2017 / iberian.propery // 49

ISSUE: TOP IBERIAN Investors //dossier

In 2016, the Spanish real estate market hit a

new record investment volume, registering

over € 14,000 million.

The total volume invested in the Spanish real

estate market reached € 14,022 million, up

8.2% y-o-y and a new record high. Major deals

that were particularly noteworthy included the

acquisition of the Diagonal Mar Shopping Centre

in Barcelona for € 493 million and Torre Cepsa

in Madrid for € 490 million. As well as portfolio

deals, such as the acquisition of the Merlin Prop-

erties hotel portfolio by Foncière des Regions.

In 2016, investors showed a clear interest in

all sectors, however, as in 2015, offices proved

the most attractive asset class, posting an in-

vestment volume of just over €4,800 million.

Nevertheless, this figure was down on the

€5,500 million booked in 2015, in contrast to

all other sectors where 2016’s volumes topped

those seen in 2015.

2017 started on a good footing and was the

best start to a year ever seen in terms of in-

vestment volume.

Things could not look better following an upbeat

Q1 2017. Interest to invest in the Spanish market

remains rife and the volume registered is the

best start to a year on record. A total of € 3,375

million was invested, 48%more than in Q1 2016.

OVERSEAS VERSUS DOMESTIC

INVESTORS

Since the sector started to recover back in 2013,

overseas investors have shown a particularly

strong interest in all sectors of the Spanish real

estate market. Almost 75% of the total volume

invested came fromoutside of Spain in 2013, and

although this percentage dropped in subsequent

years, a large part of this inflowstarted to be chan-

nelled through Socimis, companies under Spanish

ownership, but largely funded via foreign capital.

In 2016, overseas investors remained very active,

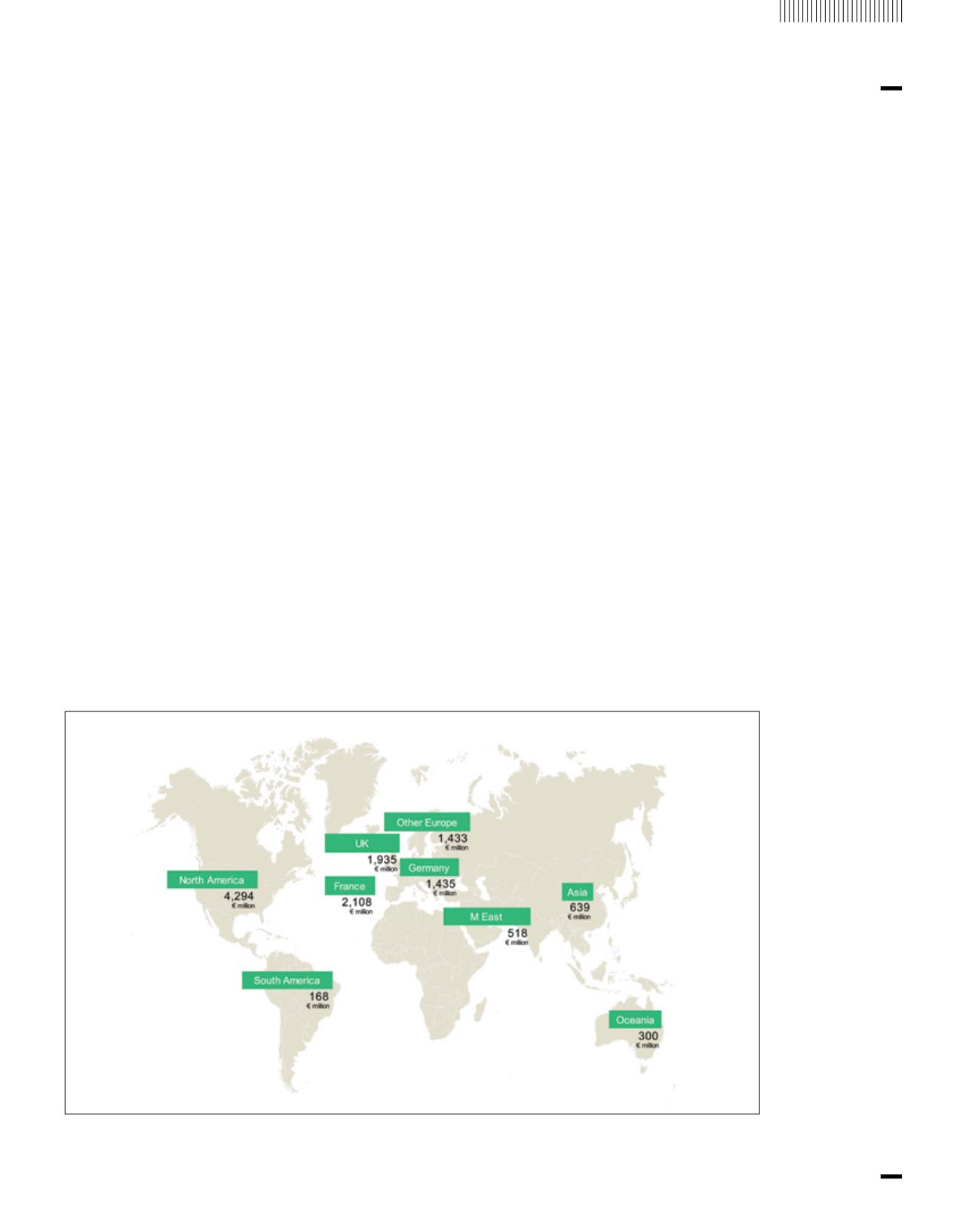

Origin of Capital Flows into Spain

representing almost 39% of the total investment

figure. Socimis accounted for39%,whilst domestic

investors represented20%.This trendextended into

Q1 2017,with68%of investment coming fromover-

seas and domestic capital accounting for just 13%.

The current heightened level of liquidity on the

market, instability in international financial mar-

kets, low-yielding debt markets and forecasts for

rental growth in various real estate sectors, are

some of the factors that have drawn overseas

investors towards the Spanish market during

the past two to three years.

By nationality, since 2015 US investors have

clearly been the most active, accounting for

36% of direct foreign investment, followed by

UK investors who represented 19%.

Among these, we would highlight players such

as Blackstone, Invesco, Intu Properties and CBRE

GlobalInvestors. Regarding themost activedomes-

tic investors since 2015, Pontegadea, Inmobiliaria

ColonialandMeridiaCapitalparticularlystandout.