Spanish real estate takes centre stage in a changing environment

Spain Real Estate Summit - 2025

On the 6th and 7th of May, Iberian Property brought back to Madrid the key event for all who are already investing or contemplating to do so in the Spanish real estate sector. In the 2025 edition of the Spain Real Estate Summit, the global property sector was well represented by over 350 industry leaders from a wide range of countries, such as Spain, Portugal, France, Germany, Belgium, Greece, the UK and USA, among others. The second year of the event had the institutional support of the Comunidad de Madrid, welcoming for the effect some of its Consejeros such as Rocío Albert, Minister of Economy, Finance and Employment of the Community of Madrid, in a private lunch that gathered the Editorial Council of Iberian Property and other guests.

With a fresh economic perspective, the Spain Real Estate Summit officially kicked-off by the hand of Luigi Caruso, Chief Operating Officer for Europe at Blackstone, who provided a financier’s view of real estate.

The days of abundant liquidity and benign macro conditions are gone. What remains is a market shaped by costlier capital, persistent inflation, and a deepening need for strategic clarity. At the Spain Real Estate Summit, this new financial order was dissected in a panel conversation between Luigi Caruso, COO for Europe at Blackstone, and Adolfo Ramírez-Escudero, Chairman of CBRE Iberia & LATAM—where Caruso’s message was clear: opportunity persists, but only for those with discipline, scale, and long-term vision.

“In the past 24 months, we’ve seen financing go from expensive to very expensive,” Caruso remarked. But instead of retreating, Blackstone has leaned into the market’s complexity. In the first quarter of 2025 alone, the firm acquired and sold €1.5 billion in logistics assets across Europe. This is not a passive rotation—it’s a sign of conviction.

With over €120 billion in European assets under management and nearly €10 billion in dry powder from its latest opportunistic fund, Blackstone continues to act thematically. “We don’t try to time markets,” Caruso explained. “When we believe in a structural trend, we invest through the cycle.” Logistics, data centres, residential, and hospitality now account for 80% of their global real estate portfolio. Not because these sectors are fashionable—but because they’re underpinned by supply-demand imbalances that remain unresolved.

Logistics was the earliest example. When Blackstone began investing in the sector at 7–8% cap rates, the market doubted the rationale. But the firm saw the shift from physical to digital retail early, and scaled ahead of consensus. The same pattern now applies to data centres. “We're not traditional developers,” Caruso noted, “but data infrastructure is so vital—and so complex to scale—that we’ve committed significant capital and operational focus to it.”

That same logic has driven one of the most visible transformations in Blackstone’s portfolio: the decline of office exposure. In 2007, offices represented more than half the firm's assets. Today, that figure is below 2%. “Europe’s office market was structurally better positioned than the U.S.,” Caruso explained, citing smaller buildings and stronger ESG compliance. Even so, high-quality assets in cities like Milan or Dublin are the exception, not the rule. The majority of commodity offices are structurally impaired.

In residential, Blackstone has acted early—particularly in Spain. “The rental market reflects a fundamental imbalance between demand and supply,” Caruso said. That imbalance, coupled with investment in CAPEX and ESG upgrades, creates room for long-term value creation. “Affordability is the challenge,” he noted. “But restricting supply is not the solution. Regulation needs to focus on enabling development.”

Notably, the U.S. single-family rental model—so successful in scaling institutional ownership—has no true equivalent in Europe. Market fragmentation, inconsistent product, and ownership dispersion prevent replication. “We’ve tried aggregation in the Netherlands, but the scale just isn’t there,” he explained. For Blackstone, scale is not optional—it’s structural to the model.

OFFICIAL PHOTO GALLERY

Access all the photos (DAY 1) of the Spain Real Estate Summit 2025That same emphasis on scale is increasingly visible on the credit side. As banks pull back and traditional high-yield appetite wanes, Blackstone sees rising opportunity. “We’ve already deployed €1.1 billion in Spain through our credit platforms,” Caruso said. The firm also reopened the European CMBS market with a €500+ million issuance—its strongest execution since 2021. While many see credit markets as tightening, Blackstone views them as selectively opening—especially for platforms with data, underwriting strength, and flexibility.

This integrated model—deploying capital across equity and credit, logistics and residential, Europe and the U.S.—is powered by something less visible but equally strategic: information. “We’ve invested heavily in technology,” Caruso emphasized. “We can track leasing velocity, energy usage, and market performance across our portfolios in real time. That allows us to move early—and with confidence.”

Spain and Portugal stand out in this environment. As Caruso pointed out during the panel, Spain is the only European market where 2024 investment volumes have already exceeded 2019 levels. That statistic alone signals more than resilience—it signals capital’s growing trust in Iberia’s fundamentals. Portugal, while smaller, shows similar momentum—particularly in tourism, tech, and services. Still, the return of long-term institutional capital depends on one thing above all: regulatory clarity. “If countries like Spain and Portugal can offer policy stability, the upside is significant,” he concluded.

Capital shifts force lenders to adapt

As capital markets cautiously reset, real estate lenders are navigating a profoundly reshaped European landscape—defined by increasing appetite for bespoke capital, evolving underwriting standards, and the rise of alternative financing channels. Following Blackstone interview, senior voices from M&G Investments, Citi, Apollo, and Generali unpacked the structural shifts underway, and what they mean for debt providers in 2025 and beyond.

Edward Boots, Head of Real Estate Finance for Continental Europe at M&G Investments, was unequivocal: “We are seeing increasing competition from alternative financiers, which are complementary to traditional banking.” In his view, this competition is not a threat but a sign of a more dynamic market. “The approach of both financing channels is not the same, but demand for different solutions is growing—and that’s generating a more competitive environment.”

