Each market is quite different from a market structure and a regulatory standpoint. Most alternative property types are highly operational in nature and need platform investments to achieve scale and efficiency. They are complex and they need special talent and skill sets to access the product, and later to manage the properties and eliminate risk.

The complexity is inherent to the relation between the owners of those assets, and their future tenants and occupants. The profiles vary by country and even by city, so international capital is joining forces with local investors who are more knowledgeable about the location and can easily identify opportunities and scale investments.

The alternative property types fall loosely into four categories: healthcare and well-being, living alternatives, supply chain, and tech and digital. Iberian Property analyses in more detail the Senior Housing, Student Housing, and Data Centre segments, as the first months of 2022 set a particularly positive outlook on major investment operations soon to be closed both in Spain and Portugal.

STUDENT HOUSING

The student housing segment has gradually moved from being considered an alternative asset to being a segment of its own.

As in all other real estate markets, investment activ- ity in student residences suffered during 2020 due to the mobility restrictions caused by the health crisis on the one hand, and the overall wait-and- see attitude in the face of uncertainty on the other.

However, the market has regained momentum, and during 2021 more than €405M were trans- acted in Iberia, accounting for more than 21% of the total in 2020. So far, in 2022, eight operations have already been carried out with an estimated value surpassing 200 million euros.

The profile of active buyers in the market is mainly international, although the creation of joint ventures (JVs) with international capital and local knowledge is becoming increasingly more frequent.

The high interest in the market and the signif- icant level of liquidity continue to mark a clear trend of yield compression. The yield for prime product in Spain closed at around 4.50%, and in Portugal it reached 5.0%. In the last ten years the downwards yield adjustment has been close to 200 base points.

DATA CENTRES

The Iberian Peninsula is positioned as one of the strategic European markets for the imple- mentation of Data Centres. Spain and Portugal have a strategic position for both distributing and receiving content, thanks to the submarine cables connections and, also, because of the backbones and dark fibre networks, which place them as areas of high attraction for operators and investors. To date there are more than 700 MW under development in data centre projects in the 3 main locations of the peninsula: Madrid, Barcelona, and Lisbon.

Madrid is the benchmark market in southern Europe, concentrating 31 operational data centres with 100 MW installed and a pipeline of 505 MW, equivalent to 70% of the total under development in the Iberia region.

In the province of Madrid, 14 projects have been identified, located mainly in the north, around the A1 and A2 axes. However, some locations on the A4 axis monopolize very relevant projects such as the one announced in Fuenlabrada by Thor Equities this year, which provides for a 100 MW Data Centre, and represents an investment of 600 million euros.

The city of Barcelona and its metropolitan area have a dozen operating data centres and a 110 MW pipeline under development, a figure more than 5 times higher than the current operating capacity.

Portugal concentrates the interest of international investors and operators, and it is estimated that, together with Madrid, it will lead this market in the medium term. Both the city of Lisbon and other locations in the south of the Portuguese country accumulate important projects in development. Specifically, Sines has been the location chosen for the largest Data Centre project announced to date in the Iberian Peninsula. This is the Star Campus, one of the largest in Europe, developed by Pioneer Point and Davidson Kempner with a capacity of over 450 MW. The investment in this specific data centre ascends to 3.5 billion euros.

Revenue in the Data Centre market is projected by Statista to reach 3.35 billion euros in Spain, and 761.7 million euros in Portugal, by the end of 2022. During the next four years, both markets are expected to show an annual growth rate above 2.5%.

SENIOR LIVING

From an investment perspective, given the demographic trends, this is a market with high potential in the medium and long term. The end customer of this product are people in good health with spending power. To a certain extent, this clientele is protected against economic cycles (pre-retired and retired homeowners), generating security forthe investor regarding the occupancy levels of properties and the payment capacity of tenants.

This format provides an alternative for the real estate investor in the current climate of high liquidity and low yield by combining the benefits of housing investment (stable cash flows and low correlation to economic cycles) with those of commercial investment (20- year contracts; triple net lease to a single operator), as well as demonstrating high occupancy levels in comparable markets.

The yield on senior living registered during the last quarter of 2021 stood at 5.50% in Portugal, and at 4.6% in Spain. This is a significant difference compared to the yield offered by other real estate products, although senior living is still maturing and pending development. In this scenario, it is normal to see the entry of opportunistic or value-add investors in the development phase, and once the market has stabilised, to start receiving “core+” and “core” investors.

