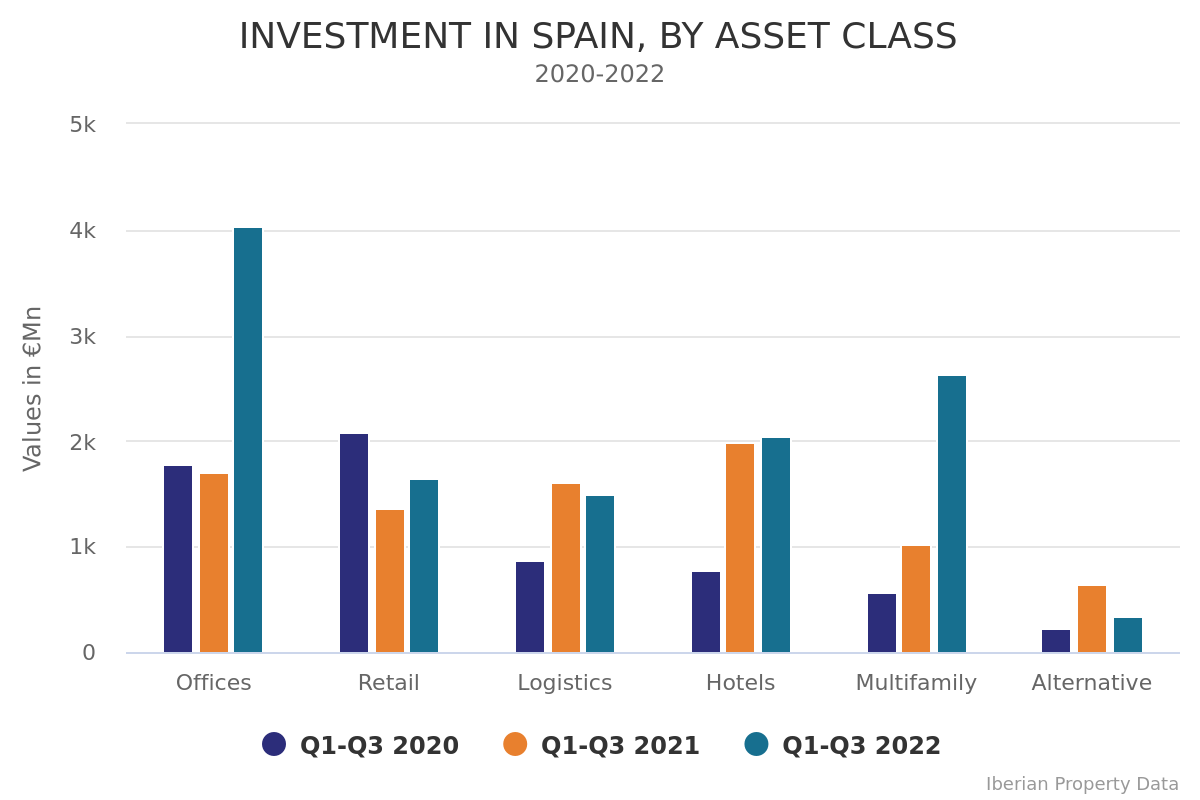

If in 2019 (Q1-Q3) offices and retail were the major stars of real estate investment in Spain, leading the podium with, respectively, 45% (3.17 billion euros) and 17%(1.20 billion euros) of the total investment, followed by hotels in 3rd position with a share of 12% (784 million euros), in 2022 the scenario is quite close, with only the second position of the ranking belonging to a different sector.

Firstly, there is clearly a greater balance between the amounts allocated to the different asset classes. More than doubling the volume of capital attraction offices take the lead at ease with 4.03 billion euros (33% of the total), followed by multifamily (2.63 billion euros, 22% of the total) and hotels (2.04 billion euros, 17% of thetotal). Retail is off the podium for the second consecutive time since Iberian Property started tracking this series, with a share of 14% and 1.65 billion euros invested (21% y-o-y growth) which, nevertheless, bring it to 4th position on this ranking. Logistics comes next, in 5th position with a 12% share and 1.50 billion euros invested. Finally, Alternatives come in 6th position, with 332 million euros traded and a share of 3%.

Alongside these changes in position, we note the exponential growth in the total amounts allocated to Hotels, Multifamily and Logistics between 2019 and 2022, reflecting the importance these assets classes have gained among investors in the wake of the pandemic.

On one hand, the last months have been marked by great momentum in hotel investment. Since tourism was one of the economic sectors most negatively impacted by Covid-19, various institutional and private investors are now capitalising on this opportunity, positioning themselves to, given the better conditions, add to their portfolios assets in this sector that were not even on the market before. The data is clear: after the capital allocated to this asset class more than doubled (+142%) in the last year, from 785 million euros until the 3rd quarter of 2020 to 1.9 billion euros at the end of September 2021, there was still room for increase and to surpass the 2 billion investment mark in 2022. Looking back before Covid, the growth in 2022 was 247% compared with the 827 million euros invested until the 3rd quarter of 2019.

The pandemic also seems to have had a positive effect on the investment in multifamily, which increased more than 600% between the 3rd quarter of 2019 (7% of the total) and the 3rd quarter of 2022 (2.63 billion euros). Inside this sector Residential attracted the largest amount (1.14 billion euros), however the greatest ‘leap’ was registered in the Student Housing segment, which this year attracted approximately 1.12 billion euros (also a 9% share of the total). Senior housing captured almost 200 million euros, translating in 2% of the total investment.

After emerging as a ‘winner’ from the Covid-19 crisis, benefitting largely, among other factors, from the boom in e-commerce, the investment in logistics decreased this year, from 1.61 billion euros in 2021 to 1.50 billion in 2022, nevertheless it remains way above the levels of 2019 (789 million euros).