Altogether, the ten players that make up the 2023 edition of the Top Investors Portugal ranking invested more than €648 million, distributed across 13 operations concluded between January and June this year. Compared with 2022, a greater concentration of capital is evident, as last year “only” 72% of the investment was in the hands of the Top 10 investors, amounting to €513 million, while this year the share is 90%.

Likewise, the average ticket invested by this group is also higher in 2023, amounting to €49.85 million, a figure 36% above the €36.64 million calculated in the 2022 benchmark. Comparing the average ticket spent by the Top 10 with the remaining investors operating in Portugal in the first six months of the year, the difference is staggering, almost seven times higher than the €6.42 million invested on average by this last group.

North Americans dominate the podium

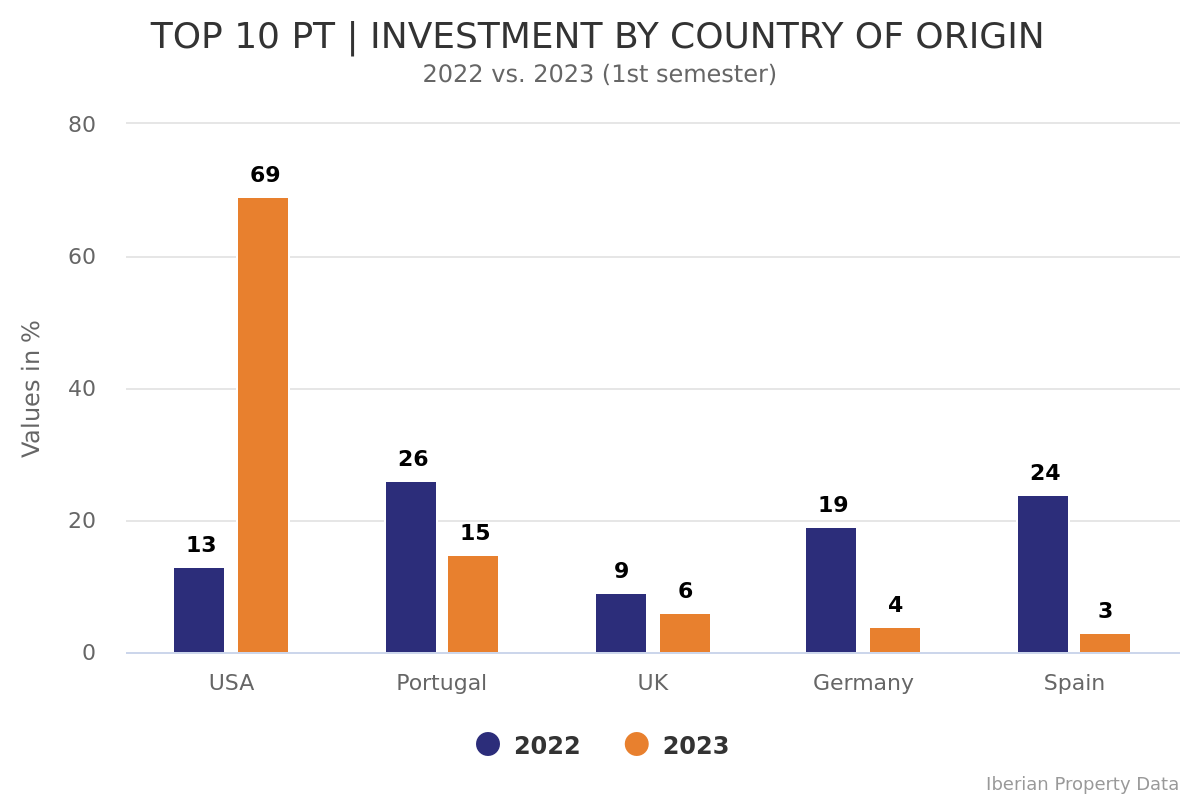

In 2023, the podium is led by three North American entities which, with only three operations (one each), accounted for 69% of the total value traded by the top investors in this period, amounting to €450 million. This result reflects an intensification of this incoming market’s position compared with 2022, when its share was just 13%.

Portuguese investors follow, represented by three entities – Square AM, Rolear Group and Silvip – with a total investment of €96 million, or 15% of the value led by the top investors in 2023. This result represents a decrease from the share achieved in 2022, when domestic capital led the ranking with a 26% share.

With Savills IM as its ambassador, British capital is the third most represented, with 6% of the total of this Top 10, in other words, €39 million, a y-o-y decline from the 9% share achieved last year. The drop was even more substantial for Germany and Spain, this year obtaining a share of 4% (€27 million) and 3% (€20 million) respectively, when in 2022 these shares were 19% and 24%. On the contrary, France returned to the ranking this year with a 2% share.

Private Equity returns to the ranking in a prominent position

Among the changes observed in the last year in the composition of this Top 10, a greater balance is also evident between the amounts invested by Asset Managers & Investment Funds – a total of €276 million invested by five entities – and Private Equity - with €250 million led by just one entity-, with these investor types representing 43% and 39% of the value concentrated in this ranking, respectively. In comparative terms, in 2022 Private Equity was absent from the Top 10, and Asset Managers & Investment Funds concentrated almost 80% of the capital.

End User Companies and Commercial & Investment Banks were other newcomers to the ranking this year, entering directly with shares of 13% (€86 million, invested by two entities) and 2% (€17.5 million by one entity), respectively. On the other hand, Family Offices are absent from this year’s ranking, while last year they represented 12% of the figure invested by the Top Investors. Insurance Companies & Pension Funds lost ground, going from a share of 12% in 2022 to just 3% this year.