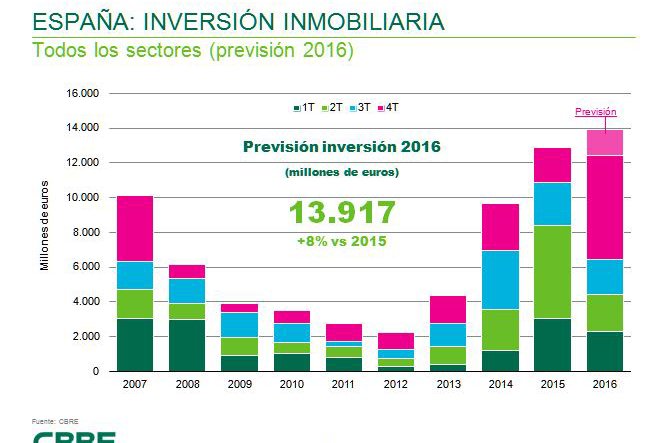

Even though it is clear that until the third trimester the volume of real estate transactions was not more than the previous year, the last trimester has recorded extraordinary activity, exceeding 7,500 million euros. In this way, in just one trimester, investment is almost the same as that registered in 2011, 2012 y 2013 together.

Among the operations of the last trimester which stand out, Torre Foster of Madrid can be highlighted, acquired by Pontegadea (490 million euros) and Adequa Ciudad Empresarial acquired by Merlin Properties (380 million euros).

At close of year, the most active real estate sector has been in offices, at 5,000 million euros, slightly below the 5,500 million in 2015. For its part, the retail sector, with an investment of about 4,200 million, has shown the greatest growth, 15% more compared to the previous year. In Logistics, (slightly more than 720 million invested) 2015 levels have been maintained whilst in the hotel sector, with approximately 1,700 million, there was a slight drop in investment. Lastly, in the sector denominated ‘Others’, which includes residential, parking spaces and further alternative assets, investment exceeded 2.200 million euros.

In this sense, Adolfo Ramírez-Escudero, President of CBRE Spain pointed out “2017 will be the year of the consolidation and recovery of the residential market, especially in Madrid and Barcelona where demand clearly exceeds the minimal supply on offer”.

Up to now, CBRE stresses that more than 37% of investment has come form abroad, led by North Americans, followed by the Germans and British. However, the SOCIMI, with Merlin at the head, are leaders in the Spanish sector at 40% of total investment. This national investor is more and more active, up five points in the percentiles compared to last year.

According to this real estate consultant, invested have continued to be interested in the Spanish real estate market, even though activity has been less to more. Thus, rents have remained somewhat low, especially during the second half of 2016, although a clear polarisation of the market can be observed: prime assets have fallen to historic lows of below 4% for offices and 3.5% in the high-street, whilst secondary locations have received less attention in 2016 than in 2015 on the part of investors. The highest yields at this moment are in Logistics assets, with totals around 6-6.25% in prime product.

Para Adolfo Ramírez-Escudero, “It is important to emphasize that investment is more fundamental than three years ago: the difference between opportunistic investors who were the first to invest strongly in the Spanish market, and the recent activity on the part of investors seeking low risk opportunities, insurers and institutional funds, among others, whose presence on our market confirms the trust of this investor profile in our real estate sector. Prices quoted have also gained weight, which generates more stability and liquidity in the long term. In this way, investment is more diversified and with less than in previous cycles”.