As it does every year, MSCI has published its benchmark index on investment in the Spanish real estate sector. The offices of the law firm Uría Menéndez were the venue chosen to present the results of the index and to hold a debate on the main conclusions of the study and on the key factors that shape the present and future of real estate investment in Spain.

The results of the MSCI Spain Annual Property Index 2022, were presented by Luís Francisco, Vice President of MSCI, in collaboration with Iberian Property. The debate that followed was moderated by Diego Armero, partner at Uría Menéndez, and included the participation of Roger Cooke, Chairman of RICS Spain and independent advisor of Grupo Iberinmo; Juan Manuel Ortega, Chief Investment Officer of Inmobiliaria Colonial; José Manuel Llovet, CEO Tertiary of Grupo Lar, and Federico Bros, Head of Investment and Asset Management at M&G Real Estate Iberia.

The MSCI index began to be published in 2000, and has become a benchmark for the real estate sector, now more than ever because, as José Manuel Llovet pointed out, "at a time when there is so much pessimism and we see so many prophets of disaster, having real data, provided voluntarily by companies, is essential for the sector". The index is currently published in more than 30 countries and takes into account data from 60,000 assets located in more than 1,400 cities. In Spain, the sample taken into consideration by MSCI has increased by 8.2% compared to the 2021 index due to the new assets and portfolios included.

Despite everything, investment grew in 2022

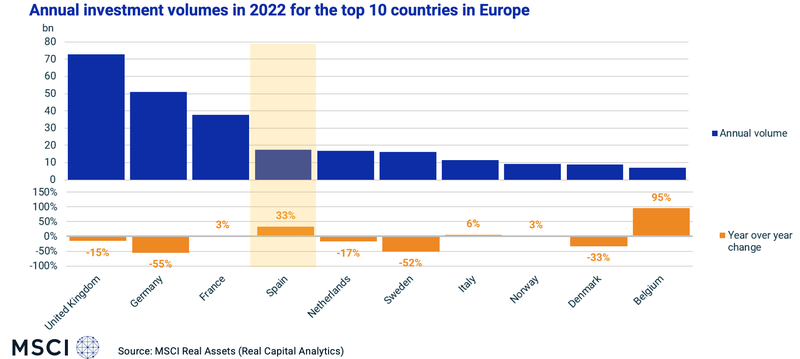

Despite the context of macroeconomic uncertainty, the instability brought to the sector by the tension between Russia and Ukraine and the unprecedented inflation plaguing the Old Continent, the volume of investment in the Spanish real estate sector has grown by 33% in 2022. This is one of the main conclusions presented by Luís Francisco, vice president of MSCI, at the presentation of the annual index. This increase makes Spain one of the few European countries in which there has been a significant upturn and, at the same time, the fourth nation on the continent in terms of investment volume.

LUÍS FRANCISCO, VICE PRESIDENT OF MSCI

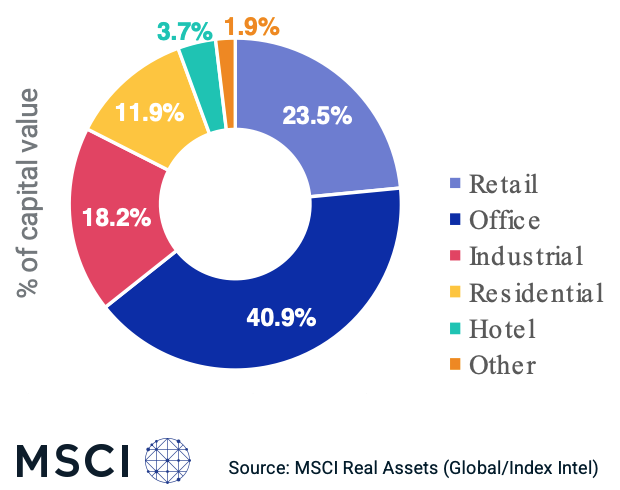

Offices were the segment with the highest investment according to MSCI data, accounting for 40.9% of the total volume. This was followed by retail, which accounted for 23.5% of investment. Within this segment, retail parks were the type of asset that generated the highest appetite for investors, and Luís Francisco also pointed out that 2022 was the year in which the recovery of shopping centres was consolidated. José Manuel Llovet, CEO Tertiary of Grupo Lar, provided data that reinforces this positive trend: in 2019, the year prior to the COVID-19 crisis that did so much damage to retail, Spanish shopping centres registered 2,000 million visits. After the setback, and in just three years, the figures collected by the Spanish Association of Shopping Centres and Parks speak of 1.7 billion visits, a figure that speaks of resilience, future prospects and, indeed, recovery.

