CAPITAL MARKETS SPEED UP IN IBERIA

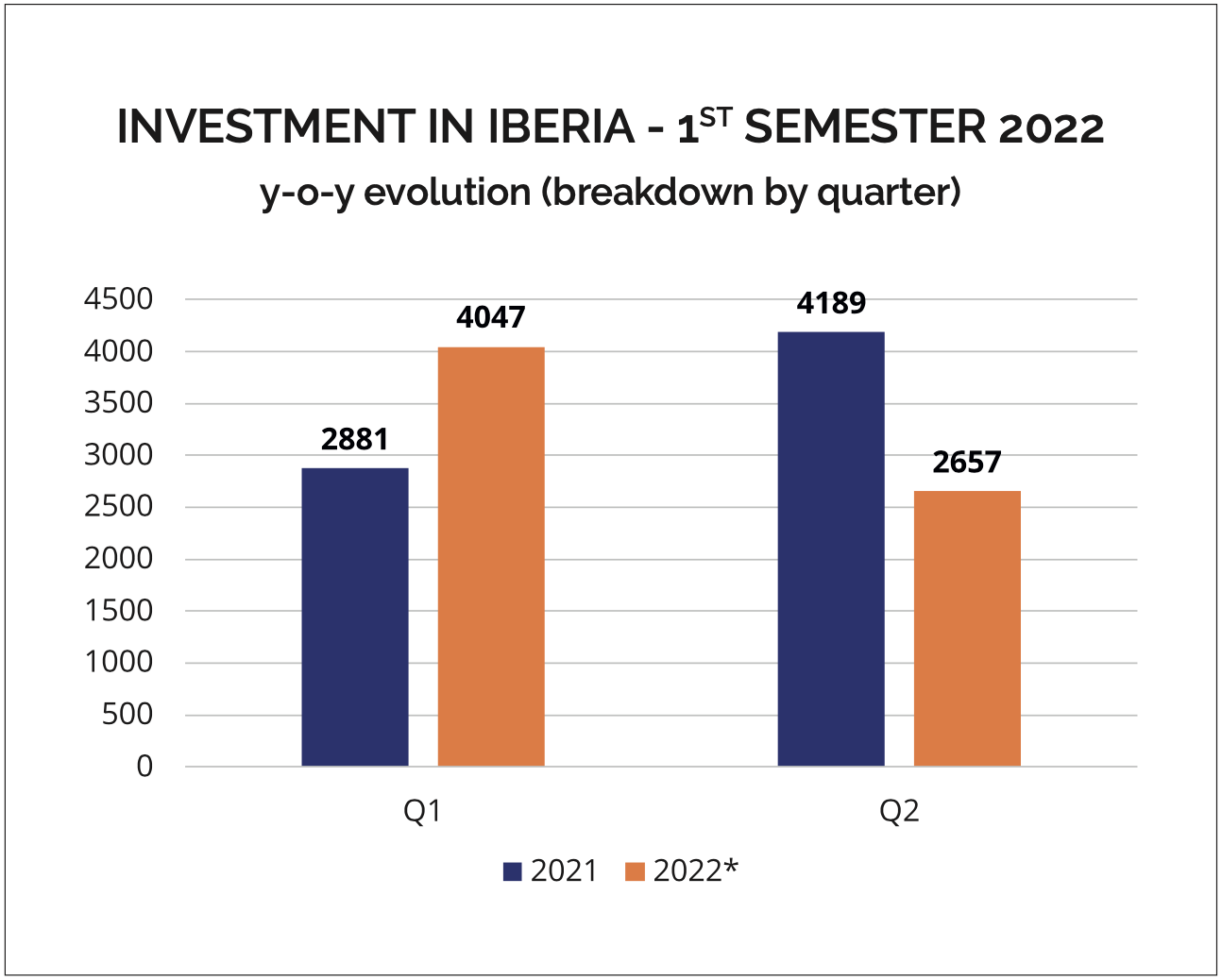

This data was calculated by Iberian Property Data© whose database identified and monitored a total of 150 deals concluded in Spain and Portugal between January and the end of April 2022, amounting to more than 6.70 billion euros. This figure is only 5% below the 7.07 billion euros calculated for the entire first semester of 2021.