“Alternative funders are more focused on protecting investor capital. That means stricter underwriting, and more discipline.” — Edward Boots, M&G Investments

For Omar El Glaoui, Managing Director and Co-Head of EMEA Real Estate Finance at Citi, the shift is as much about the nature of real estate as it is about capital itself. “Real estate is becoming more of an operational asset—even in what we used to call the most traditional asset classes,” he explained. El Glaoui sees this as part of a broader realignment across capital markets, where risk appetite is recalibrated, and value creation is tied more to operating fundamentals than to passive yield. “It’s no longer enough to lend against a building. You need to understand how it performs—day to day.”

George Molesworth, Managing Director of Credit at Apollo, echoed this need for structural realism. “2024 was a very positive year for us—we closed approximately $6 billion in deals,” he said. Still, he was quick to add that deal volume alone is not the goal. “The level of leverage in each transaction will always depend on pricing and the client’s ability to justify it. We look closely at structure, execution capability, and alignment.”

Stefano Lombardo, Head of Debt Funds Europe at Generali, spoke remotely but reinforced the same themes. His team is focused on pan-European lending with a concentration on value-add opportunities. “The market has changed significantly since the pandemic. We came from a period of containment, and now there is more capital in circulation—along with more openness,” he said. Generali currently manages around €2 billion in real estate credit and is actively underwriting transactions across the continent, including in Spain. Yet Lombardo also cautioned that private debt still faces structural headwinds: “The European market has historically been dominated by traditional banks. While private equity and debt funds have grown in importance, the legacy framework is still there.”

Omar El Glaoui pointed out the growing diversity in liquidity sources: “There is now greater diversification of capital—across banks, funds, and hybrid vehicles. Investors are seeking more efficient ways to structure their operations, and that’s accelerating the role of alternative lenders.” He also predicted a continued trend toward lower leverage financing and more flexible governance models—particularly in residential build-to-rent and operational real estate sectors.

Edward Boots added that what sets alternative lenders apart is their sharper focus on protecting investor returns. “There’s a deeper level of scrutiny in how deals are evaluated,” he explained. “We are seeing more developers coming to us specifically for that reason—they want a partner who brings capital discipline and execution know-how.”

On the legacy side of the market, Omar El Glaoui acknowledged that while Citi has long been active in NPL (non-performing loan) portfolios—including in Spain—the pipeline has changed. “We haven’t seen opportunities of scale in recent years. The businesses that have emerged during this time are very different from those we used to target,” he said, suggesting a permanent shift in how value distress is understood.

George Molesworth offered a more reflective close, pointing to the resilience shown by the market during turbulent years. “People were much better prepared for crisis than we gave them credit for. That’s one of the lasting lessons from the pandemic,” he said.

“We need to stop thinking of real estate purely as a financial asset. More and more, it’s an operating business, and we need to finance it accordingly.” — Omar El Glaoui, Citi

When asked about the rise in trades for debt portfolios—whether this signals a natural trading of loans or indicates a significant volume of non-performing debt—Omar El Glaoui reflected on his experience in NPLs, including in Spain. He remarked that “it’s always an interesting question, especially in times of volatility and uncertainty.” While Europe has seen some distress since COVID, it does not compare to the large-scale deleveraging during the global financial crisis. “The banking sector fundamentals in Europe have come a long way,” he added. “We haven’t seen large-scale stress nor do we expect it, though certain assets do require active resolution or accelerated recovery.” He emphasized that these situations tend to be isolated cases rather than indicative of a widespread NPL market as seen in the past.

George Molesworth noted that covenant breaches, often triggered by downgrading valuations, created stress but “people were better equipped to handle those breaches during COVID than expected.” He pointed out that enforcing covenants outright is rarely the preferred route; instead, lenders and sponsors usually work collaboratively toward restructuring solutions. “This approach bought time until interest rate environments stabilised and allowed delayed business plans to progress,” he said. Despite challenges in certain office sectors, “the occupational market has generally outperformed, benefiting from inflation-linked rent increases.”

Edward Boots weighed in, noting that alternative lenders often act earlier and more proactively to protect investor returns. “Compared to banks, we are more focused on managing our portfolios proactively to mitigate risks,” he explained.

Looking ahead, George Molesworth expressed cautious optimism: “There’s a lot of powder dry, and I expect transaction volumes to pick up later this year.” However, he flagged the challenge of maintaining pricing and deal structures amid increased lender competition and a relatively small market pie. “It will be interesting to see if lenders can sustain margins or become more conservative as volumes rise.”

Omar El Glaoui preferred a more measured outlook, stating, “I expect many of us will increasingly have to think about real estate as an inherently operating asset class.” He pointed out that the traditional view of real estate as merely a financial asset is evolving globally.

Edward Boots agreed, adding that the role of debt funds will likely increase as refinancing volumes continue to dominate the market. “If transaction volumes pick up, the main challenge will be capacity—whether lenders have enough people to manage all the deals effectively.”

Omar El Glaoui concluded the discussion by reminding the audience that “many of us are going to have to start thinking more and more about real estate as an operational asset class,” underscoring a theme that resonated throughout the summit.

In 2025, creativity, discipline, and alignment are the new priorities in real estate debt. As the capital stack becomes more fluid and asset performance becomes more complex, lenders are no longer just financiers—they are partners in strategy, structure, and execution.

Geopolitical world balance at stake

At a troubled time for the balance of global power—when globalisation seems to be entering a new cycle and new blocs are emerging—Europe has a renewed opportunity to reaffirm its relevance on the world stage. This shift could significantly benefit Iberia, a region historically labeled as a peripheral player in European affairs.

On the opening day of the Spain Real Estate Summit, the former Portuguese Prime Minister and former European Commission President, José Manuel Durão Barroso, addressed the gathering with a wide-ranging keynote that explored not only economic issues but also Europe’s place in a fractured and increasingly multipolar world.