Investment in logistics-industrial, with 18.2% of the total; in residential, with 11.9% and in hotels, with 3.7%, would close the distribution of real estate investment in 2022, always according to the data presented this Monday by Luis Francisco at the Uría Menéndez facilities.

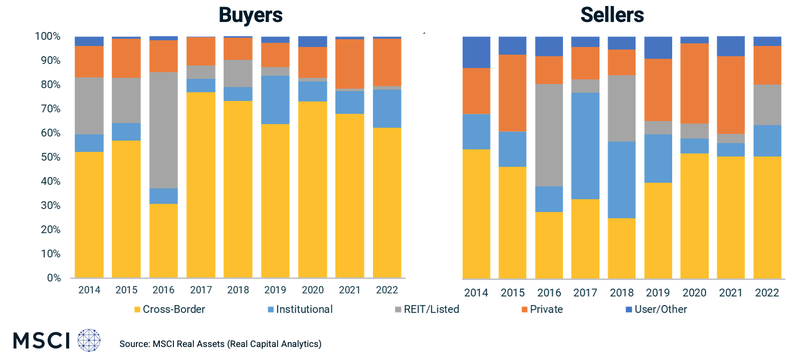

In terms of buyers and sellers in the real estate landscape, international investors continue to occupy the top position in the ranking, but the MSCI Spain Annual Property Index 2022 shows that local players have gained weight compared to previous years. Institutional investors, private funds and listed companies share the rest of the capital, both on the buy side and the sell side.

Yields, inflation and the sustainability challenge

After Luis Francisco's presentation of the MSCI annual index results, a panel discussion moderated by Diego Armero, partner at Uría Menéndez, began. The first to speak was Roger Cooke, Chairman of RICS Spain, who said that the results of the report were extremely interesting but not surprising in the sense that they were in line with expectations. "Capital Return has been hurt by interest rate rises but the data is still positive, which means asset managers have done a good job," he said.

ROGER COOKE, JUAN MANUEL ORTEGA and JOSÉ MANUEL LLOVET

Juan Manuel Ortega, CIO of Inmobiliaria Colonial, made a very optimistic reading of the data presented by Luis Francisco, supported by the good results obtained by his company in its three main markets: Madrid, Barcelona and Paris. However, he added that "2022 seems to be the year of the positivist speeches, but it is true that things have been going well". He also emphasised the importance of the push for flex spaces: "the office market, over the last three years, has been marked to a large extent by the rise of flexible workspaces: approximately 70% of tenants are interested in the hybrid work model".

José Manuel Llovet, CEO Tertiary of Grupo Lar, joked at the beginning of his speech, thanking MSCI for having counted on him in a year in which retail had achieved such good results. From his point of view, "the COVID has tested us in the toughest way imaginable, but the retail sector has managed to prove its resilience once again". Even so, the Grupo Lar representative is aware that "market volatility and inflation make investors more cautious than ever when choosing where to invest". But in spite of everything, and as the results of the MSCI report show, the good news is that "Spain and its assets continue to be very attractive to international investors".

In the same vein, Federico Bros, Head of Investment and Asset Management at M&G Real Estate Iberia, pointed out that "we must be prudent, now more than ever, because it is foreseeable that the European Central Bank will continue to raise interest rates and that this will affect yields". In addition, Bros wanted to make it clear that, in order to establish a proper framework for talking about real estate investment and the local economy, "we cannot look exclusively at CPI because that would give us a biased view of the economy; to have a complete view we must take underlying inflation into account".

ESG criteria: a new way of defining strategies

"Before the Covid-19 crisis, I'm sure half the people in this room had never heard of the ESG concept". Roger Cooke began his presentation on environmental, social and governance criteria for companies in the real estate sector and their impact on their value and attractiveness to investors with this blunt and, at the same time, accurate statement.

FEDERICO BROS and DIEGO ARMERO

On the other hand, the president of RICS Spain acknowledged that "in terms of ESG, the real estate sector has done a great job, especially in terms of new projects, but the existing building stock is now the big challenge". So much so that the ESG strategy of companies in the sector has become the direct focus of most corporate policies and at the top of the list of demands of major investors. "The objectives of reducing greenhouse gas emissions by 2030 are not limited to being a CSR complement, but mean that the company's entire strategy has to be redesigned," said Juan Manuel Ortega, CIO of Colonial.

No one doubts the importance of this type of policy within companies. In the opinion of Federico Bros, "it is no longer a question of maintaining a discourse on the ESG criteria of the company or on the sustainability of an asset, it is that if you do not have certain credentials, it is impossible to obtain financing". For José Manuel Llovet, financing requires a great deal of prior work and is often difficult to quantify or convert into visible results. "If I put an asset up for sale, the buyers are usually not going to pay more for it, no matter how much ESG work I have done.