Given that the provisional data for 2022 does not include the activity in May or June, which is traditionally a very dynamic month, a conservative forecast allows us to anticipate that the first semester of this year should close with a performance above the same period last year.

This outlook is also sustained by forecasts of a robust quarterly evolution, with the 2.66 billion invested in April representing 66% of the total performance achieved in the first quarter of 2022 (4.04 billion euros).

Spain continues to reinforce its share

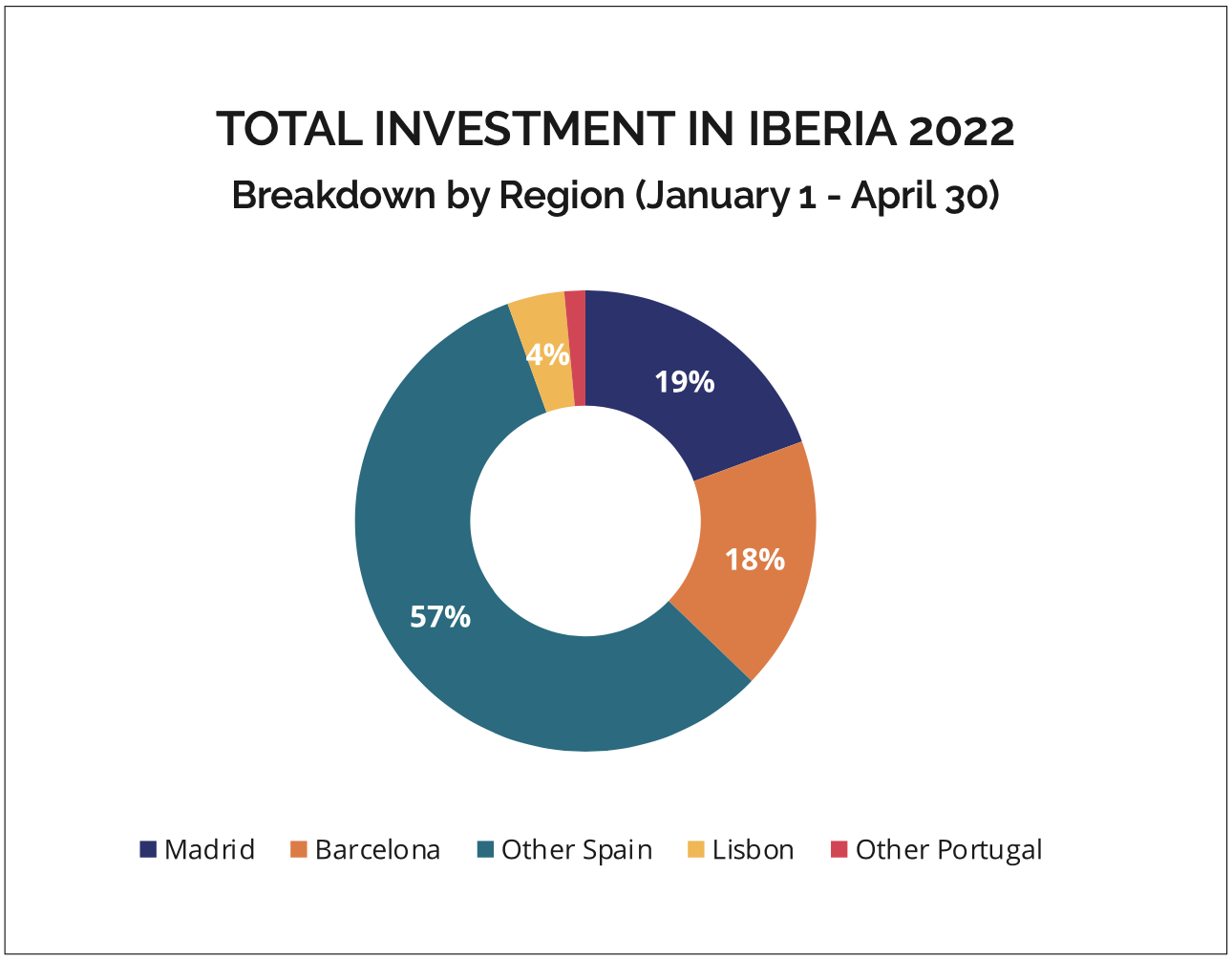

Reflecting the different size of both markets, as well as the recovery situation in each country, in these first four months of 2022, Portugal’s contribution dropped compared with Spain, with the relative share going no further than 6% of the total investment allocated to the Iberian Peninsula, trading only 398 million euros in 19 operations. This loss of percentage has been occurring gradually. At the end of the first semester of 2020, Portugal represented 22% of the total Iberian investment, dropping to 9% in the same period of 2021, and now even lower (6%). In contrast, Spain was the destination for 94% of the total amount invested in Iberia, reinforcing its share and amounting to more than 6.3 billion euros until the end of April, guaranteed by 122 deals.

Investment continues dispersed across the entire territory

These first months of 2022 also confirm the emerging trend identified by Iberian Property Data two years ago: a greater dispersal of investment in geographic terms. Thus, during the period under analysis, more than half (57%) of the total volume traded was distributed across various parts of the Spanish territory beyond Madrid and Barcelona, with 3.8 billion euros allocated to “Other