Through an interview model conducted by Enrique Losantos, CEO of JLL Spain, Mr. Durão Barroso opened with a reflection on Iberia’s long-standing perception in the global economy—a narrative that grouped Portugal and Spain with Greece and Italy under the unflattering acronym “PIGS” during the euro crisis. That categorisation, he argued, is no longer valid.

“Those were lazy, outdated stereotypes,” he said. “Today, Iberia is increasingly seen as a stable and attractive destination for investment—not just in real estate, but also in renewable energy, tourism, and digital infrastructure.”

He highlighted how both countries have modernised their economies, improved fiscal management, and become strategic hubs for global capital.

But Europe, he warned, cannot take stability for granted. The internal contradictions within the EU—between East and West, North and South—remain unresolved, and may be tested again by the upcoming enlargement process. Countries such as Ukraine, Moldova, and several Balkan states are pushing for EU membership, which could further strain decision-making and the bloc’s coherence.

“We must not forget that Europe’s strength lies in its unity,” Barroso said. “But with enlargement comes complexity. We are already 27 nations. With 30 or more, consensus will be harder.”

This complexity also manifests in areas like defense policy, economic coordination, and foreign affairs—where national interests still frequently override common strategy.

Political mistakes of historic proportions

Asked about Brexit, Durão Barroso did not mince words. “It was a political mistake of historic proportions,” he declared. “The idea that the UK would ‘take back control’ and somehow be stronger outside the EU has proven to be a fallacy.”

He pointed to the economic consequences—slower growth, reduced foreign investment, labour shortages—and also to the geopolitical impact. Britain’s voice, he suggested, is now weaker on the global stage, and its absence has hurt the EU’s collective influence too.

“It was a lose-lose situation,” he said, “not just for the UK, but for Europe as well.”

Turning to Russia, Durão Barroso shared personal anecdotes from his multiple encounters with Vladimir Putin during his time at the European Commission. He described the Russian leader as someone driven by resentment over the West’s post-Cold War posture, and who sees power through a 19th-century lens.

“He’s not an irrational actor,” Barroso said. “He’s rational in the way a chess player is rational—but the game he’s playing is one of spheres of influence, not rule-based international order.”

The invasion of Ukraine, he added, was not only a violation of international law but a strategic miscalculation that has backfired by strengthening NATO and isolating Russia economically.

Understanding China: beyond the myths and misconceptions

Joining the conversation later in the day, Brian Wong, Fellow at the Centre of Contemporary China and the World at the University of Hong Kong, brought an Asian perspective to the stage. In a nuanced and often provocative talk, Wong dismantled common Western assumptions about China’s strategic goals.

“To understand China, you must experience it—in all its imperfections, contradictions, and evolution,” he said.

He outlined three dominant but flawed narratives often applied to China’s future:

- Territorial Expansion? Unlikely.

China has largely avoided military adventurism since its short war with Vietnam in 1979. It prefers stability and economic engagement over military confrontation, particularly after watching the global blowback from Russia’s war in Ukraine. - Total Repression? Unsustainable.

With 1.4 billion citizens and stark regional inequalities, totalitarian control is unworkable in the long term. Crackdowns exist, but the Chinese state also relies on performance legitimacy. - The Social Contract? Most Likely.

Wong argued the Communist Party maintains its grip through a tacit agreement: deliver growth, and share its benefits. That’s why Xi Jinping has prioritised poverty reduction, curbing tech monopolies, and rural revitalisation—even at the cost of short-term business confidence.

He also addressed the trade war, noting that China has diversified its economic dependencies, reducing its reliance on the US and forming new trade alliances across Asia, Africa, and Latin America.

“China is not surrendering to the trade war,” Wong said. “It’s adapting—through domestic reforms, consumption stimulation, and welfare expansion.”

And while the West often personalises China’s policies around Xi Jinping, Wong reminded the audience that the Chinese system involves millions of party members, many of whom are globally educated and technocratically competent.

“We must resist the temptation to simplify. China is not a monolith.”

Durão Barroso offered his own, deeply experienced take on China. Having negotiated the handover of Macau and met with every Chinese leader since Jiang Zemin, Durão Barroso praised China’s technocratic elite and institutional complexity—drawing a sharp contrast with Russia.

“China is not Russia,” he said. “The Communist Party is a real institution with internal meritocracy. It’s nationalist more than it is communist, and its leaders are among the most educated anywhere in the world.”

He recounted a rare break of protocol during a dinner with Xi Jinping, calling it a sign of how much more assertive and informal the current Chinese leadership has become.

On technology and AI, he was unequivocal: China is not merely copying the West—it is leading in key areas. “What I saw in Chengdu and Beijing last year in terms of green tech and AI was simply astonishing.”

But Durão Barroso also emphasised that Europe must do a better job of understanding China—its language, its motives, and its culture—if it wants to engage strategically and constructively.

On Trade: A Call for Pragmatism

Durão Barroso reiterated his belief in free trade, despite rising protectionist sentiment in both the US and Europe. He argued that while the US-China trade war may be ideological, Europe’s position is inherently pragmatic. “Europe depends more on trade than the United States,” he explained. “That’s why we must avoid escalation.”

He ended with a pointed remark on potential future US policy: “If President Trump returns, and tariffs return, Europe is ready. Retaliation is prepared. But our preference is always dialogue—not confrontation.”

Opportunities in BTR, BTS and Flex Living open markets

The last panel of the day focused on the European living sector. Shaped in an interactive oval session, a central question was whether core capital is truly returning — and what kind of capital that might be. Moderated by Richard Betts, Head of Content at Real Asset Media, the conversation began with a provocation: is the real challenge not the lack of capital, but the industry's outdated expectations of it?

