INVESTMENT COOLS OFF AT THE BEGINNING OF THE NEW CYCLE

According to the data calculated by Iberian Property Data, in the 1st semester of 2023, €5.42 billion were traded all across Iberia, representing a decrease of 44% compared with the €9.73 billion traded during the same period in 2022.

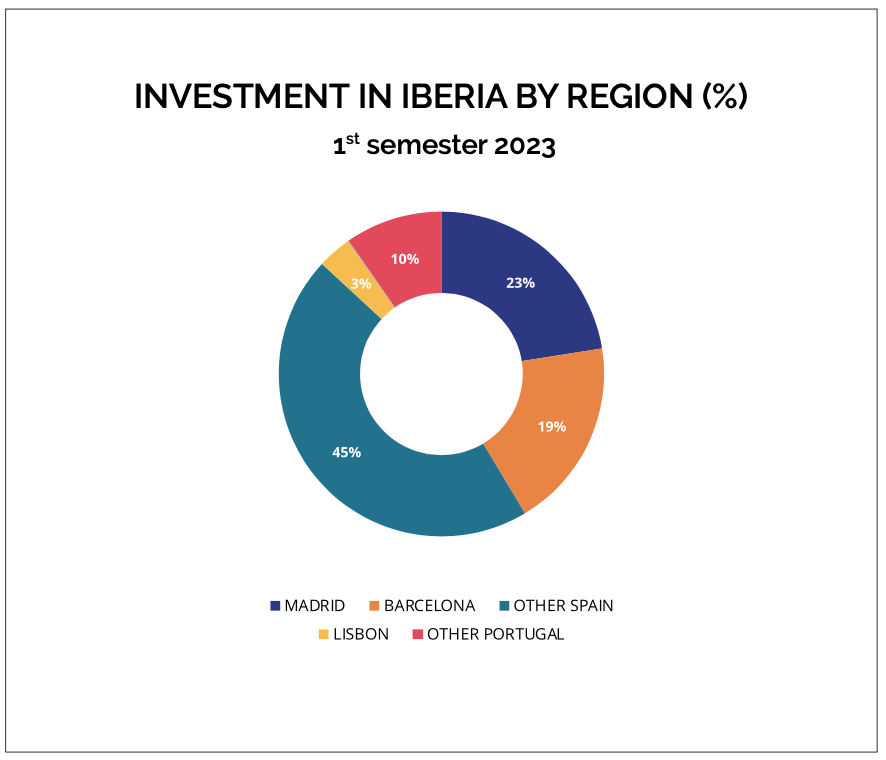

As usual, Spain concentrated the biggest share of the transaction volume in this period: 87%, in other words, approximately €4.71 billion; while in Portugal, investment went no further than €712 million, representing the remaining 13%. Nevertheless, the y-o-y comparison presents an increase in the Portuguese market share from 8% in the first half of 2022, while the Spanish market dropped four percentage points compared to 92% last year.

The drop was more significant in the major cities

We also note that both capitals presented a y-o-y loss in market share, which is explained by the fact that the amounts allocated to each of these regions in the 1st semester of the year fell to less than half of the previous year. In Madrid, investment presented a y-o-y decline of 56%, from €2.79 billion in the 1st semester of 2022 to €1.22 billion this year, with this region’s contribution to the Iberian total falling from 29% to 23%. In the case of Lisbon, although the amount traded in the 1st semester decreased almost 53% in annual terms, from €396 million currently to €185 million, the region’s loss of share was more discreet, going from 4% in 2022 to 3% in the first half of 2023.

Meanwhile, and although the amount traded in the region dropped almost 44% in annual terms, from €1.826 billion in the 1st semester of 2022 to €1.025 billion in the 1st semester of 2023, during this period Barcelona’s share of the Iberian market remained stable at 19%. The same cannot be said for the second largest city in Portugal, Porto, where investment plummeted: -98% in y-o-y terms, from €98 million to just €3 million, making this region’s contribution to investment in Iberia less than 1% in the 1st semester of 2023.

