PORTUGUESE REAL ESTATE INVESTMENT TO GROW BY 8% IN 2025

"A YEAR OF GROWTH IN EVERY DIMENSION"

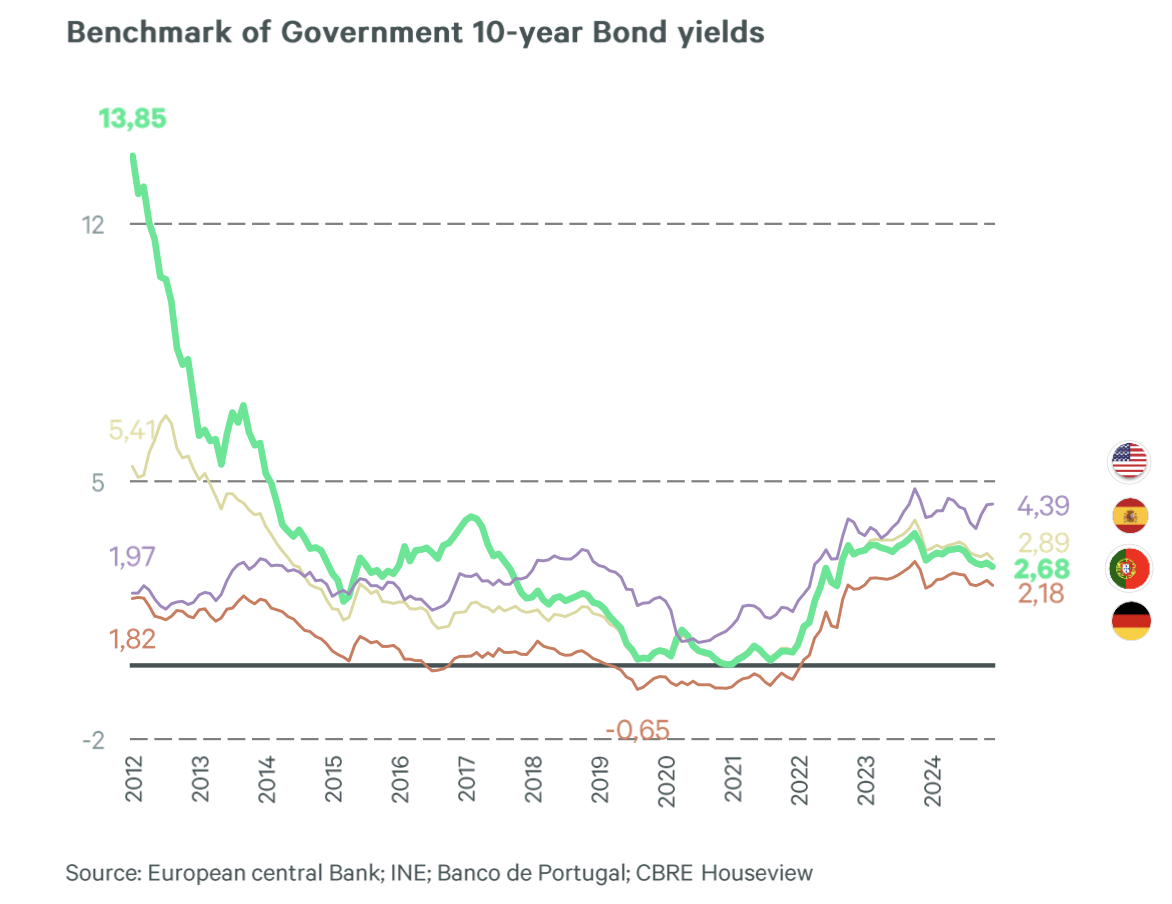

2024 was a year of adjustment and growth for the Portuguese economy, with a reduction in inflation and falls in benchmark interest rates. The economy performed well, taking into account the wider European context, and property investment showed signs of recovery.