Lee Coward, Vice President of Investments at Oxford Properties, dismissed the notion of “core capital” as a monolithic category. “What people really want is low-returning, passive capital that keeps quiet and writes cheques,” he remarked dryly. “But that’s not what capital looks like anymore — especially not over the next decade.” Instead, pension funds and institutional investors have grown increasingly sophisticated, with in-house development and credit arms that are comfortable with risk-adjusted strategies. Coward noted Oxford’s own $4 billion real estate credit platform in the U.S., which yields “a consistent 10% return on a pretty defensive basis.” He concluded with a clear message: capital exists, but it won’t come cheap — and the sector must reset its pricing expectations accordingly.

For Pavlos Gennimatas, Managing Director of Europe Living at Hines, the Iberian Peninsula offers a compelling case. “Iberia is very well positioned,” he argued, pointing to a strong demand-supply imbalance, relatively low regulation compared to cities like Amsterdam or Dublin, and higher liquidity than markets such as Germany. Crucially, he agreed with Coward that while core capital is not likely to get cheaper, it is indeed coming back — not only from abroad, but increasingly from European sources. In this context, Spain’s living sector emerges as one of the continent’s most promising opportunities.

Cristina García-Peri, Senior Partner at Azora, framed the issue more broadly around systemic supply shortages. “The biggest issue is the shortage of supply,” she emphasized — a structural constraint affecting not just rental housing, but also student accommodation and senior living. As she explained, “Everything is very much related with the lack of access to affordable housing.” García-Peri underscored Spain’s regulatory flexibility as a unique advantage: in contrast to other European markets, converting a rental building into individually sold flats requires no change of license, which enhances liquidity and allows investors to tap into both the rental and for-sale segments. This, she noted, inflates asset prices but reflects underlying market strength. “Returns may look compressed, but there’s also an appreciation of the asset base that you can always capture.”

David Martínez, CEO of AEDAS Homes, presented the developer’s perspective, highlighting the scale of unmet need. “The demand is virtually infinite,” he declared. With Spain producing only 100,000 new homes annually — against the formation of 250,000 new households — the imbalance is stark. Martínez painted a bullish picture: Spain contributes 40% of the EU’s GDP growth, unemployment is at a historic low, household savings are high, and both consumers and banks are minimally leveraged. “All the conditions are set,” he said, before turning to the core challenge: a mismatch between the capital currently in play — much of it private equity from the 2014–2016 cycle — and the need for new, potentially cheaper long-term investment. But with regional governments actively unlocking land and easing zoning, he insisted, “This is the opportunity. The current capital is preparing to exit, and the time for new capital is now.”

Juan Pablo Vera, CEO of Testa Homes, echoed these themes while sounding a note of caution. Institutional new build-to-rent (BTR) product has been modest, averaging 15,000 units annually, and much of the new activity is shifting toward flex living. Madrid, he pointed out, captures a disproportionate share — 60–70% — of this pipeline. Vera stressed the importance of regional differentiation, observing that dynamics vary considerably depending on local government efficiency and legal stability. “We’ll have to face this problem in other areas,” he warned, adding that the challenge extends beyond the private rental sector to affordable leasing models, where supply remains critically low.

Eduard Mendiluce, CEO of Aliseda and Anticipa, concluded the discussion with a sober but optimistic appraisal. “Scarcity of land — for sure,” he acknowledged, while insisting that investors should not be deterred. “This is complexity, not insecurity.” For Mendiluce, the key lies in proximity and agility: understanding regional specificities, working closely with local developers, and identifying viable land even if it is not yet “ready-to-build.” His teams — 60 professionals embedded in local markets — engage with over 1,200 developers, helping unlock opportunities across urban and semi-urban Spain. “We sold €500 million in land last year,” he noted, underscoring the continued appetite from small and mid-sized investors. The lesson? “Don’t be scared of buying land under subdivision. Rely on local managers. Do it case by case. There are treasures in the market.”

The consensus across the panel was clear: the fundamentals in Spain’s living sector are stronger than ever. But attracting the right capital will require realism, creativity, and a deeper engagement with regional complexity. The opportunity is not in waiting for ideal conditions — it’s in responding intelligently to the ones already here.

Lee expanded on the need to think globally when assessing Spanish real estate markets. For large-scale international investors, it’s not simply a matter of choosing between second- or third-tier Spanish cities versus other parts of Europe — they’re benchmarking opportunities against global metropolises like Sydney, Toronto, New York, and Los Angeles. That’s why, he explained, the easiest and most logical entry point for any new market tends to be the capital city. In their own case, when they entered the UK residential market in 2018, their strategy was primarily London-centric. Initially, they allocated 80% of their capital to London and only 20% to other top-five UK cities. Over time, as their team gained deeper expertise and built trust with their investment committee, they expanded to invest across the UK. For Lee, entering Spain would follow a similar path — starting with tier-one cities is the most straightforward way to gain support internally.

Pavlos agreed, while emphasizing that product type also plays a decisive role in determining location strategy. For student housing, they follow the universities, which may not always be in capital cities. For build-to-rent (BTR), they apply a broader set of criteria — including demographic trends, housing supply-demand imbalances, homeownership ratios, and even transit orientation. He noted that while central business districts (CBDs) rarely offer viable economics for these kinds of investments, there are attractive risk-adjusted returns in less obvious cities and micro-locations, which their platform actively explores.

