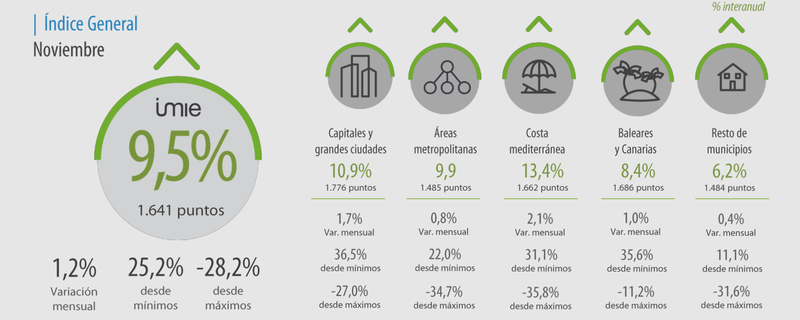

The residential market showed in November, in line with other economic sectors, an upward trend in prices. The average value of new and used housing increased by 1.2% in the monthly rate, according to the Tinsa IMIE General and Large Markets statistics published today, which leaves the year-on-year variation of the general index at 9.5%. "The evolution of the real estate sector is framed in an environment of economic recovery in which demand reactivates faster than supply and puts prices upward," says Cristina Arias, director of the Tinsa Research Service.

In the residential market, the statistics reflect that all geographic aggregates register high variations, both in interannual and accumulated terms since March 2020 and somewhat more moderate during 2021, verifying an upward trend above the rates of 2019.

As in previous months, the year-on-year variation data is boosted in its amount by the comparison with a period in which housing registered more intense price adjustments, in the last quarter of 2020. The Mediterranean coast (+13, 4%) and capitals and large cities (+10.9%) registered the highest increases in November compared to a year earlier. Metropolitan areas (+9.9%) have also appreciated in the last year above the national average.

Tinsa IMIE General index

The demand associated with the new housing needs discovered by users during confinement is being accompanied by an investment interest. "Demand reflects activity above supply in an environment of low interest rates, which together with uncertainty about inflation and the lower profitability of other financial products - deposits and public debt - make the real estate product an attractive alternative investment" , says Cristina Arias.

Despite inflationary tensions, the analysis of indicators rules out warning signs from the point of view of granting credit. "The relationship between mortgages and sales is maintained in a balanced proportion that shows the saving capacity and the own resources of the current demand, in a framework in which the granting criteria of financial institutions have not changed. For all these reasons, we rule out that there is an overconsumption of credit and residential product ”, explains the director of the Tinsa Research Service.

In the last month (November vs. October), the statistics reflect a moderate upward trend of 1.7% in the general index, with maximum growth of around 2%. The smallest municipalities in the interior and on the Atlantic coast, grouped in 'Rest of municipalities', stood out for their stability (+0.4% per month), as well as the island territories, where the average price increased by 1.1% between October and November.

Evolution from highs and lows

The average value of new and used homes has increased by 28.2% from the lowest value recorded by the general index after the financial crisis (February 2015). The rise of 36.5% experienced by the capitals and large cities and of 35.6% in the islands contrasts with the increase of just 11% experienced by the locations grouped in 'Rest of municipalities' and 22% of the areas metropolitan.

After the rise in prices registered in recent months, the average value in Spain is 28.2% below the most stressed moment of the previous cycle, in 2007. On the Mediterranean coast, the cumulative fall from its highs stands at 35.8%, remaining the group with the greatest difference compared to 2007, in contrast to the scant 11.2% that separates the current average price in the islands from its maximums.