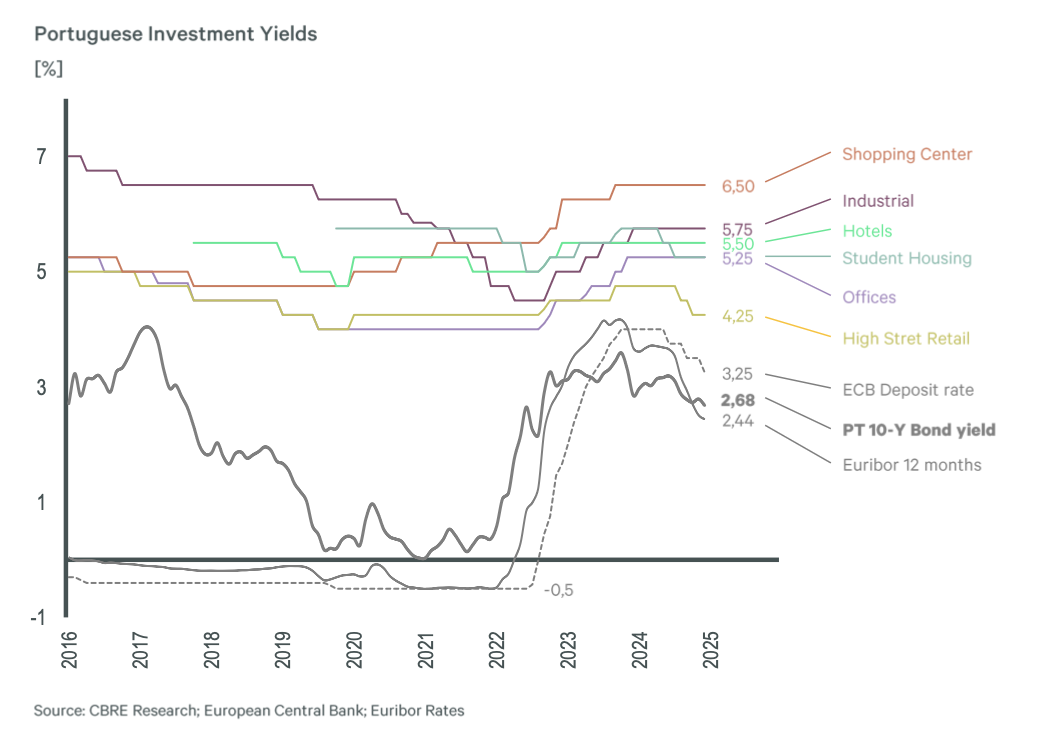

What can we expect in 2025? The outlook is optimistic: economic growth, favourable financing conditions, falling interest rates, along with the convergence of buyers‘ and sellers’ expectations.

