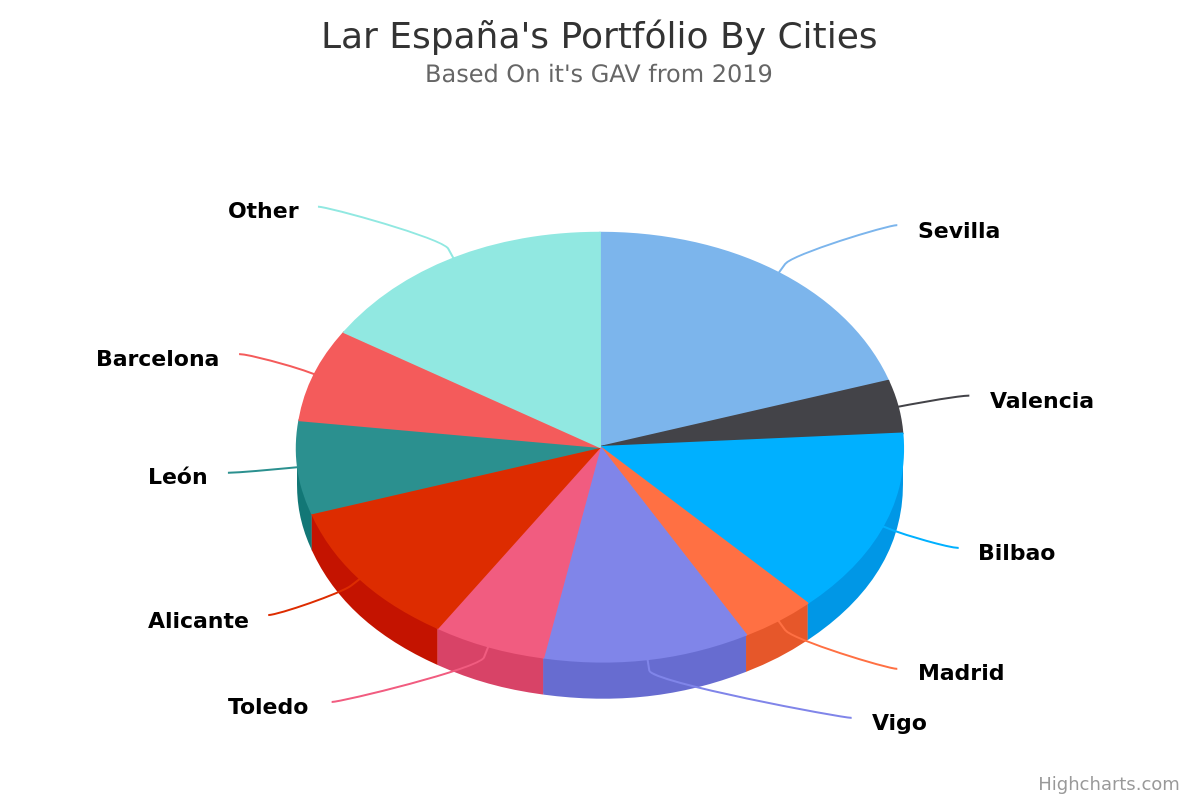

With the adjustments carried out during the last two years, Lar España consolidated its retail portfolio, and 20% of all its value is concentrated in Seville, in the Lagoh Shopping Centre – estimated at 312 million euro – the REIT’s only asset in the city.

This shopping centre is for the REIT «the best example of new generation experiential retail». Besides being fully occupied with a Net Initial Yield of 5.1%, this shopping centre was renovated, creating more offer in leisure (such as gaming, wind tunnel and giant wave) and food experiences, introducing the concept of casual dining and gourmet market, for example.

In Bilbao it’s the same story. The REIT only has one asset in this Spanish city, the 82.341 sqm MegaPark, which represents 14% of its GAV, the second highest share when divided by city. This is an asset whose market value was set last year at 217.3 million euro, after the conclusion of the first renovation stage, which focused on improving the asset’s image, creating a new landscape area with vegetation diversity and a new children’s play area. For the second stage of the renovation, the company intends to create a new leisure and dining area.

Alicante is another municipality that concentrates a considerable share of the company’s 15 asset portfolio with 11.4%. It is in this Spanish city that, according to Lar España’s latest report, the Portal de la Marina (including the hypermarket), estimated at 126.4 million euro; and the Vista Hermosa business park, estimated at 50.5 million euro, are located.

Another relevant location is the city of Vigo, which represents 11% of the REIT’s GAV, which by the end of last year had reached 1.552 million euro. It is here that Lar España has the 41.453 sqm Shopping Centre Gran Vía, estimated at close to 166.9 million euro.

With smaller shares are Barcelona, where Lar España only has the 102.1 million euro Anec Balu; Leon, where it owns the El Rosal estimated at 110.9 million euro; and also Madrid, where it possesses the Rivas Futura business park estimated at 67.5 million euro.

The municipalities of Lugo, Alcacete, Guipúzcoa, Palencia, Cantabria and the Basque Country, La Rioja, Navarre and Balearic Islands regions, were also chosen by the REIT to invest in. In total, the company has 254 million euro in assets in those areas, representing a 16.4% share of its entire portfolio.