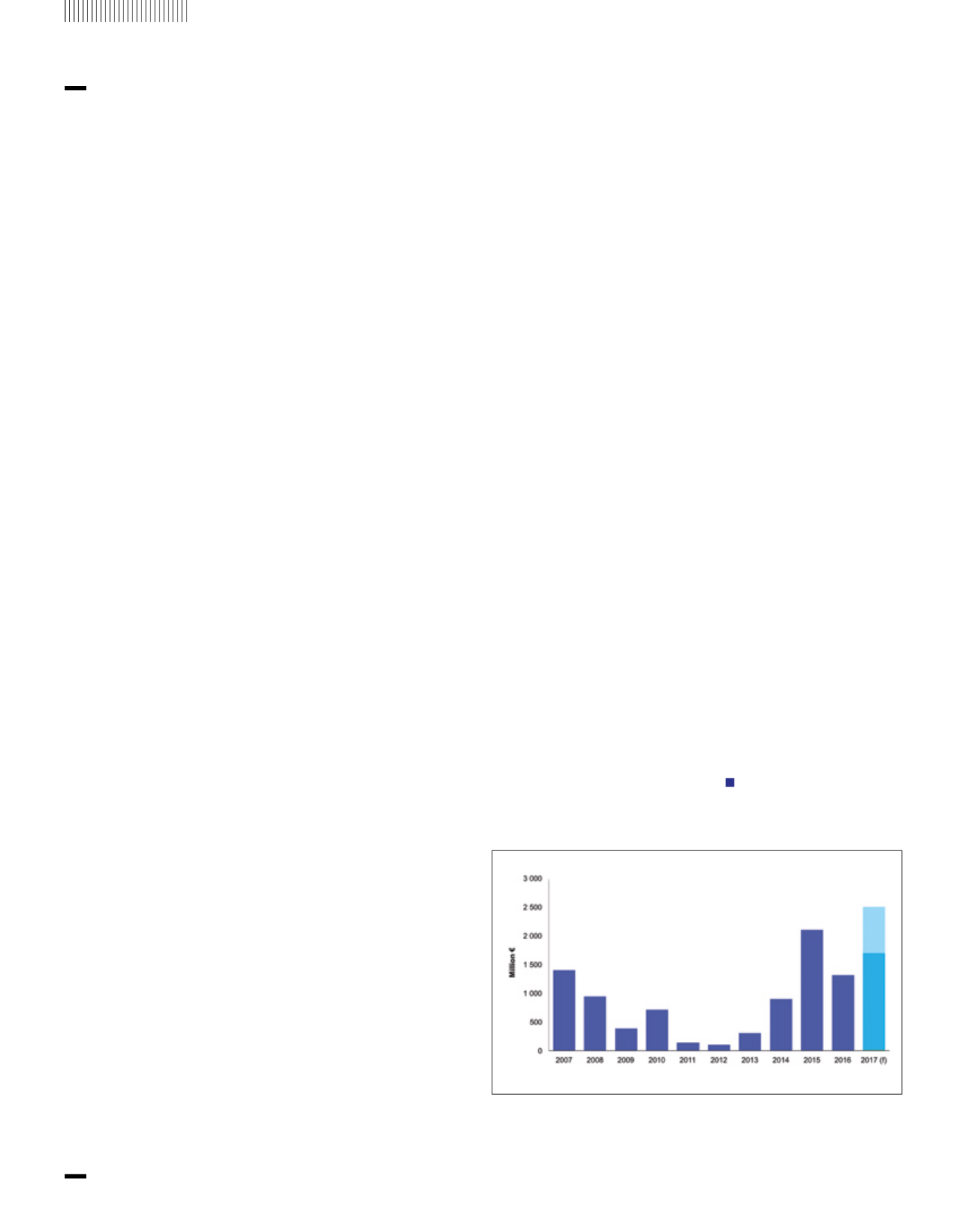

In conclusion, CBRE expects 2017 to be another year of strong investment

in commercial real estate in Portugal. CBRE estimates that, in the first half

of 2017, a total of € 1.000 million in transactions will be completed, with

the year closing at around € 1.700 million, possibly even surpassing the

record value achieved in 2015, provided the transaction of a portfolio of

shopping centres is completed this year.

Annual Investment Turnover in Portugal

Source: CBRE Research Portugal