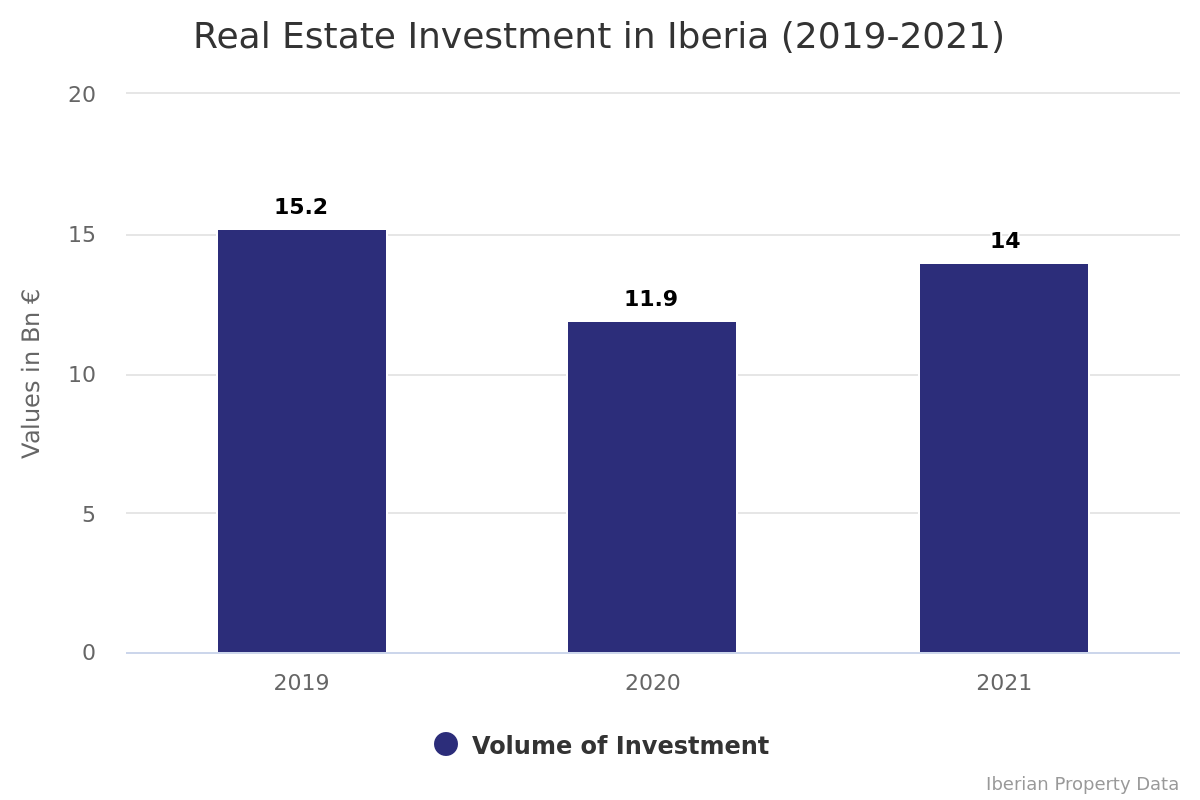

This data was calculated by Iberian Property Data, whose database identified a sample of 252 commercial real estate investment operations in Iberia throughout 2021, with a total amount traded of 14 billion euros. This result compares highly (+18%) with the 11.9 billion euros calculated in 2020, despite the decrease in the number ofoperations (-14%) compared with the 294 deals identified that same year.

Compared with the pre-covid period, the performance reported in 2021 was just 8% below the 15.2 billion euros traded in the Iberian market in 2019, which we note was a record year with the highest volume of investment in the last five years, when Iberian Property began monitoring the “Top Deals” series. We also mention that last year closed with 36 less deals than the 288 transactions registered in 2019.

Portugal loses ground

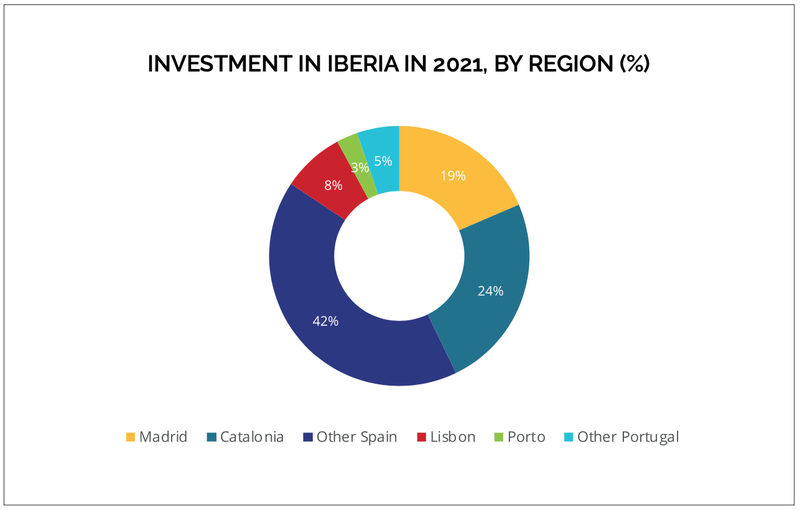

The vast majority (84%) of the volume allocated to the Iberian market in 2019 was destined for the Spanish market, which traded 11.8 billion euros – a value 32% higher than the 8.8 billion euros registered one year before, and which led to an increase of 8 percentage points (p.p.) in its share in absolute terms throughout the last year. In contrast, contributing with 2.2 billion euros in 2021, Portugal lost ground during the period under analysis, due to a y-o-y decline of 24% in the total amount traded, making its Iberian market share drop 24% in 2020 to just 16% at the end of last year.

Source: Iberian Property Data

Looking in closer detail, the Catalonia region represented 24% of the total amount traded in the Iberian Peninsula in 2021, with approximately 3.4 billion euros, while Madrid concentrated 19% of the total, with 2.6 billion euros, and Lisbon represented just 8%, the equivalent of 1.1 billion euros. Approximately 5.8 billion euros were allocated to the rest of Spain (excluding the Madrid and Cata- lonia regions), representing a share of 42%, while the rest of Portugal (except Lisbon) concentratedthe remaining 8%, in other words 1.1 billion euros.

In comparison with the previous year, we note the regions of Catalonia, Other Spain and Other Portugal, which saw the amounts allocated increase 147% (vs 1.4 billion euros in 2020), 43% (vs 4.1 billion euros in 2020) and 23% (vs 900 million euros in 2020), respectively. In the case of Catalonia and Other Spain, this improvement is reflected in the increase of their shares on an Iberian level, which grew 12 p.p. and 8 p.p.in absolute terms respectively, while the share of “Other Portugal” remained the same as in 2020. In contrast, the 26% decrease in the volume in- vested in Madrid in the last year resulted in a loss of 11 p.p. compared with the 30% share obtained in 2020, while Lisbon, with an even greater drop in the investment volume (-45%) in 2021, saw its share shrink to less than half (-9 p.p.) compared with the 17% registered one year before.