2017 / iberian.propery // 65

ISSUE: TOP IBERIAN Investors //dossier

Supply shortages available

«hinders»

further growth

in Spain

However, Madrid closed the Q1 with a total take-up of 127,700 m², been

this the region with the record of the highest rent to be applied in this

period: 6 €/m² month, to a specific transaction in the CMT area, states

Aguirre Newman. In any case, JLL’s prediction is that the industrial rents

over the Spanish capital follow the course of growth, at an annual aver-

age of 2.3%, between 2017 and 2021, that is to say the 6º largest growth

at European level.

CBRE estimates that the level of activity regarding take-up inMadrid, in the

first quarter of 2017, was 13% below than in the same period. According to

the consultant themain reason is not the decelerating of demand, but yet

the supply shortages available in linewith the requirements of the take-up.

JLL estimates that Madrid’s market shows a vacancy rate of 4.29%, being

currently under construction 206.623 m² of the newGLA, 26% alreadywith

tenant, expecting that by the end of the year 107.826m² to be completed.

Investment grew 70.4% up to March

Taking this scenario into consideration, the investors keep strengthen the

focus in the industrial and logistics Spanishmarket, inwhich they invested

about €230million during the first quarter. This figure, determined byAgu-

irre Newman, in its

“Q1 Monitor Mercado Logístico de Madrid y Barcelona”,

represents an annual growth of 70.4% in viewof the €135 million assigned

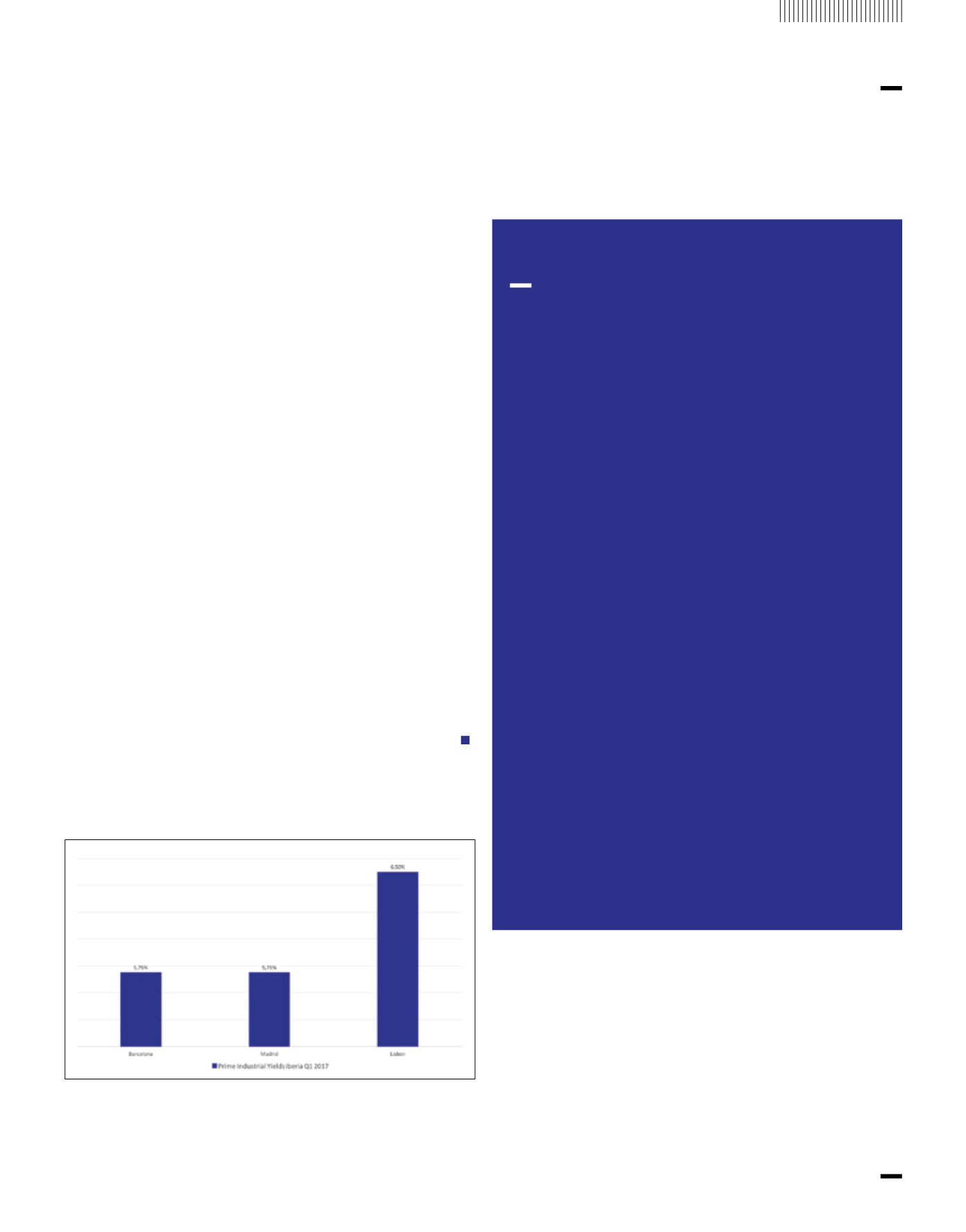

to the sector in the same period of 2016, and assume yields by 5.75%.

Prime Industrial Yields Iberia Q1 2017

sources: Cushman & Wakefield, JLL

The other side of the coin: the Portuguese case

On the other side of the border, the industrial market is the one

that has taken longer to recover, with the take-up of sites on the

market of Lisbon somewhere around 140,000 m² in 2016. This

figure, indicated by CBRE, already unfolds a 5% growth regarding

2015, but still 16% below the average of last decade.

This take-up also reflects a market where over the last four years

does not exist new construction, where the entry of newoperators

is not significant, and where large distribution companies have

been settling their expansion needs into the places they already

occupied, due to the lack of available qualified warehouses.

Nevertheless, after five years of residual encouragement in greater

Lisbon area, it was launched in 2016, in Alverca, the first speculative

construction project. Taking into account the business growth of

the distribution companies, the CBRE expects more movements

in this sector this year, anticipating the launch of new buildings.

One of those projects concerns the construction of the first naves

in the Logistics Platform Lisbon-North, in Castanheira do Ribatejo.

With a development potential of 430,000 m² of Gross Floor Area,

this platform would gain a fresh impetus after its acquisition last

September, by Merlin.

This asset was one of the five included in the “

done deal”

by Spanish

socimi with SABA, acquiring by €115 million SABA Parques Logísti-

cos and its assets, namely the parks in CimVallès (Barcelona) and

Lisboa-Norte (Portugal), as well as equities in Parc Logístic de

la Zona Franca (Barcelona), Sevisur (ZAL Puerto de Sevilla) and

Arasus (Álava).