The volume of global real estate investment increased by 38% year-on-year, reaching the figure of 1.3 trillion dollars, according to the latest update of Impacts, the global real estate analysis program of Savills Aguirre Newman, with data until the end of November 2021.

The study concludes that the total volume of investment recovered strongly in 2021, due to the growing number of funds interested in investing in the real estate sector, which reached maximum levels driven by investors' search for diversification in sources of income. In 2021, 1,250 funds with $365 billion of capital were identified to invest in real estate, according to Preqin data, compared to 1,000 active funds in 2020.

According to Savills, the residential and industrial-logistics sectors will be the strongest globally in 2022, maintaining the trend of the previous year, retail will recover share and the implementation of ESG criteria will boost activity in offices.

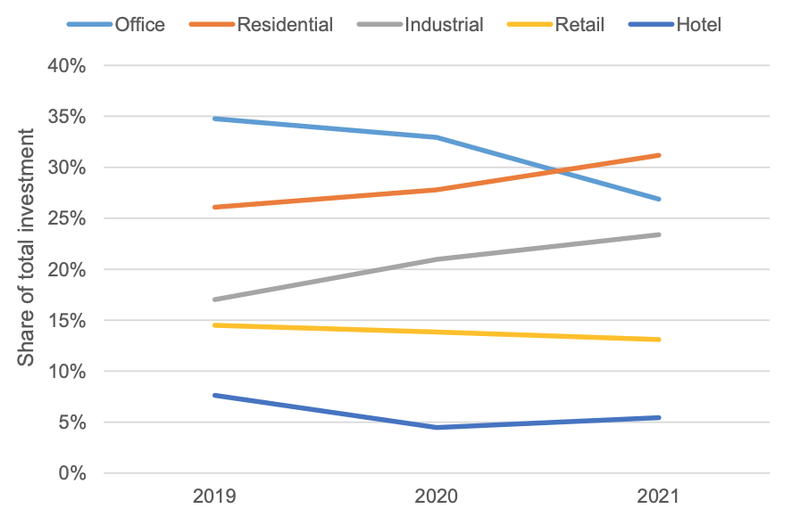

Evolution of participation by sectors in global real estate investment

Source: Savills World Research with RCA, data covers 12 months to November of each year.

The residential sector (multifamily, residences for students and the elderly) accounted for the largest volume of investment worldwide last year, surpassing offices for the first time. The international real estate consultancy notes that investors are increasingly attracted by the security and income produced by the residential sector, the strong underlying demand and its resilience in the face of technological disintermediation. In addition to maintaining the trend in 2022, the lack of current stock suggests that the promotion will be an entry point for many investors through forward funding strategies. Secondary cities also show potential due to users' search for a better quality of life at more affordable prices.

Investment volumes in the industrial-logistics sector increased by 54% in 2021. For 2022, Savills points to potential in this market in new locations due to offshoring, to bring supply chains closer to home and sub-sectors as the last mile.

Regarding offices, the international real estate consultancy indicates that, although the data show a lower share of investment in offices in favor of residential, these continue to monopolize a greater share of the global market than the logistics sector. Taking into account that cross-border investors, especially in Europe, will develop their ESG strategies this year, the consultancy sees good opportunities to reposition, rehabilitate or reconvert the current office stock into high-yield sustainable assets.

In the global retail market, Savills points out that 2022 could mark a turning point after the price revision of recent years, as it is now a more competitive segment and is at a time when retailers have improved their adaptation to new habits. shopping.

The international consultancy also highlights the attention to new sectors with a path such as data centers and life sciences. In the first case, the data center segment offers good opportunities for portfolio diversification and Savills points out that investors are also increasingly aware of their environmental footprint. As for life sciences, the potential is significant for those who know the know-how of this sector of activity, which creates an ecosystem and needs other uses in the knowledge hubs around it.

As the report concludes, in addition to the deployment of investment focused on types of core assets and income generators in sectors such as logistics, prime offices and residential in 2021, there has been a strong demand for opportunities in new developments and rehabilitations. In 2022, inflation -although it may be temporary- will be one of the obstacles to overcome and in fact, according to Savills, some real estate sectors can offer a good hedge against inflationary pressures, especially in the case of assets that have shorter lease terms or where rents are tied to the CPI.