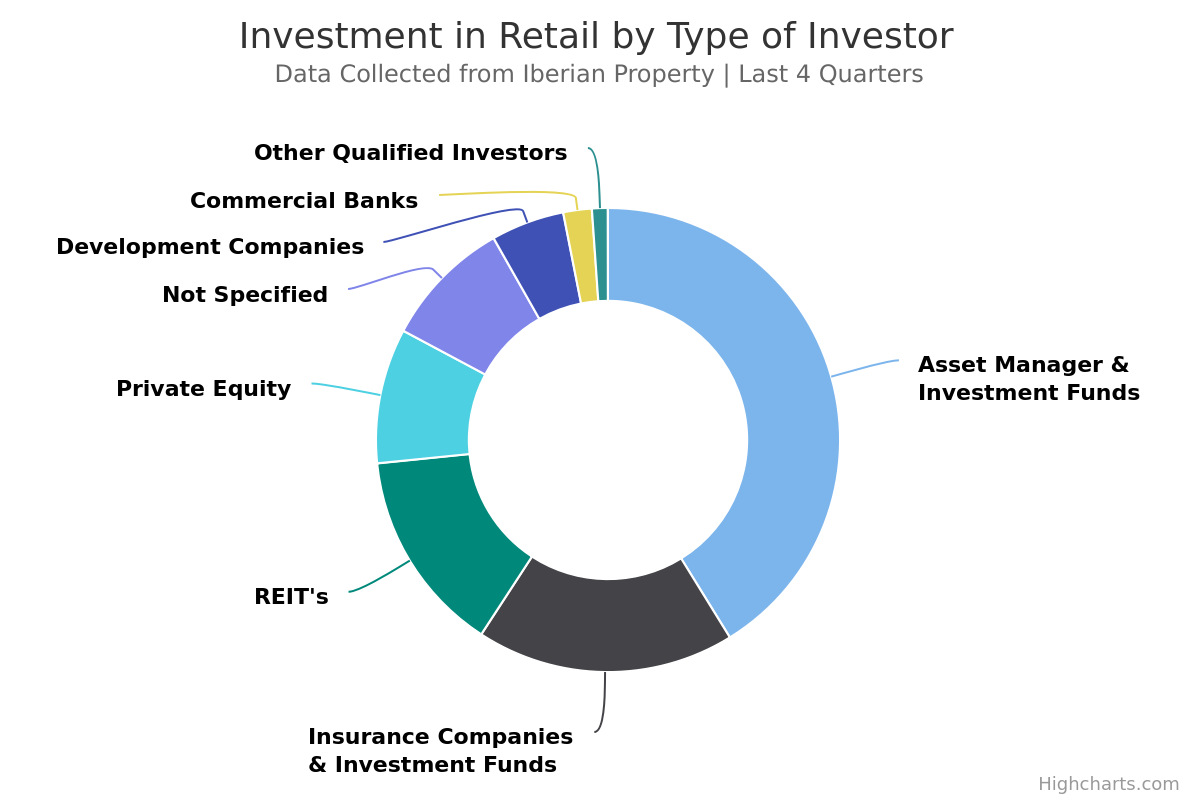

Assets Managers and Investment Funds represented around 41.2% of all retail investment in Iberia during the last 4 quarters. Just in the first quarter of 2020, the retail investment reached a total of 1.377 million euro.

This is one of the main conclusions from the report on retail from Iberian Property concerning the first quarter of 2020 which has just been released. The document further revealed that one of these players carried out one of the largest operations during this period: the acquisition of intu Asturias for 290 million euro by German fund ECE European Prime Shopping Center Fund.

Next came Insurance Companies & Pension Funds with 18%. Within this group of investors were group Allianz and Elo which carried out one of the largest operations ever recorded, the purchase of a 6 shopping centre portfolio spread across Portugal (4) and Spain (2) for 525 million euro.

With 14.2% of investment in Iberia during the last 4 quarters came the REITs. This number was strengthened by the transaction of 3 commercial units from Merlin Properties sold to REIT Silicius for 170 million euro and the purchase of the commercial area from Edifício Espanha building by Inbest Prime Socimi for around 160 million euro.

Private equities were also active within the Iberian retail market during this period representing 9.4% of all transactions. In this segment, development companies represented 5.1% and commercial banks only 2% of transactions. It should be noted that in 9% of the transactions the type of investor was not identified and that 1.1% were carried out by other types of qualified investors, such as family offices.

Retail evolves in all market indicators

Despite the pandemic crisis having closed the doors of most retail spaces in Iberia, the segment showed a positive evolution in terms of the main market indicators during the first three months of the year.

Not only the investment volumes tripled, but their share in terms of total investment in Iberia also increased significantly, from 19% during the four quarters of 2019 to 30% during the first quarter of 2020. The number of deals carried out also more than tripled between those two periods, registering 16 concluded operations. The average ticket by transaction almost doubled when compared to the previous 4 quarters, reaching 86 million euro.

Spain remains ahead in this league since 11.5% of the investment volume went to Madrid, 7.9% to Catalonia and 39.2% to other Spanish regions. In Portugal, Lisbon received 14.2% of the investment, Porto 3.8% and the rest of the country 23.4%.

All the information is available at the Report from Iberian Property which can be downloaded HERE.

For more information on how to subscribe to the Iberian Property Data service, click HERE.

Disclaimer: This information is based on public data gathered within the platform Iberian Property Data. All estimates were calculated based on registered public information and data from the main consultants within the market. It should be noted that the results presented here may be updated if new information is issued.