REIT Meridia III closed the year with a 247.2 million euro Net Asset Value. New acquisitions are not on the table for this year.

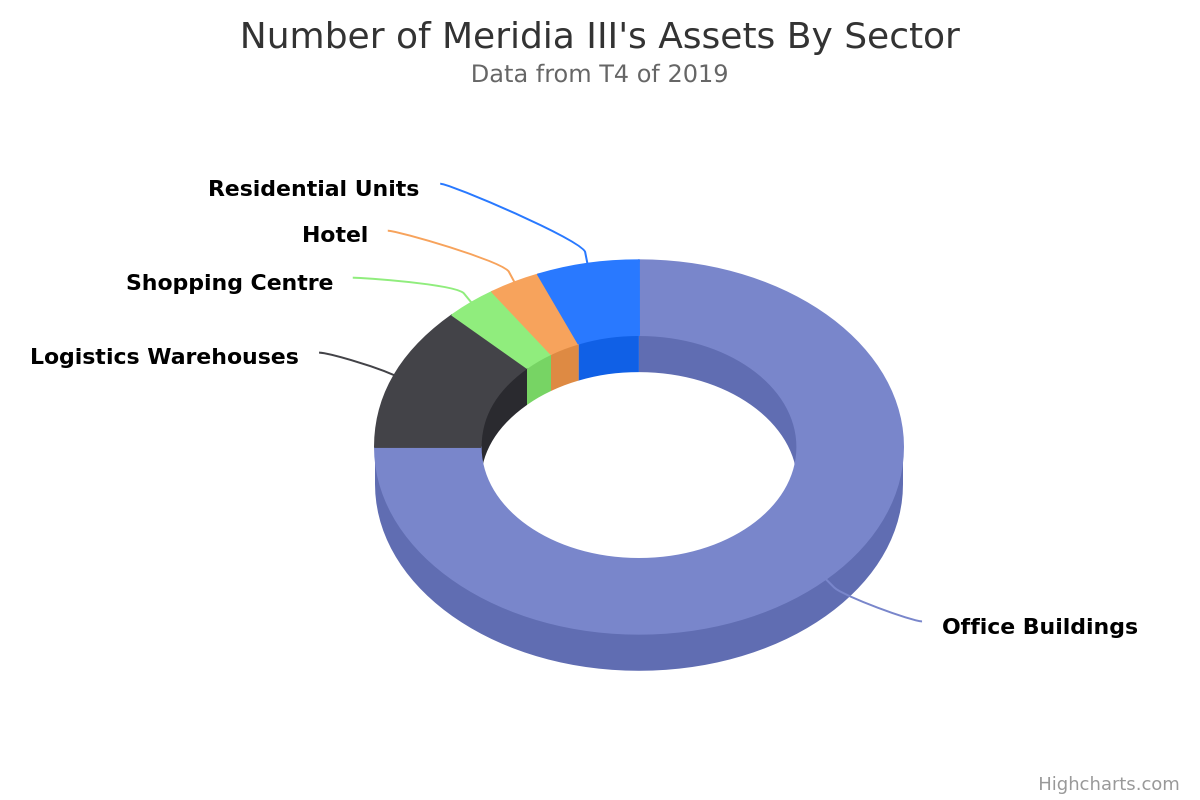

Last year’s end of the year operational results had already been announced by Meridia III, in a report where the portfolio composed by 32 assets: 24 office buildings, 4 logistics warehouses, 1 shopping centre, 1 hotel and 2 residential units, were highlighted. These assets are located, for the most part, in Barcelona and Madrid.

These acquisitions were carried out with a «total equity invested amount of 158.5 million euro, plus an additional 21.3 million euro of committed equity for further payments in Project Scottish and for CapEx in other deals», revealed the document.

Amongst the assets acquired last year is 3 star Hotel Madrid Chamartin, which cost 27.5 million euro. This asset which has a 12.580 sqm gross area – should be converted so as to become a 4 star hotel and increase the number of rooms from 199 to 204.

The REIT’s goals for this year do not include new investments. According to Javier Faus and Juan Barba, administrators of the vehicle, «Meridia III is virtually fully invested and as of now we do not expect to complete any new acquisitions».

«Meridia III is now focusing on potential exits, always considering the life span of the asset, value-add implementation and potential pricing of the building. We expect 2020 to be an active year in that regard, and anticipate the first meaningful realisations to start during the first quarter», added the administrators.