50 // iberian.propery / 2017

dossier// ISSUE: TOP IBERIAN Investors

INVESTOR PROFILE: BEFORE AND NOW

During the recession years, office take-up declined, whilst the amount of

available vacant space rose. As a result, the prime rent dropped sharply,

plunging by around 40% in both Madrid and Barcelona.

Investing in the Spanish real estate market was therefore considered a

risky investment and as a result prices fell considerably, not just due to

the lack of demand, but also due to the rising number of divestments

taking place in the real estate sector, a situation which drove up supply.

Against this backdrop, opportunistic investors entered the market in 2013

and 2014, taking advantage of these low prices on the expectation that

the market would recover, that the value of their assets would increase

and that they would be able to subsequently sell them above their

acquisition price, thereby obtaining healthy capital gains.

Since then, the sector’s recovery has been clear for all to see. Demand

has recovered and prime rents have grown at a healthy rate for nearly all

of the last two years. Growth forecasts are also very upbeat for all sectors.

For example, in the office sector, Madrid and Barcelona are two of themain

European cities forecast to register the highest y-o-y rental growth until 2021.

Madrid and Barcelona boast strong rental growth potential for the next

5 years in all sectors.

This backdrop has fuelled investor confidence, and allowed the Spanish

real estate market to post two consecutive record investment volumes

in 2015 and 2016.

This newmarket climate has also allowed a newtype of investor to enter the

market, investorswith a Core Plus or Core profile that are looking for quality,

well-located assets where returns are mainly generated via rental income.

However, despite this type of investor’s heightened interest in the Spanish

real estate market, there is a lack of quality product on the market, given

that many owners are holding onto their properties in light of the forecast

rental growth. This has created a barrier to entry for this type of investor,

given that current owners who are willing to sell, are doing so based on

futuremarket conditions and not based on the reality of the current market.

The lack of prime product on the market is causing these investors to

move towards markets that have traditionally been classed as secondary,

or even to invest in non-prime product alternatives, such as construction

projects. Some isolated alternative investments were seen in 2016 and

more are expected to appear in 2017.

Core-Plus and Core investors are showing the greatest interest in the

Spanish real estatemarket, howeverValue-Add investors are best-suited

to the current market climate.

Given the lack of quality product, the investor profile that is undoubtedly the

best-suited to the current market climate is Value-Add. There are several

examples of these types of deals, especially in theoffice sector,where inves-

tors purchase assets with low occupancy rates or high capex requirements

in order to reposition and subsequently sell them when the assets have

higher occupancy rates, thereby obtaining attractive returns via value uplift.

