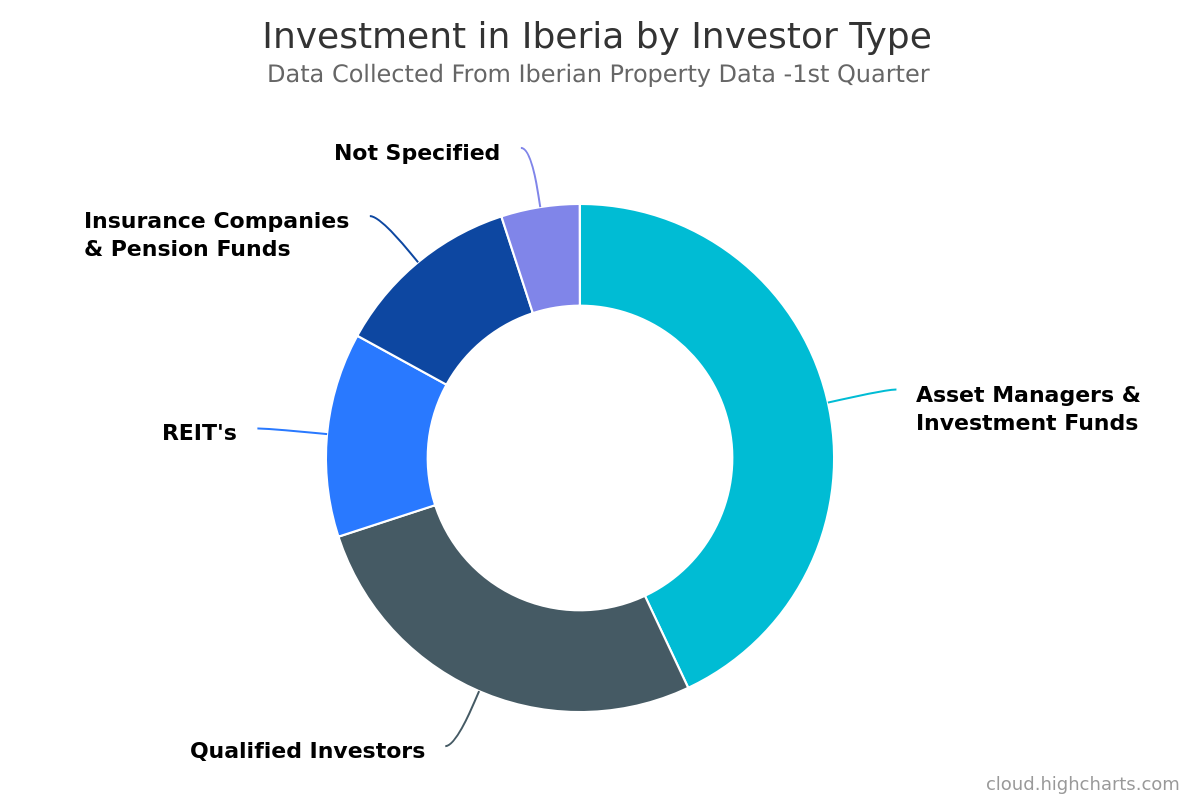

Asset Managers and investment funds were not only the players who were responsible for the largest number of operations in Iberia during the first 3 months of the year – 43 –, but also the ones with the largest share of total investment – around 43%.

More than 2 billion euro were invested by asset managers and investment funds, with the largest operation being the acquisition of intu Asturias for 290 million euro, carried out by ECE European Prime Shopping Centre Fund II.

In second place came the qualified investors who represented more than a quarter of all investment, with 1.270 million euro spread across 28 transactions. Within this group, private equity investors were the ones who invested the most in Iberia, adding around 801 million euro (17% of the whole), followed by the development companies with a 6% share, commercial banks (2%), as end-user companies (1%) and family offices (1%).

In third place were the REITs. These players carried out 14 operations between Portugal and Spain, totalling approximately 594 million euro – 13% - of the whole. Insurance companies and pension funds totalled only 3 operations and represented a similar share –12%. The purchase of a 6 shopping centre portfolio from Soane Sierra and APG by Allianz and Elo for 525 million euro may explain that number.

It should be further noted that the protagonists of 12 investment operations, representing 5% of the whole, were not disclosed yet.

Disclaimer: This information is based on public data gathered within the platform Iberian Property Data. All estimates were calculated based on registered public information and data from main consultants within the market.