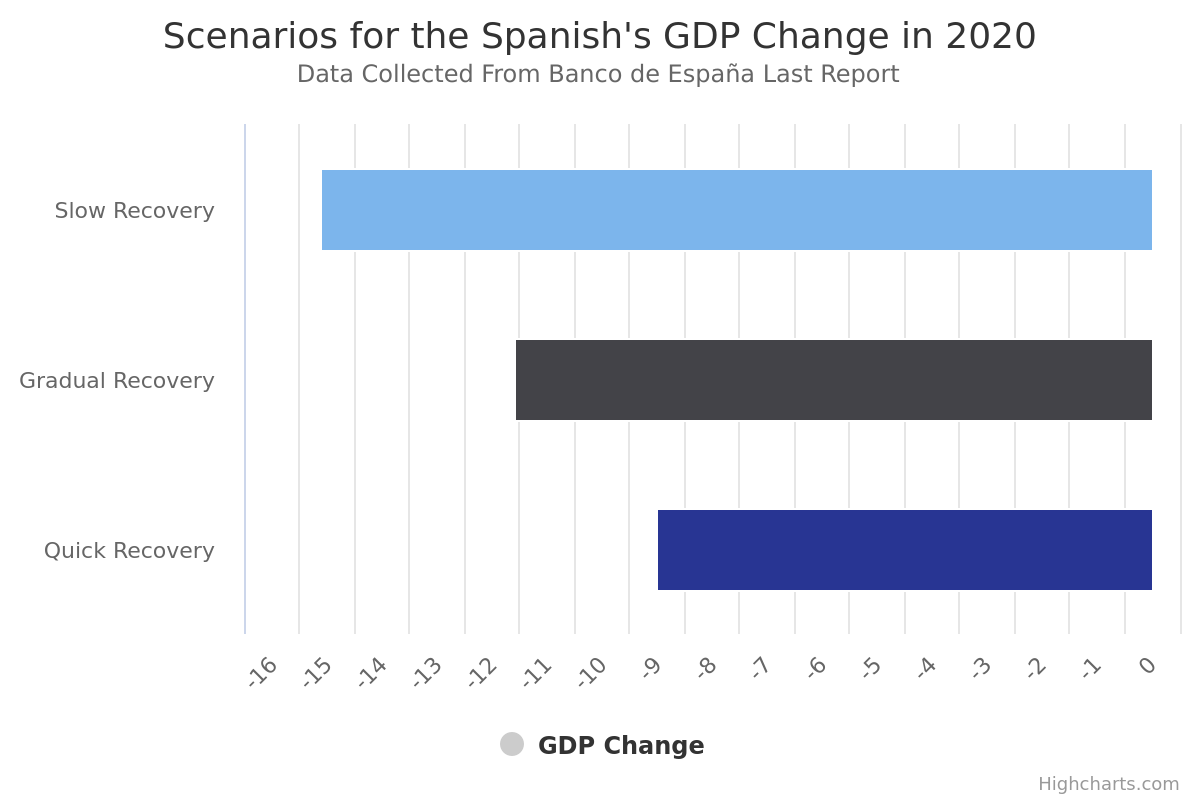

The latest macroeconomic projections for Spain are not encouraging. Banco de España assumes that the country’s GDP can drop between 9% and 15.1% this year. The speed of the economy’s recovery and the associated risks explain the variations.

The worst scenario assumes the «risk of an epidemiological evolution, with intense episodes of new infections, which would require additional strict confinements, with a high economic cost», it can be read on the note published by the bank last week. This scenario would mean «liquidity pressure for companies», which would result in «the destruction of companies, long term unemployment, reduced availability and increased financing costs». It is within this context that Banco de España assumes the GDP’s 15.1% drop in 2020 and it further predicts a «very slow» recovery: 6.9% of the GDP in 2021 and 4% in 2022.

In an intermediate scenario of gradual recovery, it is expected «a somewhat greater impact of the measures adopted to contain the pandemic during the second quarter», but without disregarding «neither possible new outbreaks nor the appearance of more persistent damages to the productive fabric». In this case, the assumed GDP contraction would be 11.6% this year and recovery to 9.1% and 2.1% in the following two years.

The best scenario conceived by Banco de España assumes a 9% GDP contraction, even worse than the value assumed by the International Monetary Fund at the beginning of April: -8%. This scenario assumes that the «improvement on the activity observed since the end of the second quarter will continue without any new significant sanitary, economic or financial constraints». Under this scenario, the bank predicts a faster economic recovery of 7.71% in 2021 and 2.4% in 2022.

Learn more about the other Banco de España's projections Here.