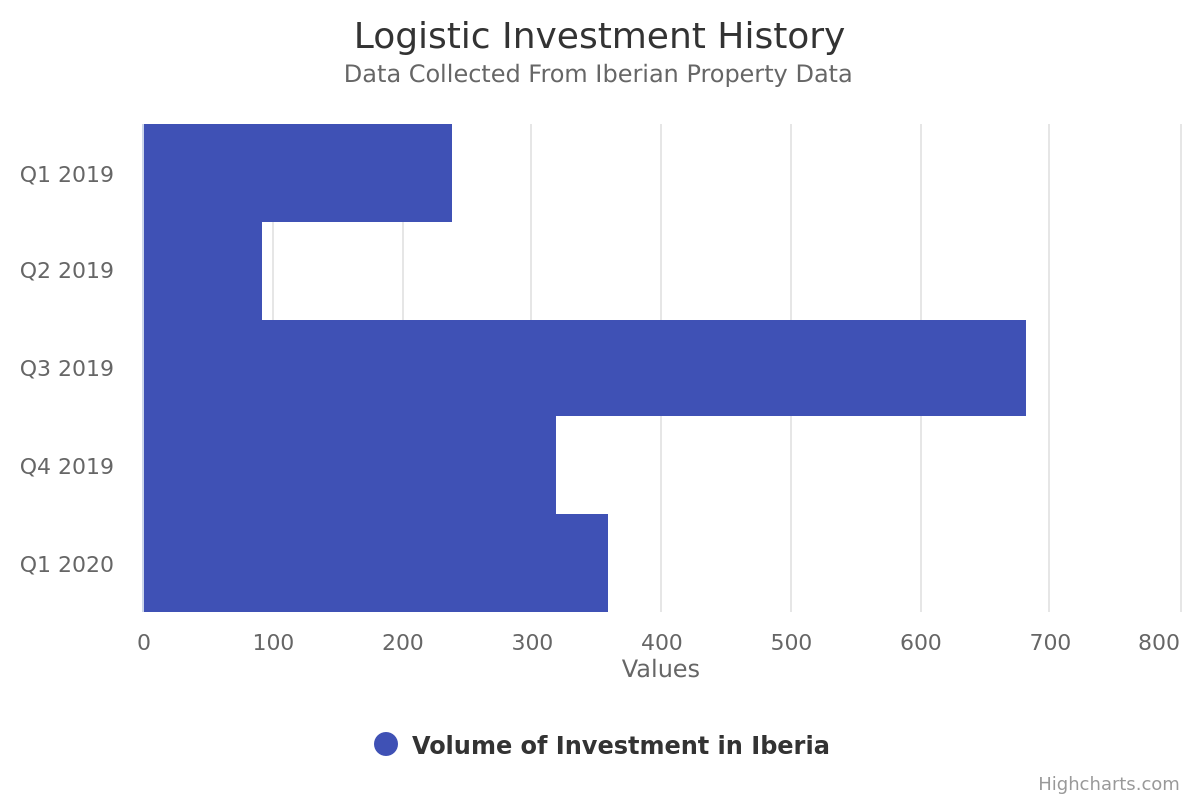

Investment in logistics in Portugal and Spain increased around 49.8% yoy during the first quarter of the year, representing a total of 360 million euro.

Even when compared to the last quarter of 2019, there was a 12.3% increase, for a total 10 operations, with the average ticket per operation at 36 million euro, less than the average ticket for operation during the previous 4 quarters which was around 43 million euro.

These are some of the conclusions that can be drawn from Iberian Property’s latest logistics report, which further revealed that the logistic segment only represented 8% of all real estate investment in Iberia during this period.

The 5 largest operations within this segment were carried out in Spain, the country which also represents the overwhelming majority of investment during the last 4 quarters with more than 98%. The acquisition of the 11 unit portfolio from German Patrizia for 213 million euro was the largest transaction registered since the beginning of the year.

Within this segment, asset managers and investment funds are the most active, since during the last 4 quarters they carried out most of the investment with 65.6%. REITs also had a significant share of logistic investment during this period, around 30.5%. With a smaller share within the segment are Private Equities (3.3%) and Insurance Companies (with less than 1%).

All the information is available at the Logistic Report launched by Iberian Property, which can be downloaded HERE.

For more information on how to subscribe to the Iberian Property Data service, click HERE.

Disclaimer: This information is based on public data gathered within the platform Iberian Property Data. All estimates were calculated based on registered public information and data from the main consultants within the market. It should be noted that the results presented here may be updated if new information is issued.