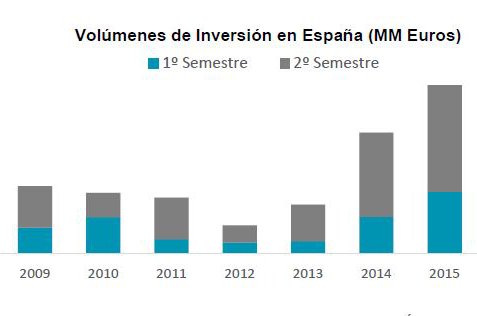

In the first nine months of the year, investment volume stood at approximately 5,500 million euros (not including the offices portfolio transferred from Banco Santander, BBVA million euros), 25% lower than the same period of 2015, but in line with the first nine months of 2014, according to the latest report Mercados de Inversión en España (Investment Markets in Spain) published by Cushman & Wakefield.

The average volume of operations was considerably reduced, at about 40 million euros, compared to 55 million in 2015 and an average of 50 million euros in the last decade. The increase in activity by private investors in the market partially explains this tendency.

The report from C&W reflects that in 2016 the volume of investments by national investors is considerably less than last year (43% compared to 57% in 2015). “This is mainly due to the current strategy of consolidation of the SOCIMI, which has reduced investment activity, and which are now more centred in the management of their portfolios”, explains the consultancy.

After a sharp fall in yield in 2015, the tendency has continued throughout this year, although with less intensity. Retail assets recorded the greatest drop in profit led by those in prime commercial locations.

Retail, investment ‘star”

Investment activities have centred in large measure on the retail sector, with 44% of total investment volume. The main operations were the sale of the Eroski holdings, and the sale of shopping centres such Diagonal Mar, Gran Vía in Vigo, ABC Serrano, L´Aljuby Festival Park, among others.

The office sector has had smaller results, just 25% and below the average for the last ten years, which was 30%. During the third trimester, investment in office assets increased from 18% to 26%. This sector recovery in the 3T is due to large transactions like the purchase of the Parque Empresarial Las Mercedes by Oaktreeo and the purchase of Torre Foster by Pontegadea.

The industrial and hotel sectors continue to attract investment, with 8% and 10% of cash flows, respectively. The hotel sector continues to grow - the purchase of the Hotel Skipperen Barcelona, was the second largest operation of the trimester in Barcelona, after the aforementioned Diagonal Mar.

The alternative investment sector represents 6% of total investment volume. The biggest operation was the purchase of a portfolio of parking plazas at national level by a North American investor for 300 million euros. It was one of the largest transactions of the year,

Land and Development operations are not included in reported volumes, although they have attracted 650 million euros investment in the Spanish real estate market during the first nine months of 2016.