36 // iberian.propery / 2017

dossier// ISSUE: TOP IBERIAN Investors

Global Value Invested

(million €) - estimated Type

Country of Origin

1

Merlin Properties Socimi

769,4

Socimi & REITS

Spain

2 CBRE GI

545,4

Managers & Funds

US

3 Foncière des Regions

535

Socimi & REITS

France

4 Deutsche AM

530

Managers & Funds

Germany

4 Intu

530

Socimi & REITS

Spain / UK

5 Pontegadea

490

Private Equity & Insurance Companies & Pension Funds

Spain

6 Axiare

453,3

Socimi & REITS

Spain

7 Oaktree and Freo

330

Managers & Funds

US

8 Spanish Association of

Rural Savings Banks

320

Private Equity & Insurance Companies & Pension Funds

Spain

9 Lar España Real Estate

Socimi

298,2

Socimi & REITS

Spain

10 Trajano Iberia Socimi

288,1

Socimi & REITS

Spain

11 TH Real Estate

285,5

Managers & Funds

US

12 SG Trust

285

Private Equity & Insurance Companies & Pension Funds Singapore / France

13 Baraka Group

274

Private Equity & Insurance Companies & Pension Funds

Spain

14 M&G Real Estate

250,2

Managers & Funds

US

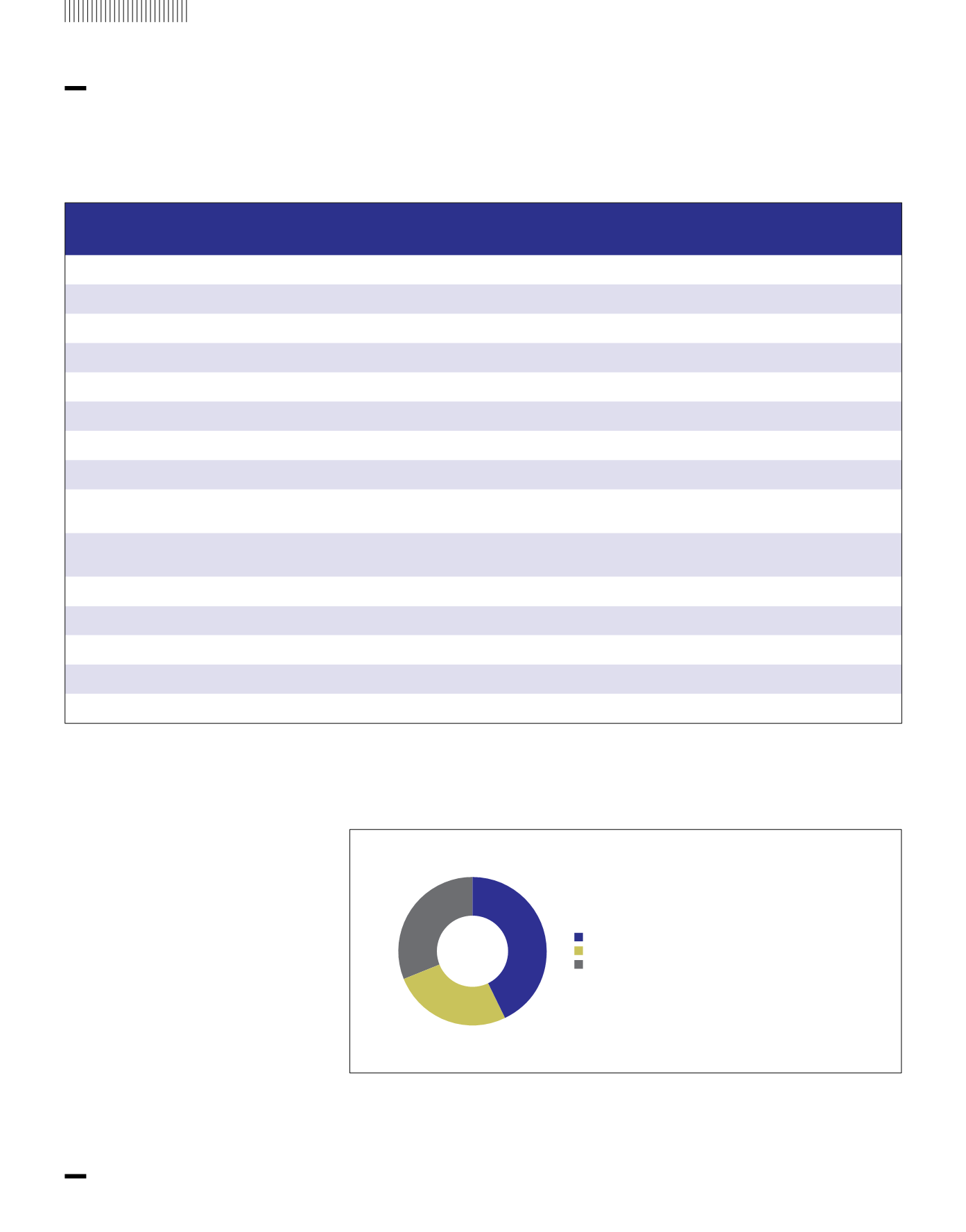

Table 2 – TOP 10 Most Active Investors, Breakdown by Value invested in 2016 /2017 (H1)

source: Iberian Property

In this analysis of the type of entities that made

the most purchases in the last three semesters,

«Asset Managers & Funds»

spent the largest

amount of money on asset acquisitions in Portu-

gal and Spain: 5.83 billion euros, surpassing the

4.15 spent by

«Socimi & REITs»

from the sample.

«Private Equity & Insurance Companies & Pension

Funds»

spent

«only»

3.45 billion euros (graph 2).

Table 2. source: Iberian Property

Most Active Investors 2016/H1 2017

Breakdown by Value Invested / Type of Investor

Asset Managers & Funds

Private Equity & Insurance Companies & Pension Funds

Socimis & REIT’s

43%

31%

26%