INVESTMENT PUTS ON THE BRAKES AT THE BEGINNING OF 2023

This result was calculated by Iberian Property Data based on an analysis of its database which, at the closing date of this edition, had identified a total of 125 real estate investment operations in Iberian territory between 1 January and 30 April 2023, altogether amounting to €2.7 billion.

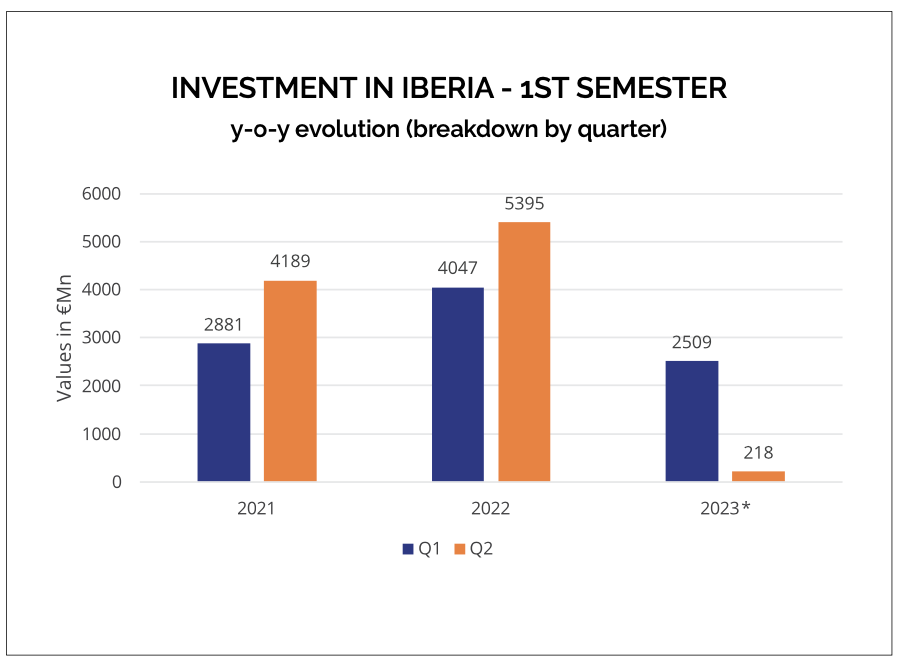

While this is still preliminary data, it confirms the forecasts presented by investors at the beginning of year, which pointed towards a deceleration trend in Iberian capital markets, in line with what has been observed in the remaining global markets. Thus, Iberian Property Data’s analysis of the performance in the first four months indicates a y-o-y decrease of 59% in terms of investment volume, and of 17% in the number of operations, compared with approximately €6.70 billion invested through 150 deals monitored during the same period in 2022.

Madrid strongly in the lead, attracting more than a third of the capital

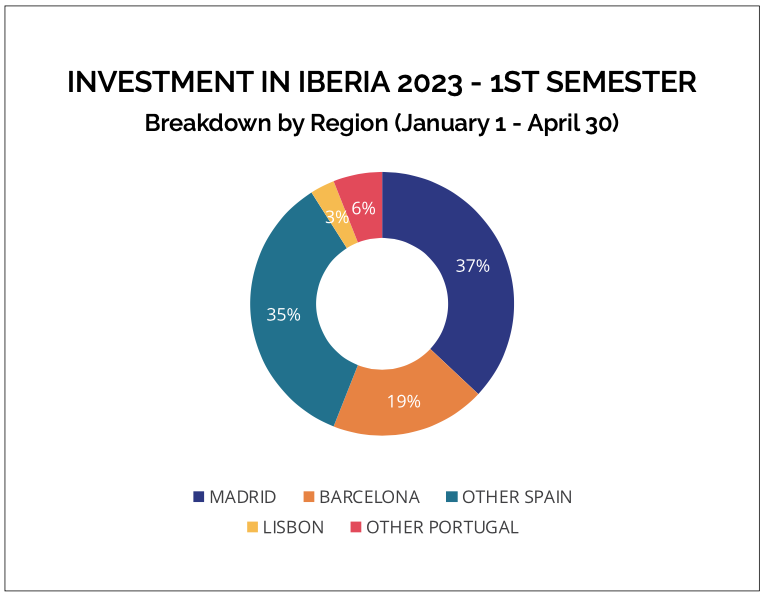

Looking at the distribution of investment, Spain is once again the leader of capital markets, attracting 91% of the volume traded, namely €2.466 billion, while the Portuguese market went no further than €259 million, representing 9% of the total. Nevertheless, this is an increase from the 6% share obtained in the first four months of 2022, while Spain’s share decreased, comparing with 94% the previous year.

In a more detailed analysis of the performance of the different Top Cities, Madrid firmly remains the principal destination to attract investment in Iberia, representing 37% of the total amount allocated to the region: €1.011 billion, increasing its position from the 19% share obtained during the same period in 2022. Like last year, in 2023 Barcelona was the second most dynamic region for capital markets, attracting €506 million that represent 19% of the total amount allocated to the Peninsula, a performance that is in line with the 18% share obtained by this region in the same period the previous year. The Portuguese capital, Lisbon, continued to lose share in 2023, representing no more than 3% of Iberian capital markets at the beginning of this year, a downturn from the 4% obtained in the first four months of 2022, and amounting to only €86 million of investment.

On the other hand, the rest of Portugal saw its relative share increase in comparative terms, rising from 2% in the first four months of 2022 to the current 6%, worth €173 million. The remaining 35% of the total investment allocated to Iberia, approximately €949 million, was distributed across the rest of Spain, which saw its share decrease from the 57% obtained one year ago.

Domestic capital is worth one third of the market

We note that, although most of the capital traded (66.3%) issued from international origins, amounting to €1.8 billion, domestic investment represented one third (33.7%) of the operations recorded in Iberia between January and the end of April, valued at €920 million.

Among the international capital, North Americans were the most dynamic investors, allocating €690 million to the region until April, followed by European players, headed up by Germany, with €314.5 million, and France, with €196.7 million. Switzerland was the fourth most active incoming market, with €135 million in transactions, followed by the UK in fifth place, with €104 million.

Multifamily represents more than half the investment

Multifamily stands out for positive reasons at the beginning of this year, attracting the largest share (39%) of Iberian investment, undertaking 23 operations that amounted to €1.06 billion. This performance was strongly driven by the completion of the sale by Via Célere to Greystar of a residential portfolio valued at €400 million, comprised of 2.425 homes distributed across five Spanish cities.

Offices follow close behind which, while leading in the number of operations (24), occupy second position on the podium in terms of investment volume, namely €708 million, securing a market share of 26%.

Closing the podium with a 15% share, retail attracted €416 million over the first four months, undertaking 21 investment deals, among which is the sale of several portfolios, both in Spain and Portugal. Among these, we highlight the transaction for €150 million of Project Amália, comprised of 50 supermarkets in various Portuguese cities, which was acquired by LCN Capital Partners from the Tengelmann Group.

Presenting 18 operations, hotels accounted for €337 million in transactions between January and the end of April, representing a 12% share of the total volume invested in the region, with this asset class positioned as the fourth most dynamic among investors.

The end of the ranking features alternative and logistics assets, whose contribution to the market total went no further than 4% in both cases. Regarding alternative assets, 10 operations were concluded during the period analysed, totalling €106 million, while although the number of logistics deals identified was double (20), the total volume invested was lower, just €95.6 million.