The Iberian Property Data© database identified 74 commercial real estate investment operations concluded in Madrid between January and December 2021, amounting to a total of 2.6 billion euros. This result is lower than the performance in 2020, both in the number of deals (with less 11 operations than the 84 registered that year) and the total volume invested (-35% y-o-y, compared to 3.5 billion euros). In line with this trend, the average value per operation also shrank in this period, from 41.6 million euros in 2020 to 35.1 million euros.

Despite this annual decrease, looking at the evolution of capital markets in Madrid throughout the year, the outlook is undeniably positive, with persistent growths in the number of deals and amounts traded in every quarter. Therefore, after a slow start to the year, with just 14 operations and 364 million euros invested in the 1st quarter, investment increased 64% to 597 million euros in the 2nd quarter (16 operations), followed by a new quarterly growth of 28% in the transition to the 3rd quarter, which amounted to over 766 million euros and 21 transactions. Registering yet another growth of 14%, the 4th quarter was the best of the year, with 871 million euros invested in 23 deals. And this upward trend is expected to continue in 2022.

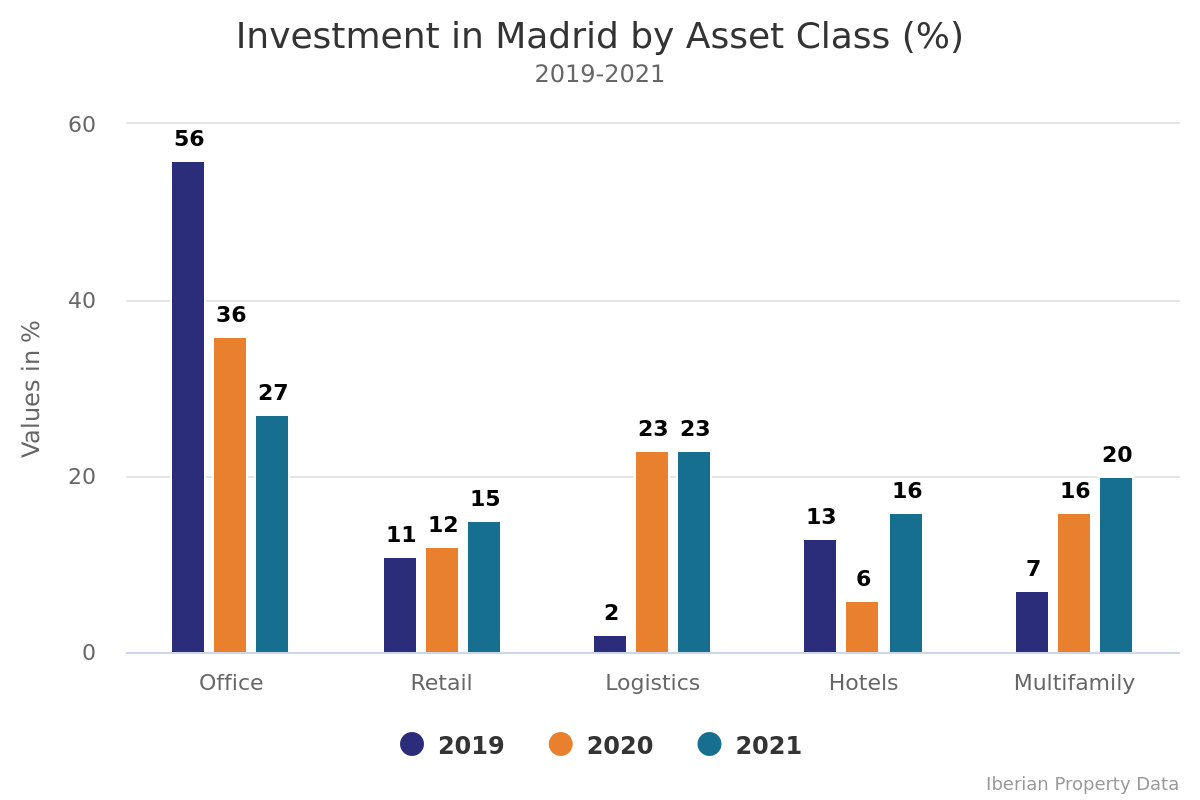

Offices and logistics are worth 50% of the market

Offices were the asset class that attracted the largest share (27%) of capital invested in Madrid last year, undertaking 23 operations amounting to approximately 695 million euros. Valued at around 150 million euros, the purchase of 50% by Incus Capital of the 50% of Torre Caleido owned by Villar Mir was the largest operationconcluded in this segment in 2021. Although still very much on the investor radar, the flow of capital allocated to office acquisitions in Madrid has been decreasing substantially in the last three years, going from 2.1 billion in 2019 to 1.3 billion euros in 2020, and dropping again in 2021, to 695 million euros. In other words, although they maintained their lead on the podium, last year Offices saw their market share in Madrid fall 9 p.p. compared with the 36% recorded the previous year, and 29 p.p. compared with the 56% obtained in 2019.

As is happening all over Spain, the logistics sector seems to be following the opposite trend, displaying strong growth in the volumes invested in Madrid compared with the pre-pandemic period, going from a 2% share in 2019 to the current 23%, in line with the performance observed in 2020, guaranteed by 12 operations that amounted to 585 million euros. The principal operation was the purchase of a portfolio of logistics warehouses by Aberdeen, for 227 million euros.

Multifamily appears in third position and, like logistics, this is one of the asset classes that seems to have gained momentum among investors during the pandemic, carrying out approximately 25 operations that totalled almost 511 million euros in 2021, representing a 20% share of Madrid’s market. Among the most important operations, we note the purchase of a Build-to-Rent project in Arganzuela by Greystar, for 120 million euros.

With around 414 million euros in transactions, Hotels also saw their market share grow substantially last year, rising from 6% in 2020 to 16% of the total value traded in the Spanish capital, now occupying 4th place in this ranking.

In 2021, there were also nine operations for the purchase of Retail assets, valued at 393 million euros, a figure that remained relatively stable compared with the 438 million euros in 13 deals registered in 2020, and giving this asset class a 15% share of Madrid’s market.