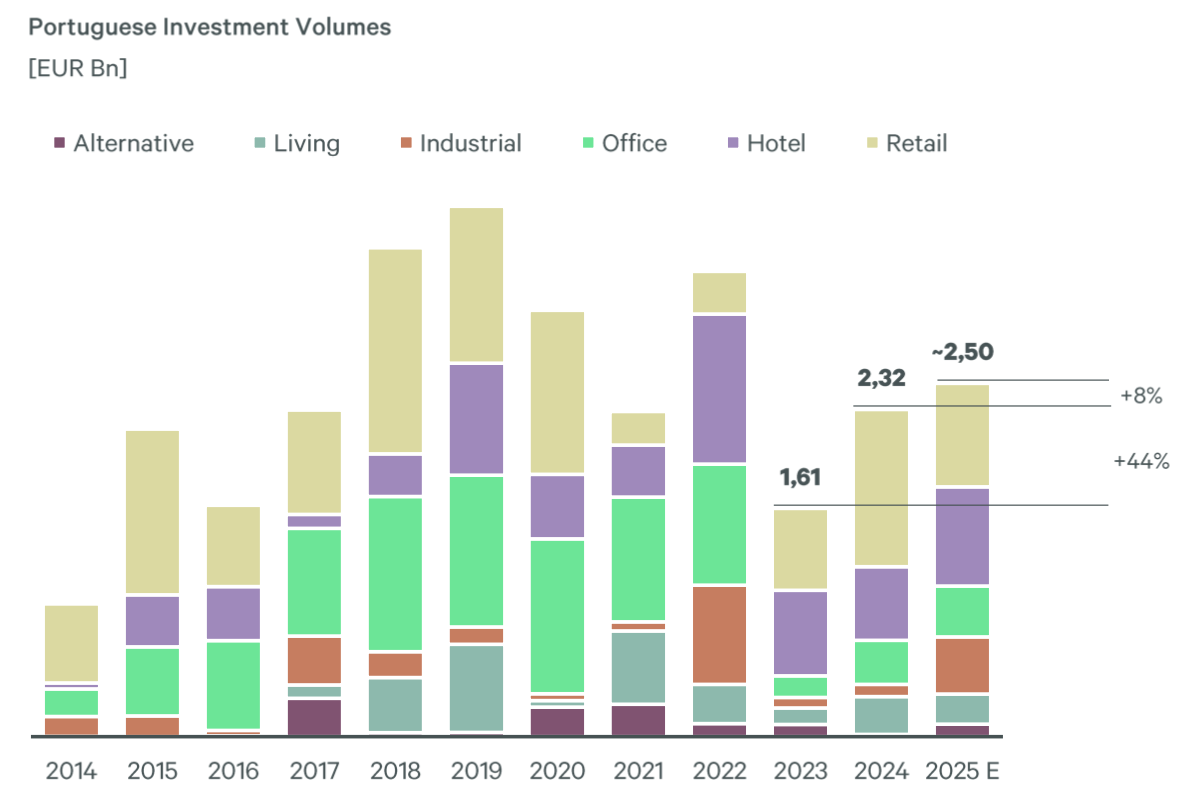

The property market in Portugal is expected to continue its upward trajectory, with an increase in transactions and investment volumes, which could reach 2.5 billion euros, representing growth of 8% on the previous year. The retail and hotel sectors should continue to attract the largest volume of investment for the third year running.

In the occupational markets, activity is expected to intensify throughout the year. In the office sector, demand for high-quality buildings will drive up prime rents. The same is expected in the industrial and logistics sector, benefiting from the growing trend towards industrial nearshoring and its logistical implications. In the high street retail sector, where a shortage of supply marked the scenario in 2024, new stock currently under construction is expected to come onto the market. Strong performances are expected in the main high street retail centres in 2025, both in terms of occupancy and rents. The hotel sector is expected to maintain a positive performance, in line with the substantial growth recorded in 2024. Sustainability will be a cross-cutting theme, with stricter regulations impacting property development and management.

Portuguese economic performance fuels investors' interest

CBRE's latest forecasts, revealed at the ‘Portugal Real Estate Market Outlook’ conference, held at the Museu do Oriente in Lisbon, that investors interest is set to become more and more positive. From the key economic takeaways, the consultant highlighted an advantageous Geopolitical situation, a Demographic dynamism sustained by a high migratory balance, and a sound economic performance with public finances showing signs of better managed public accounts.

‘Portugal remains a strategic destination for property investment with a solid performance. We expect a year in line with 2024, with clear challenges, particularly with regard to sustainability: it is no longer optional and has become central to the competitiveness of assets. In 2025, the ability to adapt will be crucial in order to take advantage of the opportunities that the market continues to offer,’ says Francisco Horta e Costa, Managing Director of CBRE Portugal.

‘Southern Europe is going through a moment of prominence, with Portugal in particular asserting itself as an example of innovation. We face a decade full of challenges. Let's see how we live through this common sense revolution that Donald Trump mentioned,’ said Alexandra Abreu Loureiro, Head of Portugal at Brunswick, in her presentation.

Jos Tromp, Global Head of Data Intelligence at CBRE EMEA, gave an overview of how we are experiencing real estate in Europe. ‘Interest rates will continue to fall, but not as quickly as we had hoped, partly due to the latest news about less effective control of inflation. However, this scenario should result in an increase in investment volumes by 2025.’

2024 investment grew 44% y-o-y

After the 2023 investment dip, 2024 was a recovery year. Although with sluggish start, the year end brought some large closings which made the total investment volume achieve 2.3 billion euros.

With a realistic presentation, Igor Borrego, Head of Capital Markets, and Duarte Morais Santos, Head of Hotels, said that CBRE ‘estimates a year very much in line with 2024, but with some important nuances: we expect a slowdown in growth (around 8 per cent) and the retail segment should see a drop in volume from 1.1 billion to 700 million euros, with most of the transactions taking place in the northern region’.