Cristina then weighed in, pointing out that looking at fundamentals alone is not enough. Liquidity is a critical factor. An asset in a location with solid fundamentals might still be unattractive from an institutional perspective if it lacks liquidity. This is precisely why her firm continues to focus on major Spanish cities, even though, as she acknowledged, people need to live across the country. One of the historical barriers to investment in Spain has been the perception — or reality — that it’s not a liquid market. That narrative is beginning to shift. There’s now a cohort of investors who are here for the long term and recognise the compelling risk-return profile Spain can offer. But Cristina cautioned that straightforward rental yields often don’t compare favourably with other European countries. That’s because Spanish investment returns are heavily dependent on the underlying asset appreciation, which inflates asset prices and reduces nominal yields. Unlike other countries where converting a rental asset to private sale might require a licensing change, in Spain the transition is more fluid — and that structural difference impacts how returns should be assessed.

She argued that this creates a psychological hurdle for some investors. The fundamentals are strong, but if they only assess returns based on rental yield, Spain might not appear attractive. This, in her view, is a structural issue when trying to attract long-term institutional capital. She also raised a concern about the current shape of public-private partnerships in Spain, noting that they often seem designed with developers in mind — not the eventual long-term owners. Institutional investors need structures that consider their role too, especially in a country where institutional ownership of rental housing is still below 5%.

“This is the opportunity. The current capital is preparing to exit, and the time for new capital is now. Regional governments are unlocking land, zoning is easing, and all the macro conditions are aligned.” — David Martínez, AEDAS Homes

David agreed, reinforcing that historically public administrations haven’t thought about who the end owners of assets would be. The good news, he said, is that this is starting to change. After years of underproduction, authorities have finally recognised the urgent need to increase housing supply. Looking at land markets, David reflected on how for years investors had the luxury of cherry-picking land parcels that ended up with the banks after the financial crisis. That was an abnormal time. Today, the reality is different: the land available often needs additional permitting or capital expenditure to become buildable — and this, he argued, represents a return to normality. He noted that their firm had acquired €400 million worth of land in Madrid in 2024 alone. The main barrier to scaling further wasn’t land availability — it was finding sufficient equity. The capital is there, the opportunities exist, but equity constraints are the main bottleneck now.

Juan Pablo built on the conversation around PPPs and residential rental. He reiterated that institutional rental ownership in Spain remains extremely low — around 5% — so in many ways, the industry is still in its infancy. He noted several structural challenges around land cost, permitting processes, legal hurdles, and overregulation, all of which increase development costs and timelines. However, he also observed a notable shift: due to the acute supply-demand imbalance, both central and regional governments are beginning to adopt more proactive and flexible stances. Coming back to Cristina’s earlier point, he agreed that the focus for institutional portfolios has largely been on the top five cities. In their own case, over 70% of their assets are in strong, established locations — especially in the Mediterranean corridor and the islands. However, he added that as portfolios grow in volume, it becomes more worthwhile to consider emerging urban areas like Alicante or Murcia, which are beginning to show attractive dynamics of their own.

Eduard turned the focus toward affordability and the structuring of PPPs. He stated plainly that if Spain wants to scale up rental housing in a meaningful way, public-private collaboration is essential. However, he was critical of current schemes, which he feels are not mature or robust enough. Public administrations, he said, need to better understand how capital works. He gave an example: if investors are expected to sign up for 70-year projects with vague or insecure terms, the result will inevitably be higher required returns — which defeats the purpose of affordability. He referenced how in the UK and other markets, better-designed schemes help ensure predictability in net cash flows, even under long-term concessions. In contrast, if Spanish frameworks fail to define who selects tenants, how legal risk is managed, or how returns are secured in case of political change, investors will continue to demand a higher cost of capital.

Eduard’s view was clear: there’s a fundamental disconnect between what the public sector wants to achieve in affordability and what the private capital markets require to fund it. He argued that a more pedagogical approach is needed — one that presents successful case studies from other countries, showing how large-scale PPP frameworks can attract private capital without compromising stability. He also touched on the importance of private partnerships beyond just affordability, particularly between international investors and experienced local asset managers. For him, these relationships are essential to deploying capital responsibly in Spain.

Investors celebrate the main achievements of Iberian real estate activity in 2024

And because the sector also deserves to celebrate and enjoy some relaxed networking time, the Iberian Property Investment Awards ceremony were the perfect moment to wrap-up the night. With a total of 8 categories, leading companies from both Spain and Portugal were recognized for their outstanding activity during 2024.

WINNERS - IBERIAN PROPERTY INVESTMENT AWARDS

Get to know all the winning projects and initiatives of the Iberian Property Investment Awards 2025Day 2 - Spain Real Estate Summit 2025