Spain”. This result highlights the growing prominence of this territory, whose share increased again for the third year in a row, after going from 34% in 2019 to 37% in 2020, and to 42% at the end of 2021. On the contrary, the region “Other Portugal”, which includes all the investment allocated to Portugal outside the Lisbon region, lost prominence compared with the 4% achieved in the first semester of 2021, going no further than 1% and with an investment of 98 million euros in the first four months of 2021.

Madrid takes the lead among the Top Cities

Comparing the performance of the Top Iberian Cities, Madrid is the primary player in 2022 so far, attracting 19% of the total investment registered in Iberia, with nearly 1.3 billion euros. A result that displaced Barcelona as the leader of this podium, with the Catalonian capital attracting an 18% share of the Iberian investment, with almost 1.2 billion euros.

Madrid recovers the title of "Iberian city to attract the most investment"

This change in positions is indeed one of the key aspects to note in this period, since Madrid recovered its place as the Iberian city to attract the most investment, a position firmly held by this city since the beginning of this series analysed by Iberian Property Data, in 2017, losing to Barcelona only in 2021. However, Barcelona’s evolution is noteworthy since, until 2020, the city usually competed with Lisbon in terms of investment volumes, while it now remains very close to the Spanish capital’s volume. In this scenario, the Portuguese capital lost prominence at the beginning of 2022, representing only 4% of Iberian investment, the equivalent of just over 267 million euros although, in terms of investment volume, the city registered an increase of 7% compared to the same period in 2021.