In the hospitality sector, Duarte Morais Santos stressed that ‘2025 will be a year of consolidation, with several transactions started in 2024 materialising in the new year’. On the other hand, the industrial and logistics sector ‘could record one of the best years ever’, reaching around 400 million euros transacted.

As for the residential market, sales prices are expected to continue to rise due to the shortage of supply, while construction costs, despite remaining high, show signs of stabilising. In property development, the outlook is for a ‘return to optimism, with encouraging signs for the sector’.

Igor Borrego highlighted the student residence segment, ‘which sustained the growth of the living sector in 2024’. He also pointed out that ‘it wasn't in 2024 that we saw investment in Build to Rent, maybe 2025 will bring us some news, but it's taking time for this sector to take off’.

With only a slight compression of 50bps on the PBSA and High-Street, 2024 was a year of stabilization in pricing. For 2025, if inflation, interest rates and the global economy keep the expected trend the market should expect further yield compression in the remaining sectors, mostly in Tier 2 assets and locations.

What to expect in 2025?

CBRE Portugal's experts were challenged to summarise their expectations for next year in a single word, each reflecting key trends in their respective sectors.

André Almada, Senior Director Offices, chose ‘30’, referring to the breaking of the 30 euros per square metre barrier in the Lisbon office market.

'Industrialisation' was the adopted word by Nuno Torcato, Director Industrial and Logistics, referring to the wave that is putting pressure on industrial and logistics assets in Portugal.

In the retail sector, Carlos Récio, Senior Director Retail, highlighted ‘rents’ as the key word, underlining the general increase: in the high street trade in Lisbon and Porto, in retail parks and in the average rent of shopping centres.

Still in the capital markets spectrum, Datacenter and Agribusiness were highlighted as two relevant bets for the future - the first benefiting from cables landing location, competitive energy costs and available skill force; and the second, driven by growing labor productivity and increasing adoption of innovative technologies (Iberia stood out as the region in Europe with the greatest weight in agricultural production in 2024).

Sustainability is the new industry standard

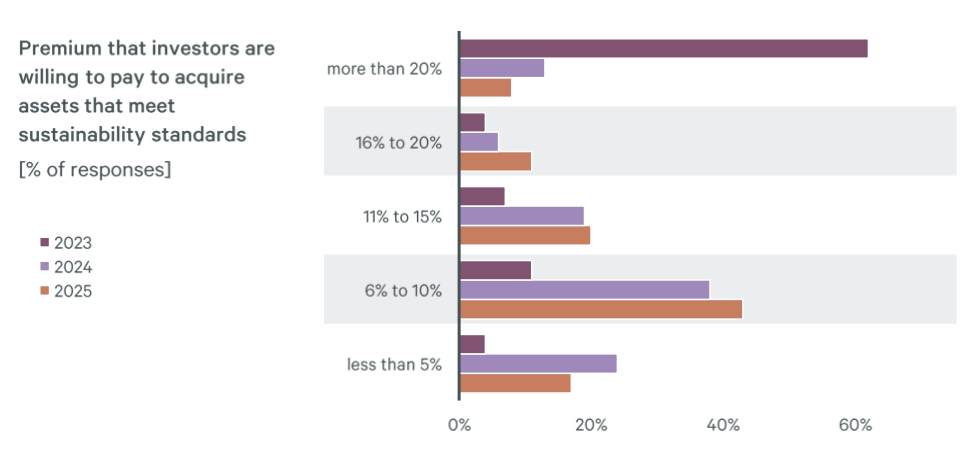

The CBRE EMA Investors Survey also presented two clear conclusions: sustainability is becoming a norm, and financing is evolving.

Liliana Soares, Head of ESG & Sustainability, pointed to the future with ‘Green Financing’, predicting that sustainability will be a central theme in investments and in the property sector by 2025.

While in 2023 the investors have shown willingness to offer a large premium for compliant buildings, that preference for large premiums has been diluting towards less generous premiums, making the sustainability become more of a norm and less of a differentiator.

From the lending perspective, institutions will offer incentives for retrofitting, necessitating clear valuation of transition risks for investors.

Besides the economic and business angle to sustainability, the reporting landscape will be more complex to navigate, which will require ESG professionals to assist companies in developing their reports for the applicability of reporting directives to the SME.