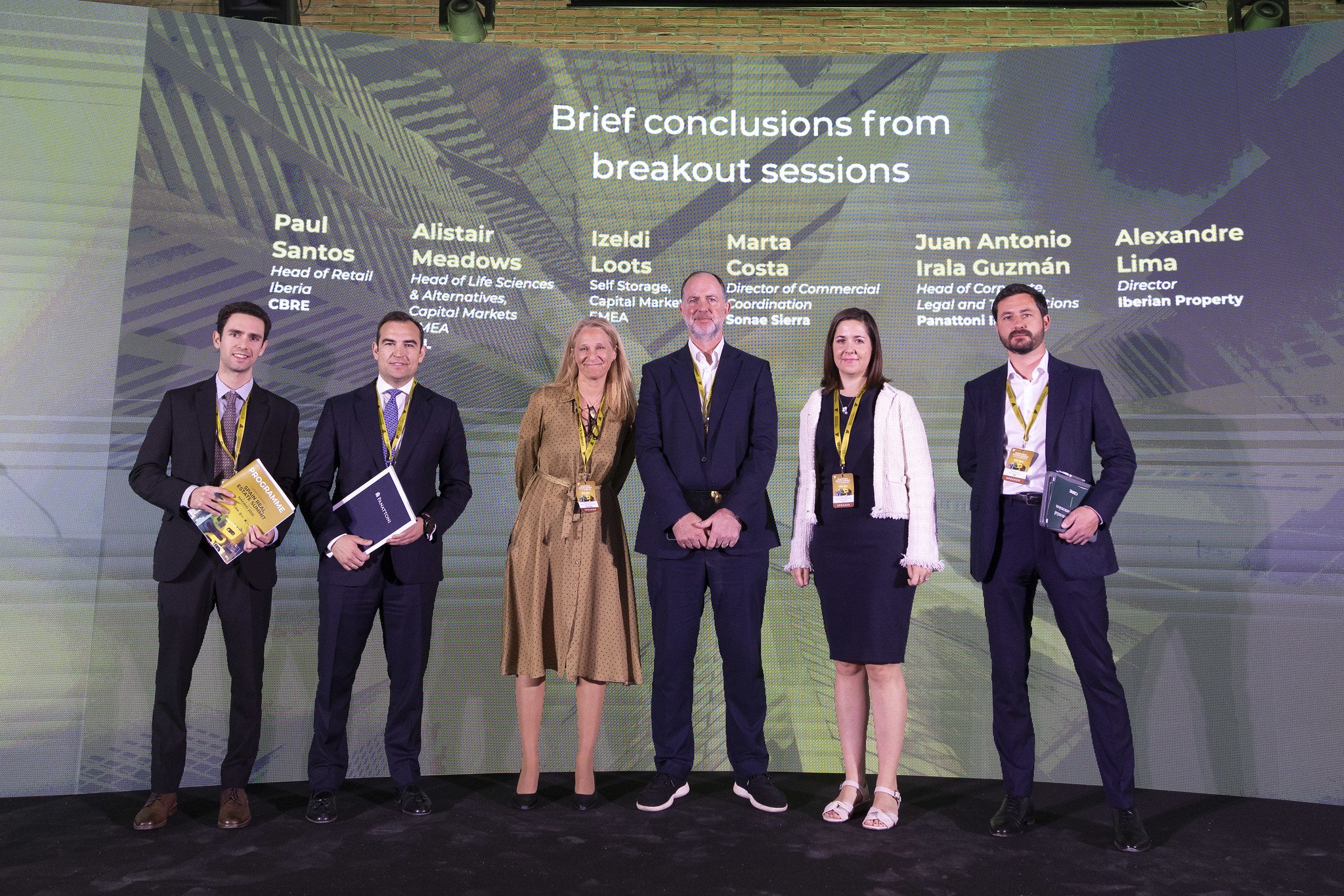

On the second day of the Spain Real Estate Summit in Madrid, international investors, operators, and thought leaders convened to explore the country's growing role as a real estate transformation hub. Through five dynamic sessions, participants engaged in deep discussions across key sectors—including life sciences, self-storage, logistics, hospitality, and offices—highlighting Spain’s adaptability to meet emerging demographic, technological, and economic demands.

- Life Sciences and Self-Storage: Institutional Appeal in Emerging Segments

Chaired by Alistair Meadows, Head of Life Sciences & Alternatives, Capital Markets EMEA, and Izeldi Loots, Self Storage Capital Markets EMEA at JLL, this session explored how science-related real estate and self-storage are becoming cornerstones of institutional portfolios. With universities driving innovation ecosystems and shifting scientific practices reshaping facility needs, life sciences demand is increasingly concentrated in well-connected urban hubs. Meanwhile, self-storage is surging due to social mobility, urban housing constraints, and last-mile logistics. The session emphasized the importance of digitalization, operational expertise, and localized strategies in scaling these alternative assets. - Retail’s Resurgence: Reclaiming its Spot in Core Portfolios

Moderated by Paul Santos, Head of Retail Iberia at CBRE, this session highlighted the renewed momentum of the retail sector. As investor concerns around e-commerce subside, both high street and retail park formats are gaining traction, especially amid stabilizing yields and improving macroeconomic sentiment. The discussion emphasized that prime locations remain fiercely competitive, while retail parks are increasingly seen as resilient and adaptable investment vehicles in diversified portfolios. - Office Sector Reinvention: From Downsizing to Purpose-Driven Spaces

Led by Marta Costa, Director of Commercial Coordination at Sonae Sierra, the office session addressed how workplace strategy is evolving post-pandemic. After a period of contraction, companies are again expanding, yet with new priorities focused on flexibility, sustainability, and user experience. This shift is driving demand for reimagined office environments that support collaboration and well-being, underlining the need to adapt outdated assets or develop new, purpose-built spaces aligned with modern expectations.

4. Logistics: Unlocking Growth Amid Land Shortages

Chaired by Juan Antonio Irala Guzmán, Head of Corporate, Legal and Transactions at Panattoni Iberia, this session tackled one of Spain’s biggest logistical bottlenecks: the scarcity of developable land. Participants noted that, despite strong demand, the ability to launch new projects hinges on unlocking and preparing land assets. Developers were identified as crucial players in this landscape, with value creation increasingly tied to proactive land strategies and the acceleration of planning processes.

5. Hospitality Evolution: From Accommodation to Experience-Driven Assets

Moderated by Alexandre Lima, Director at Iberian Property, this session explored the professionalization and diversification of the hospitality sector. No longer limited to traditional lodging, hospitality assets now integrate offerings like wellness centers, event venues, and lifestyle programming to enhance profitability and guest experience. Institutional capital is showing increased interest in a sector that demands bold investment and operational transformation, highlighting a shift in focus from just physical assets to the experiential value delivered to end users.

OFFICIAL PHOTO GALLERY

Access all the photos (DAY 2) of the Spain Real Estate Summit 2025At a time when European cities are "choking on their own success" - rising populations, gentrification, and housing stock lagging decades behind demand - Spain finds itself at a crossroads. Can it build a housing model that meets the needs of its people, attracts global investment, and evolves beyond a legacy of home ownership into one of flexible, inclusive living?

