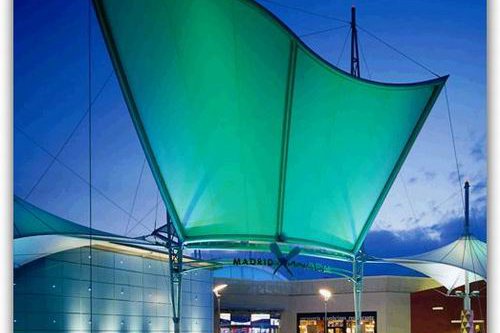

intu Xanadú Shopping Centre | Photo Collected From intu properties

This information was reported by agency Bloomberg which further informed that consultant CBRE had been chosen to mediate the operation. Although the value of the operation was not disclosed, it is estimated that it was around 131 million euro. This number represents half the market value assigned to Intu Xanadú at the end of last year: 262.18 million euro (233.9 million pounds). It should be noted that the negative impact the pandemic had on the retail segment may lower this estimate.

The placement of this shopping centre on the market was already expected to take place in August, when the impediments imposed by the clause agreed with Nuveen Real Estate, owner of Intu Xanadú’s remaining 50%, expired. The truth is that this deal did not prevent investors from showing their interest in the asset. South Korean fund Samsung SRA was one of them.

The interest already shown by investors on Intu Xanadú is not surprising, since this shopping centre located in Madrid is considered one of the largest in Spain. It has a total 153.000 sqm of retail, leisure and catering areas featuring 220 shops and 8 thousand car park spaces. The 13 million annual visits boost the retail spaces’ occupancy, which, according to the latest results report from 2019, is around 96%.

Intu Xanadú’s sale had already been planned before the pandemic and before intu properties declared insolvency, according to the American news agency. The reason behind the divestment was the same that led the company to sell intu Puerto Venecia and intu Asturias during the first half of the year: to pay its debt to the banks which reached 5 billion euro (4.5 billion pounds). It was precisely intu’s inability to negotiate the payment of these debts with the financial institutions that led to its collapse in June.

Now the circumstances of the operation are different and there are good indicators which motivate intu’s administrators to continue with the sale of this shopping centre: in Spain, retailers’ revenues continue to be encouraging as is the recovery from the pandemic. It should also be added the fact that intu Xanadú’s 147.6 million euro (131.5 million pounds) debt – which expires in 2022 – is smaller and more “balanced” than that of other shopping centres.