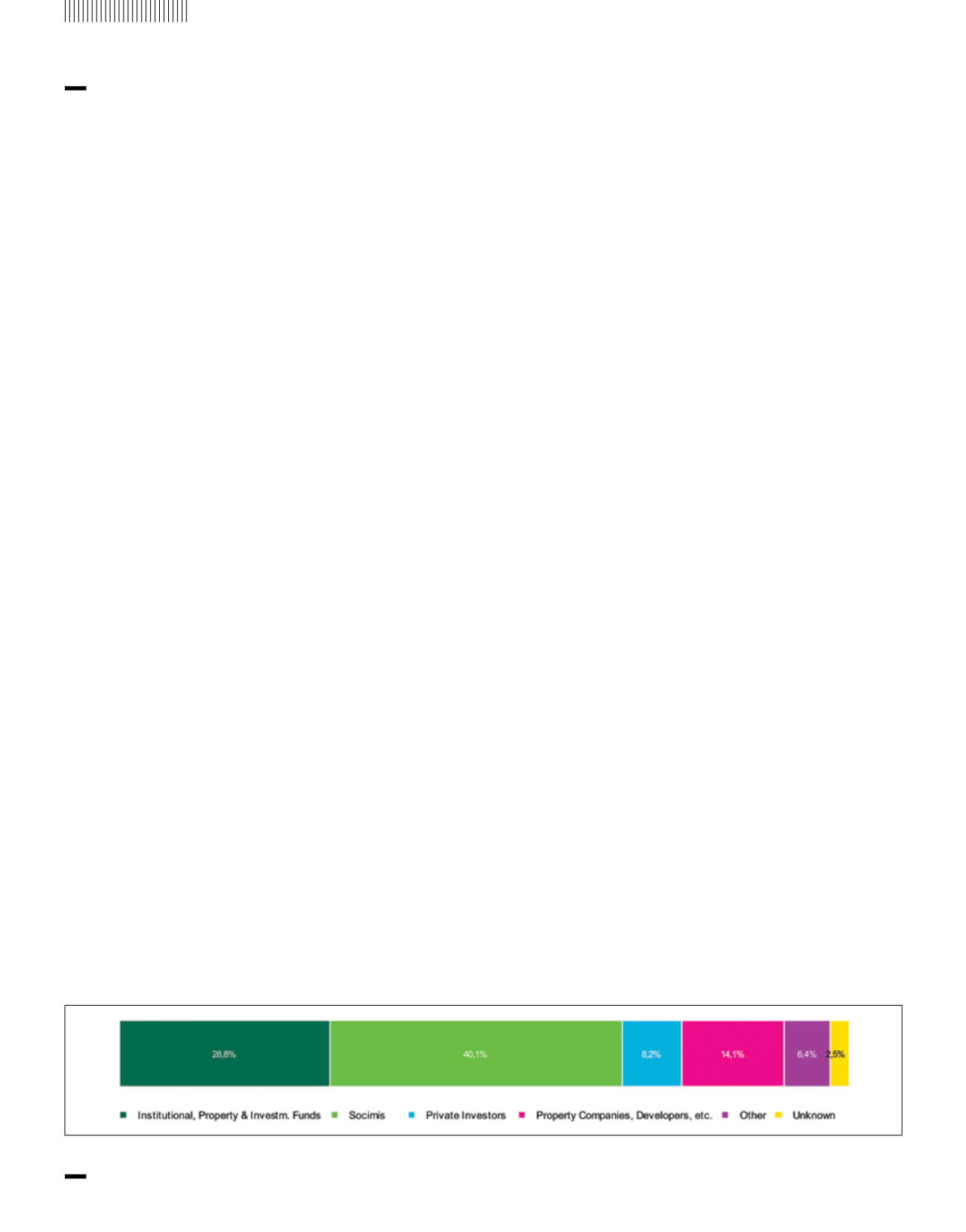

INVESTOR TYPE

Since 2014, theword Socimi has become synonymouswith the Spanish real

estatemarket.Their role in themarket has andwillcontinue tobe key: in 2016

theywere once again the most active players, representing 39% of the total

investment volume. Moreover, aswell as the fourmajor players in the sector,

Merlin,Axiare, LarEspaña andHispania,which are listedon theSpanish stock

exchange, a total of 29 other Socimis are also listed on the MAB (Alternative

Stock Exchange Market), 17 of which were floated in 2016. This figure is ex-

pected to continue climbing in 2017, as newSocimis take the plunge and list.

In parallel with this, and in line with their target to grow in size and offer their

shareholdersmoreattractive returns,weare likelyto seemoreM&As, in some

cases clearlyaimedat developing specialisations anddivestingnon-strategic

assets. Socimis such asMerlin Properties have headed up some of themost

important deals in the sector, such as thepurchaseofTesta, ormore recently

the acquisition of Torre Agbar in Barcelona’s 22@ district.

In terms of investment volume, Socimis are followed by institutional funds

such as insurance companies, pension and sovereign funds, aswell as other

collective investment vehicles such as investment funds. Since 2015, this

type of investor has accounted for 29%of the total investment volume, high-

lighting big names such as Blackstone, Invesco, GreenOak andAxa among

others. Among domestic investors of this calibre, Meridia Capital is one of

the most active players, investing in almost all sectors, especially offices.

GRAPH 3: INVESTOR TYPE VERSUS TOTAL INVESTMENT VOLUME (2015 – Q1 2017)