That question anchored a candid discussion at the second day of the Spain Real Estate Summit, where industry leaders weighed in not just on numbers, but on values, strategies, and what makes the Spanish market both a challenge and an opportunity.

When Verónica Gallo Álvarez, Head of Investment Management at Redevco, opened the session, she admitted that housing might not be the first thing people associate with their brand.

“We’ve been historically linked to retail—that’s been our bread and butter,” she noted. “But about six years ago, we started working in housing, building on the idea that cities should be more sustainable and livable.”

For Redevco, the shift is more than opportunistic. It’s rooted in a philosophy: create places where people actually want to live. Their focus is squarely on the younger generation - students, young professionals, and couples - who are increasingly priced out of housing markets or forced into nomadic work-lives due to rental scarcity.

“Our strategy zeroes in on what we call the ‘15-minute city’ - urban neighborhoods where everything from food to public transport is within easy reach,” Gallo Álvarez explained. “But to do that right, you need scale. We’re talking about projects of at least 200 units so we can create integrated, service-rich environments that remain affordable.”

The company’s ambition is bold: 10,000 residential units across Europe, with 5,000 already in development or pre-development, particularly in the Netherlands—Redevco’s home base—and increasingly in Spain. Why Spain? “Because the fundamentals are strong,” she said. “The coliving segment is expanding, and the Build-to-Rent (BTR) market is maturing quickly.”

“There’s no better place in the world to build community than in a home.” — Richard Powers, Brookfield

In representation of one of the largest investors in housing globally, Richard Powers, Managing Partner and COO for Europe at Brookfield, shared that the company has around 200,000 units in the U.S. and about 45,000 across Europe.

Most of those European assets have focused on student accommodation, a sector where Brookfield has been a first mover. “We built businesses like Student Roost in the UK, and we’re now growing platforms such as OxCo in France, International Campus in Germany, and Lavenza, based right here in Madrid,” Powers said.

Yet the company isn’t stopping there. They’re also venturing into conventional rental housing, and one project in Spain stands out.

“If I had to choose a favorite, I’d pick Alcobendas, north of Madrid,” Powers said. “It’s 384 units—half for longer-term young professionals and half for students. It’s a U-shaped building with wings for each group and shared amenities. I think we got that balance right.”

What makes the model work, he argues, is that it meets local needs while leveraging global best practices. “Spain has a lot going for it—positive migration, strong universities, and a real demand for quality housing. When you combine that with a community-minded design, you create something more resilient than just bricks.”

“Coming from the Netherlands, where the rental market is highly regulated, Spain feels easier to navigate” — Verónica Gallo Álvarez, Redevco

Veronica Gallo Álvarez, herself Spanish, offered a personal reflection on the country’s evolving attitudes. “When I was in my 20s, buying a flat was just what everyone did. That was the goal. But now, young Spaniards often say their goal isn’t to buy—it’s to find something they can afford. Many can’t buy, even if they want to.”

This shift is moving Spain toward a more Northern European model, she believes—one where long-term rental isn’t a fallback but a lifestyle choice. And surprisingly, regulation is helping, not hindering.

“Coming from the Netherlands, where the rental market is highly regulated, Spain feels easier to navigate,” she said. “Of course, there are rent caps in some regions, but we’re used to working under much stricter conditions. That experience sharpens your project structuring—when you’ve worked in a tough market, you know how to make the economics work in a lighter one.”

Still, both speakers acknowledged the universal barriers: land scarcity, construction costs, regulatory red tape, and a shrinking labor force. “Each market has its pain points,” Gallo Álvarez said. “But having a strong local team makes all the difference. You need people who can work with municipalities and regional authorities to keep projects moving.”

Can Social Impact deliver market returns?

At the heart of the conversation was a tension many investors are still working to resolve: can housing be both profitable and socially impactful?

Powers didn’t dodge the complexity. “We have different funds for different purposes. Housing is typically seen as lower risk, and yes—many investors are willing to accept lower returns for greater stability. But we also believe every new unit helps. Even high-end housing alleviates pressure on the system through what economists call ‘filtering’—older units become more accessible over time.”

His argument was straightforward: build more of everything, and the whole system becomes more functional. “Every kind of unit helps relieve the bottleneck. And while I hear talk about younger generations not wanting to own, I don’t think that sentiment will last. People still want homes—they just can’t get them right now.”

“The question is no longer whether we should invest in social housing,” Gallo Álvarez said. “It’s whether we’re agile enough to adapt our models and fast enough to seize the moment.”

From coliving concepts to mixed-use reinventions, from deep regulatory experience to local partnerships, both speakers made it clear: this isn’t charity. It’s a business case for impact.

How Digital Infrastructure is redefining Spain’s competitive edge

In an age where every swipe, stream, and search relies on invisible scaffolding, digital infrastructure has emerged as one of the most strategic assets a country can possess. From data centers humming at the edges of cities to fiber-optic veins connecting continents, the architecture of our digital world is no longer just a background player... it’s the stage itself. And in this performance, the Iberian Peninsula is quickly becoming a star.

Once viewed as peripheral in the European tech landscape, Spain — particularly Madrid and Lisbon — is now surging ahead as a vital gateway for global data traffic. “Latency is the new currency,” according Theresa Bobis, Managing Director for Southern Europe at DE-CIX, who was in charge of introducing the "Tech Power" theme in a keynote presentation. And it’s a currency Spain is beginning to mint in abundance. With its proximity to Africa, Europe, and the Americas, the peninsula is uniquely placed to route data swiftly across regions — serving not just as a corridor, but as a destination for investment in digital resiliency.