By contrast, the investment allocated outside the two major Portuguese urban centres in the first half of this year soared by 86%, with €524 million euros channelled to the rest of Portugal’s territory between January and June 2023, when one year before this figure had not gone beyond €281 million. In other words, the investment registered in this territory represented 10% of the amount traded in Iberia in the 1st semester, when its share in the first half of 2022 was just 3%.

Spain presented a y-o-y decrease of 43% in the amount invested in the first half of the year, dropping from €4.34 billion in 2022 to €2.46 billion in 2023, although the share attributed to this territory remained the same for the period analysed, at 45%

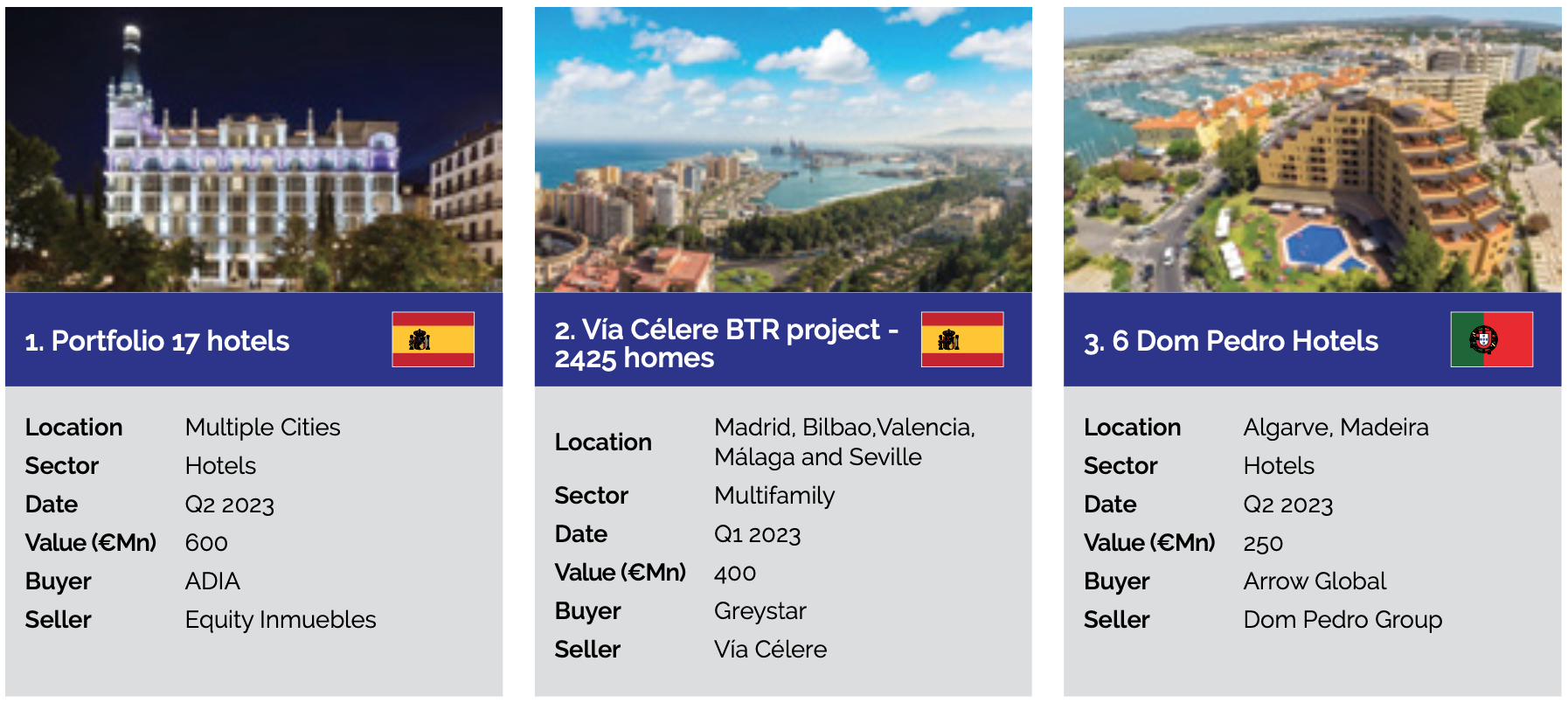

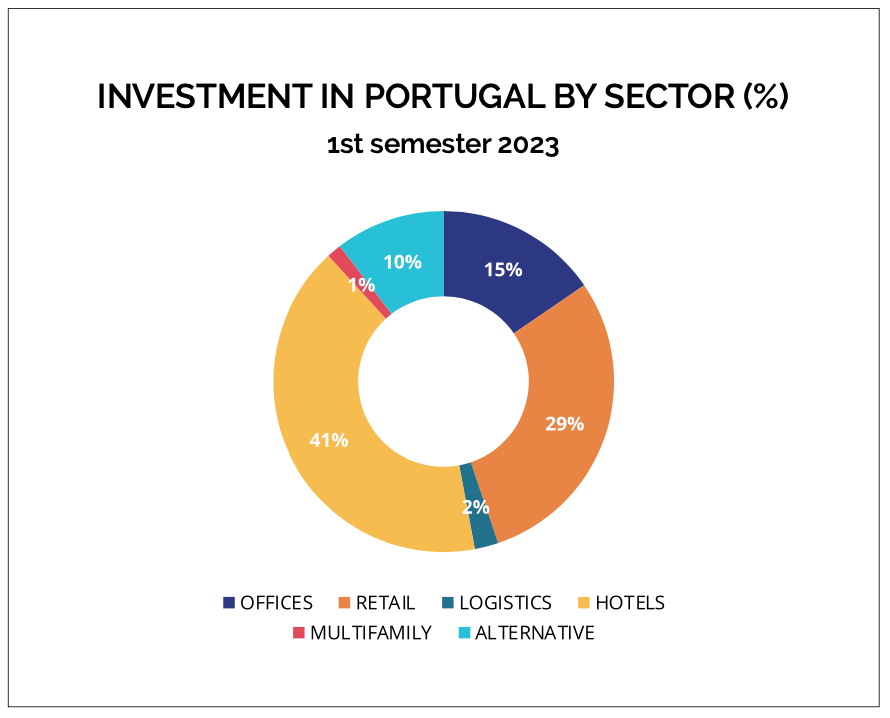

Hotels attract the largest share of investment in Portugal

Between January and June 2023, €293 million were invested to purchase hotels in the Portuguese market. In other words, 41% of the total amount invested in the country was allocated to this asset class, taking it straight to first position on podium. However, this result was strongly influenced by the conclusion of the sale by DomPedro Hotels of a portfolio of six hotels located in the Algarve and the Autonomous Region of Madeira, with Arrow Global spending €250 million and performing the largest deal completed in Portugal in the semester. Furthermore, another four operations were identified involving the transaction of hotel and tourism assets, among which, due to its scale, we also note the sale by Kronos Homes of the Amendoeira Golf Resort in the Algarve, which Iberian Property Data estimates was closed for more than €35 million.

Retail comes in second position, mobilising €209 million in the first six months of the year, earning this sector a share of 29%. Once again, the sale of a portfolio by the Tengelmann Group to LCN Capital Partners – Project Amália, comprising 50 supermarkets distributed across the country – was the major driver of the strong performance by this asset class, with €150 million traded in a single operation. This was the largest of the five transactions involving retail assets monitored by Iberian Property Data, among which we also note the purchase by Savills IM of another portfolio of four Continente supermarkets, for €39 million, and the sale to Square AM of the Guarda IN retail park, for €12 million. In the meantime, Square AM is back to purchasing in this segment, concluding in July the acquisition of a shopping centre in Funchal (La Vie) and a portfolio of two supermarkets and shops in continental Portugal, although the figures involved are still unknown.

Completing the podium, offices take up the third position, with a share of 15% and a total of €110 million invested, distributed across nine operations in Lisbon. Due to its scale, among these we note the sale of the Castilho 20 building for €26.5 million, although the names of the entities involved in this transaction are unknown, followed by the purchase of Malhoa 13 by Mapfre for €20 million, and the purchase of the Dan Cake head office by Square AM for €16.3 million.