Offices attract the most capital to Iberia

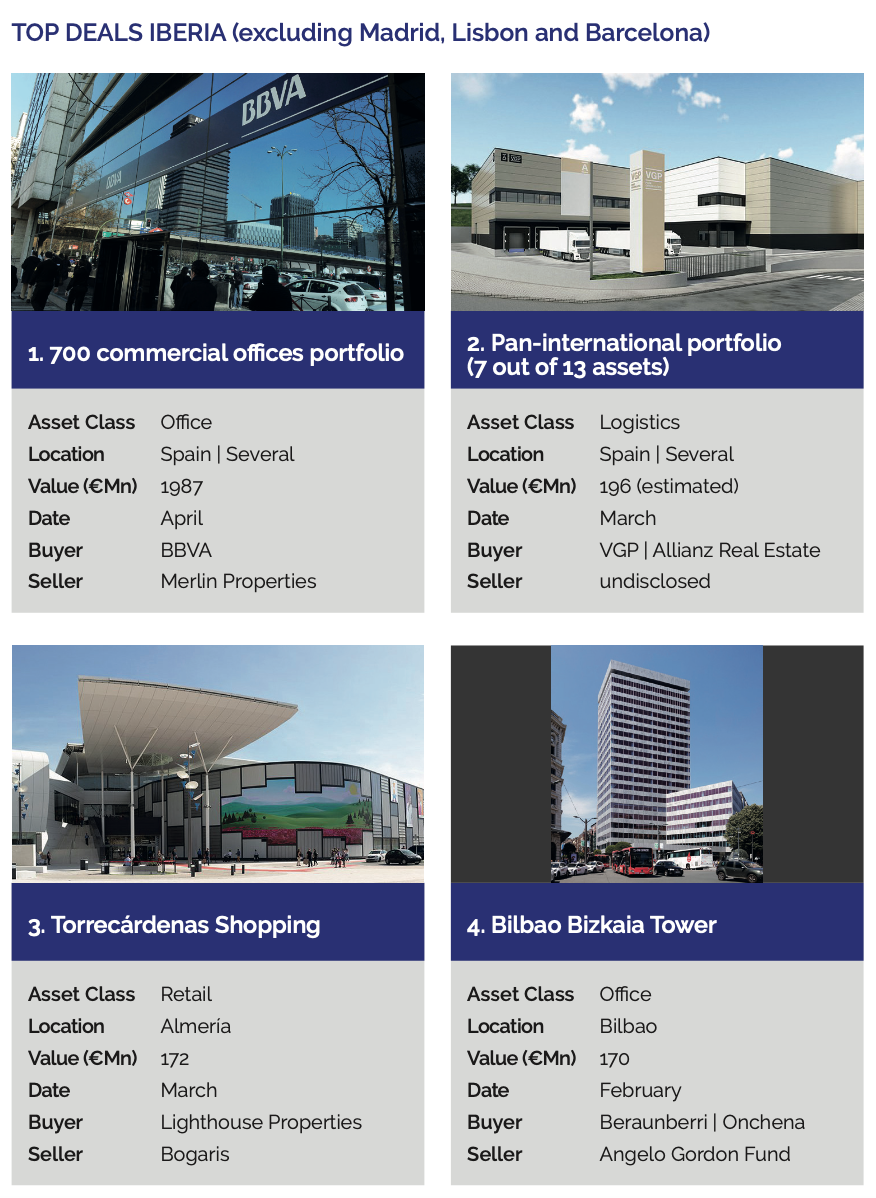

Between January and April 2021, Offices were the asset class to attract the most capital in absolute terms, amounting to approximately 3 billion euros of investment, representing a 46% share in Iberia. This figure not only reflects the recovering appetite for this asset class, but is also strongly leveraged by a mega operation valued at 1.98 billion euros involving the (re) purchase of a 700 commercial offices portfolio by BBVA from Merlin Properties, the largest transaction monitored during this period.

In second place, Multifamily received 19% of the Iberian investment, completing 30 operations that amounted to more than 1.2 billion euros, with this performance driven above all by the transaction of the residential Becorp portfolio for 600 million euros. This portfolio comprised 1500 dwellings for rental housing in Barcelona and was purchased by PATRIZIA. Build-to-rent operations amounted to 99 million euros, al- though there were 3 operations whose value was not disclosed. The senior and student housing segments accounted for 85 million euros altogether.

There were also 30 operations involving the sale of Hotels, in a total of 1.08 billion euros and securing this asset a position on the podium, with a share of 15%. Logistics occupy the fourth place, with 25 transactions and a total amount of 668 million euros invested, about 10% of the total. The end of the list features Retail, with 396 million euros and 22 operations concluded, generating a 6% share, while Alternative assets presented a share of 4%, with 8 deals that totalled 260 million euros.