112 // iberian.propery / 2017

dossier// ISSUE: TOP IBERIAN cities

RETAIL

High street retail

Demand

: remains high, with prime locations in the

city of Malaga featuring in the top 5 expansion plans

of the principal national and international retailers

operating in Spain.

Supply

: in the prime zone, namely calle Marqués de

Larios, Plaza de la Constitucíon, calle Nueva and the

beginning of calle Granada, the available supply is

insufficient to satisfy demand, especially for spaces

above 300 m².

Rents

: on an upward trajectory, with values practised

in the prime zones on a par with some locations in

Madrid and Barcelona.

Shopping Centres:

Demand

: recovering, with the average take-up of the

portfolio managed by CBRE evolving from 89.6% in

2014 to 93.9% in 2016.

Supply

: development of new supply is resuming: in

2016 a new shopping centre was inaugurated in the

region, the Nevada – Armilla, injecting 120.000 m²

of new GLA in Granada; and, until 2019 the new Intu

Costa Del Sol will open in Torremolinos, measuring

175.000 m² and developed by Intu in partnership

with Eurofund. Another opening expected in the next

couple of years is the McArthur Glen Designer Outlet

Malaga, developed by Sonae Sierra.

HOTELS

In the city of Malaga, the hotel sector has been recording extremely

solid indicators and prospects for the future are quite encouraging,

given that this is one of the principal tourist destinations in Spain.

Supply:

there has been little increase in stock in

recent years.

Demand

: meanwhile, Malaga has been consolidating

its position as a tourist destination, not only due to

the increase in tourists for leisure (driven greatly by

the municipality’s efforts to improve and expand the

cultural offer) but also due to the rise in demand in

the events and conferences segment.

36

%

Performance

: in 2016, the number of overnights was

36% higher than those registered in 2011, with the city

registering occupancy levels and average room prices

above those attained in the previous market peak.

INDUSTRIAL & LOGISTICS

Demand

: evolving positively since 2015, demand

should continue to increase throughout upcoming

months, along with a growth in demand for spaces

measuring 5.000 m² or more.

Supply

: the existing stock is predominantly obsolete

and there is a lack of quality warehouses, generating

some sites of new development.

Rents

: expected to rise over the next years, both

for built warehouses and turnkey product, in a

momentum sustained by growing demand.

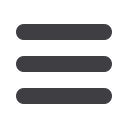

Cañada Homes, Marbella (@Neinor Homes)