60 // iberian.propery / 2017

dossier// ISSUE: TOP IBERIAN Investors

SHOPPING CENTRES: Another record year?

Both in Spain and Portugal, retail, particularly the shopping centre

format, continues to be one of the main focal points of real estate

investors in 2017.

Proof of this was the completion in the first quarter of a set of sizeable

operations on both sides of the border, totalling more than 1.3 billion euros

invested in the sector until March.

Unsurprisingly, the greatest share is concentrated in Spain. The consult-

ing firm Aguirre Newman calculates that more than 1 billion euros were

invested in the purchase of shopping centres in Spain in the first quarter.

And, in its Estudio de Mercado Centros Comerciales 2016/2017, the

company foresees that interest will remain strong throughout the year,

although they consider it unlikely that 2017 will achieve the historic level

of investment in shopping centres reached in 2016: 3.5 billion euros. The

reason for this is the decrease in product available for sale.

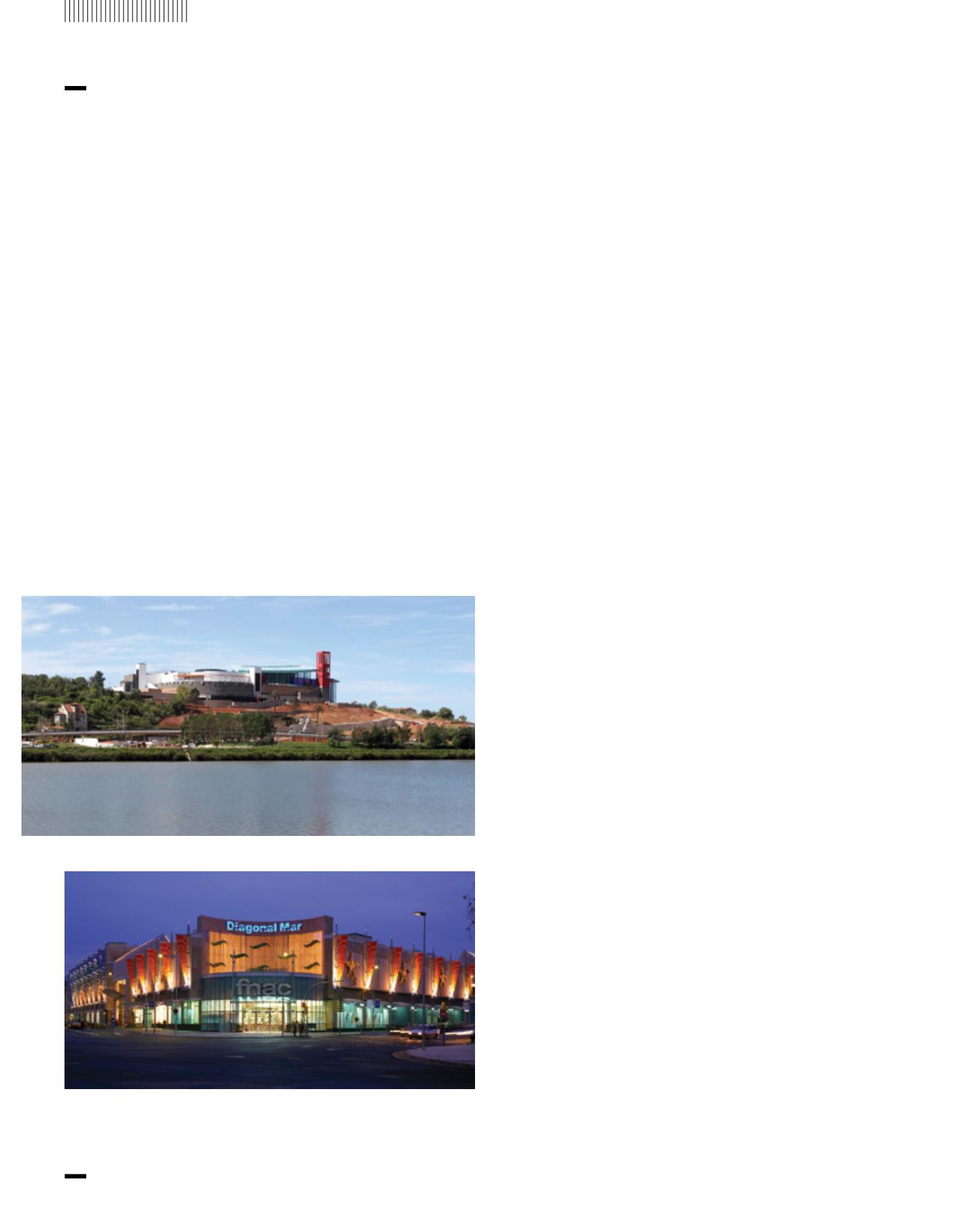

Forum Coimbra

Diagonal Mar, Barcelona

Following Barcelona, now Madrid has the most expen-

sive mall

InAugust 2016, a new Iberian recordwas set regarding the value invested

to purchase a shopping centre, approximately 490 million euros, for the

Centro Comercialy de Ocio Diagonal Mar, with 87.500m² of GLA in the Bar-

celona area, by DeutscheAsset Management fromNorthwood Investors.

However, less than six months later, in March 2017 a new record was

reached, this time in Madrid, with the purchase agreement by Intu Prop-

erties from Ivanhoe Cambridge for the Xanadú Shopping Centre, for the

historic amount of 530 million euros and an initial yield of 4.3%. Totalling

a GLA of 153.695 m², ownership of this shopping centre continued to be

disputed by investors until May when, on behalf of the fund European

Cities, TH Real Estate reached an agreement with Intu to purchase a

50% share of this asset, a deal which was closed for 264 million euros.

Also a hot year for Portugal

Meanwhile, the Portuguesemarket is also expected to have a «hot»year in

this sector, which is already off to a dynamic start with the announcement

of the purchase, among other deals, of a portfolio of two shopping centres

– Fórum Viseu and Fórum Coimbra – from CBRE Global Investors by a

consortiumof SouthAfrican investors that ismaking its début in the country,

the joint-venture Greenbay / Resilient. Closed for 219.25 million euros and

anticipating a yield of 6%, this operation illustrates the positive climate in

the Portuguesemarket, with investors originating from increasingly distant

sources andwilling to invest in the purchase of secondaryproduct, as is the

casewith these centres, with a GLAof 51.489m² and 18.705m², respectively,

and which are located outside the country’s major urban centres.

According to calculations by the consultancy JLL, retail represented

61% of the volume invested in commercial real estate purchases in the

Portuguese market in the first quarter of 2017.

And several market sources estimate that, as was the case in Spain,

Portugal may also start to register a new record for the purchase price of

a shopping centre, with one of the largest operations ever to take place

in the sector in the pipeline. This because, at the beginning of the year,

the opportunistic North-American fund Baupost placed on the market

its 90% share of Dolce Vita Tejo, located beside Lisbon and one of the

largest shopping centres in Europe, with a GLA of 104.000 m² and 300

shops. The goal of the operation is to sell for approximately 300 million

euros, in other words, almost double the 170 million euros spent to

acquire the share little more than two years ago.