KEY INVESTMENT INDICATORS IN IBERIA - ALTERNATIVE ASSETS

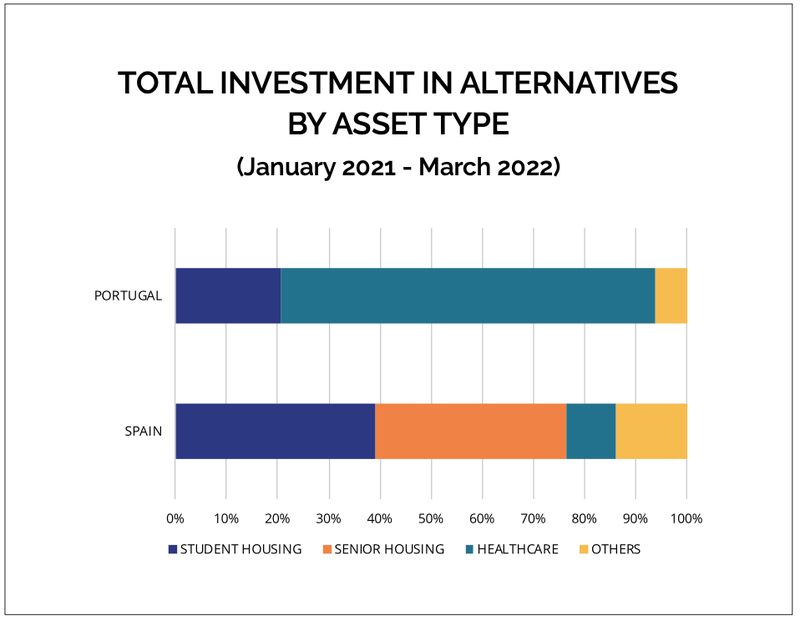

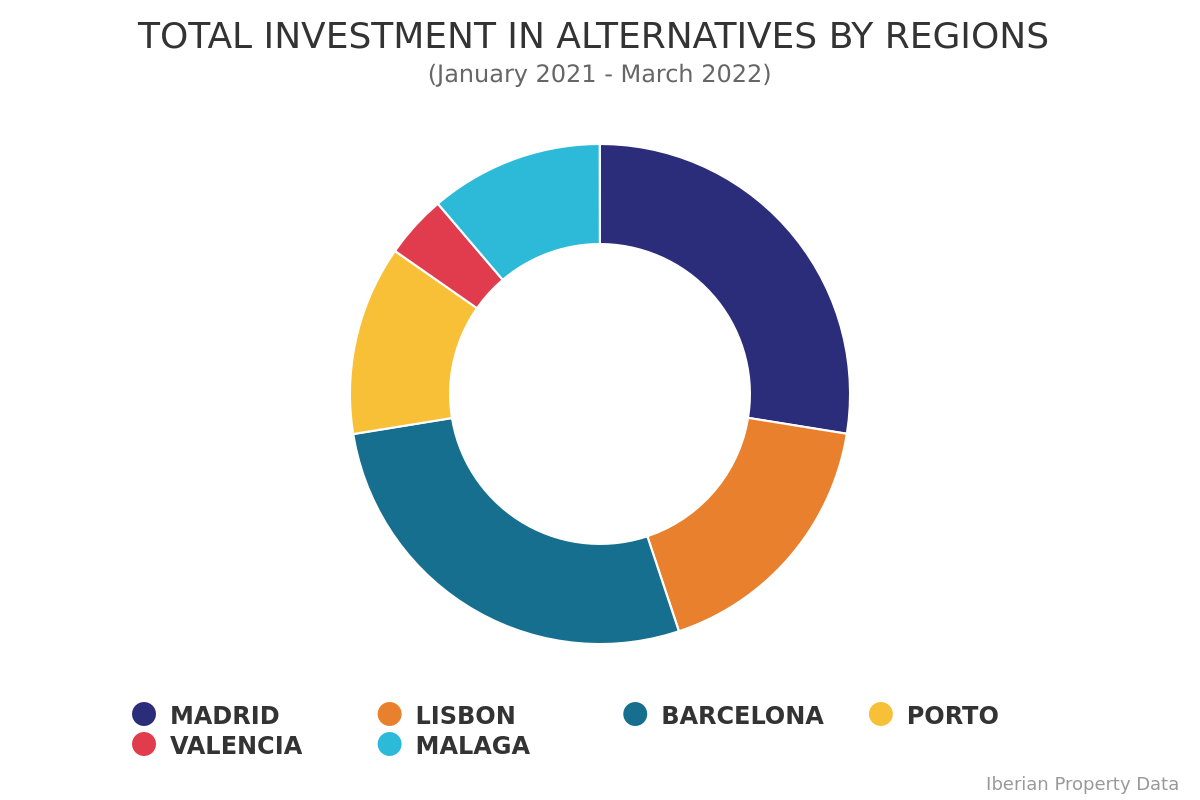

The total investment volume allocated to this asset class has been growing consecutively since 2019, and in 2021 Madrid and Barcelona attracted together more than half of the investment channeled to Iberia (54%).

Institutional capital (Asset Managers & Investment Funds + Insurance Companies & Pension Funds) was particularly important to boost the growth rate observed in 2021, capturing a total share of 82%. Private Equity was responsible for 10% of the investment, and REITS & Socimis accounted for 5%.

Regarding the origin of the capital it must be highlighted the increased presence of the French investors who accounted for the largest share of investment in 2021, specifically reaching a 248 million euros volume. Completing the podium, Belgium stood on the second place with 211 million euros, followed by the United States of America that invested around 172 million euros.