According to Expansión, who revealed the news, after the offer was confirmed, Intu Properties shares climbed more than 12% at the London Stock Exchange. Intu’s board still hasn’t confirmed whether it will accept the offer, but they made available the company’s books so that the consortium could analyse them in depth before advancing with the takeover bid.

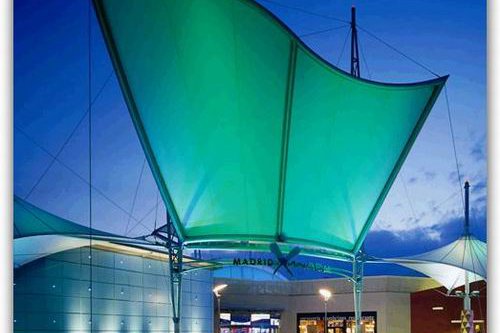

Intu owns 50% of three major shopping centres and stores in Spain, among which Xanadú, in Madrid, Puerto Venecia, in Zaragoza and Parque Principado, in Asturias, which it acquired between 2014 and 2017 for 1.100 million euro. Pension fund SPPIB owns the remaining 50% of the shopping centres in Asturias and Zaragoza, and American fund TH Real Estate owns the other half of Xanadú. They also have other projects in development in Malaga, Vigo and Valencia worth 1.500 million euro.

Market sources mentioned by the Spanish newspaper believe that the takeover of half the shopping centres might activate clauses which would allow these (sódios) to sell their share or make an offer to buy 100% of the assets.