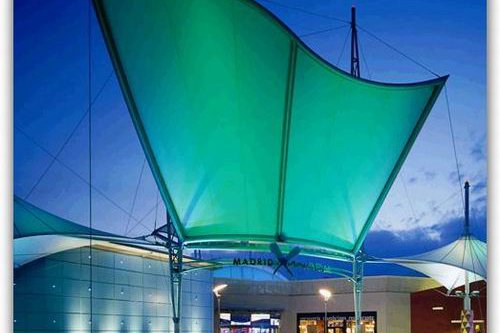

intu Xanadú, Madrid

According to the company, the negotiations were «ongoing with financial stakeholders to achieving standstill-based agreements. However, insufficient alignment and agreement in relation to the terms of such standstill-based agreements have been achieved with financial stakeholders ahead of the deadline. As such, the application is being made for the Administrators to be appointed to intu and several other key central entities in the intu Group», can be read in a release.

Leading this operation should be James Robert Tucker, Michael Robert Pink and David John Pike, from KPMG, it can be read in the document, which further advanced that intu’s shares’ trading has already been suspended by the London Stock Exchange’s Financial Conduct Authority. And it was not the only one, since «the Main Board of the Johannesburg Stock Exchange has suspended the listing and trading of intu’s ordinary shares on the Main Board of the Johannesburg Stock Exchange».

This operation should end with the sale of its assets, advanced newspaper Expansión. In Spain, the British company owns 50% of intu Xanadú together with Nuveen Real Estate currently estimated at 260 million euro and also mega-complex intu Costa del Sol worth 800 million euro, which is still in the project stage. According to information advanced by Property EU, Eurofund has already proposed to increase its share within mega-project Costa del Sol, making it a potential buyer for the asset.

On its shopping centres, intu clarified in the same release that the «underlying group operating companies remain unaffected and all shopping centres are continuing to trade». And he further revealed that, in the future, «the shopping centre operating companies have or are expected to enter into transitional services agreements with the Administrators of the central entities to ensure continuity of service provision by the central entities to the individual shopping centres».

This is an ending intu has been trying to avoid for a long time. In March, the British company had already announced the sale of a shopping centre portfolio in the United Kingdom for 1 billion euro to avoid the collapse. And, in Spain alone, intu carried out several divestments. The sale of Puerto Venecia for 475 million euro to Generali and Union Investment Real Estate was the latest divestment operation and it took place in May.