That shift is being powered by a convergence of factors: a spike in real estate demand for data infrastructure, a surge in subsea cable landings, and growing investor appetite for alternative assets with long-term returns. Land availability and energy access - often the bottlenecks for data center deployment - are now being met with coordinated financing and regional policy alignment. As hyperscalers and interconnection platforms move in, digital infrastructure is no longer just a tech issue; it’s an urban, environmental, and economic one.

But this transformation brings urgent questions. How will the energy needs of these digital hubs be balanced with climate goals? What ripple effects will this infrastructure boom have on traditional industries like logistics, manufacturing, and real estate? And as cities compete for the title of “next digital hub,” what does true readiness look like... beyond fiber maps and floor space?

These are the questions that matter now. Not just to technologists and investors, but to policymakers, urban planners, and every citizen whose life is increasingly mediated by megabytes. As Spain doubles down on its digital advantage, the conversation shifts from "can we compete?" to "how far can we lead?"

The advantage equation: Energy, Talent, and Terrain

A high-stakes roundtable followed to gather some of the leading voices in the data infrastructure space to address a critical question: What makes Iberia the next big thing for data centre growth and AI infrastructure in Europe?

Moderated by Francisco Porras, Data Centres Business Unit, Merlin Properties, the conversation featured insight from Paul Henry of Google, Ismael Clemente of Merlin Properties, and Theresa Bobis of DE-CIX. What followed was a deep dive into the fundamental drivers of Iberia’s new digital momentum and the urgent challenges ahead. From Google's global perspective, Paul Henry, Regional Director Europe, Middle East and Africa, Data Center Infrastructure of Google, was quick to emphasize Spain’s competitive edge through the lens of total cost of operation (TCO) — a decisive metric for hyperscalers.

“The biggest line item in our TCO calculation is energy - and Spain is remarkably competitive,” said Paul Henry, pointing to a cost profile more in line with Nordic markets than central Europe.

Paul Henry added that Spain doesn’t just offer low energy prices, it offers green energy, at scale. With abundant solar and wind complemented by nuclear and hydro, the Iberian Peninsula is uniquely positioned to power energy-hungry AI workloads. Add to that lower construction costs, a deepening engineering talent pool, and attractive labour economics, and the case for Iberia strengthens considerably.

Ismael Clemente, CEO of Merlin Properties, broadened the lens: “Yes, we have the cost and the talent — but we also have space, power, and the privilege of geography.” Iberia, he noted, is already the recipient of 70% of global data traffic by virtue of its submarine cable connectivity. With vast underutilized renewable capacity and "semi-virgin" land ready for scalable development, the peninsula offers more than just an operational advantage — it offers infrastructure headroom.

“We’re talking about 60 to 70 terawatt-hours of available generation capacity annually — enough to support 5 to 6 gigawatts of data centre capacity,” Ismael Clemente noted. “The question is: will we seize that opportunity?”

As workloads evolve, infrastructure must too. Theresa Bobis highlighted how the exponential rise in data — particularly from AI, gaming, and real-time analytics — demands a more distributed architecture.

“The fundamental shift is clear: infrastructure must move closer to the edge, to where data is created and consumed” Theresa Bobis, DE-CIX.

DE-CIX is already pushing toward multi-city, multi-country deployment strategies, aligned with the need for low-latency, high-resilience interconnection outside of traditional hubs.

Ismael Clemente added that beyond location and connectivity, power availability has become the new gravitational force in site selection. As AI models become deeper and more compute-intensive, the demand for power doesn’t just grow... it surges. From NVIDIA’s current B200 chips (drawing 35 kW per rack) to next-gen GPU architectures pushing beyond 300 kW, data centres must radically rethink how they cool, power, and physically support future loads.

“We’re designing for a reality two years ahead of us,” said the CEO of Merlin Properties. “We can’t afford to lag behind the wave.”

From planning to permitting: the execution gap

Despite Iberia’s assets, one hurdle remains: the speed of execution.

For the Google Regional Director, the real differentiator in market selection is no longer just cost or connectivity - it’s regulatory readiness. “We need to see unified strategy, from central government down to local municipalities,” he said. Power allocations, land use approvals, and utility coordination must align in a clear and transparent roadmap.

“You’re competing globally. Confidence in the process is as critical as capacity in the grid,” Paul Henry stressed.

The group unanimously agreed that public-private coordination will make or break Iberia’s future as a true digital hub. While operators innovate in thermal design, modularity, and rack flexibility, governments must catch up with permitting frameworks and utility partnerships that reflect the urgencyand complexity of AI infrastructure at scale.

The conversation ended where it began: on the premise of preparedness.

Spain and Portugal have the potential to become the energy-resilient, strategically positioned, cost-efficient backbone of Europe’s AI and digital infrastructure. But to do that, industry and government must act in concert - not just to build, but to anticipate the demands of a market in hyper-evolution.

As Ismael Clemente defended: “If you want to be a permanent operator (not just flip and sell), you need to go a little ahead of the curve. That’s the only way to stay in the game.”

Iberian Property would like to take the chance to recognize all the companies and entities who supported the Spain Real Estate Summit this year, and which hopefully will continue contributing to the success of such an initiative:

CBRE, JLL, Aliseda, Crea Madrid Nuevo Norte, Testa Homes, Invest in Madrid & Comunidad de Madrid, Sonae Sierra, Constructora San José, Schneider Eletric, Merlin Properties, AEDAS Homes, Azora, Panattoni, Square Asset Management, Hines & Grupo Lar, Nhood, Clifford Chance.

A word of appreciation as well for all the industry partners who accompanied us: Real Asset Media, ACI, APRESCO, AECC, ASPRIMA, EPRA, ULI Spain, APPII, SQUARE.