Real estate leaders are optimistic about the recovery even in an inflation scenario

The main leaders of the real estate sector have met this Monday, the 28th of March, where they have highlighted the current signs of strength of the sector, based on the data and on the forecast of approaching pre-pandemic values before the end of 2022. However, it was also discussed that the current instability caused by the war in Ukraine, especially if it continues over time, could have a negative impact on the recovery of the economic activity. Inflation and high energy prices were other addressed concerns.

The opening of the IV Iberian REIT & Listed Conference was carried out by the director of Iberian Property, Antonio Gil Machado, who valued the importance of gatherings of this kind to keep the sector at the forefront. The event took place in Madrid, at the Westin Palace Hotel, and counted with the attendance of more than 200 participants.

The welcome proceeded with the CEO of EPRA (European Public Real Estate Association), Dominique Moerenhout, who highlighted that all sectors have been recovering and that we are already at pre-pandemic levels. "The restructuring of the sector's debt has been very positive and has contributed a lot to improving the situation". In a keynote speech, Dominique Moerenhout referred that there are very good signs for socimis, and he recalled that Spain had a better performance than the Eurozone, during 2021. Besides the recovery, the real estate sector has now other challenges, and the conference was stage to the discussion of topics such as ESG, inflation, the current geopolitical panorama, and much more!

The real estate sector, a refuge value

Benjamín Gómez, director of capital markets at BNP Paribas Real Estate, explained that “the recovery has been very notable in almost all sectors in 2021, and in 2022 it should be better.” Spain follows the same trend as Europe and in 2021 there was already a 29% increase of the investment volume in Spain, when compared to the previous year. For BNP Paribas, the forecast for 2022 sets the tone for a new record, and Benjamín López believes that the current volatility of the investment market together with the low returns offered by other products contribute for real estate becoming once again “a refuge value in the face of global uncertainty”.

Guillermo Astorqui, Head of Real Estate Finance, BNP Paribas Real Estate, brought up for analysis the yield compression, which as he explained have different impacts according to the sector. Regarding offices, Guillermo Astorqui identifies a market activation, but conditions are improving mainly for prime locations, the secondary ones are still behind; for logistics the appetite remains high; and in retail “we are waiting for a big operation to see at what point the levels of returns are”.

Investment volume in Spain grew 29% in 2021

What’s next? The recovery route after 2 pandemic years

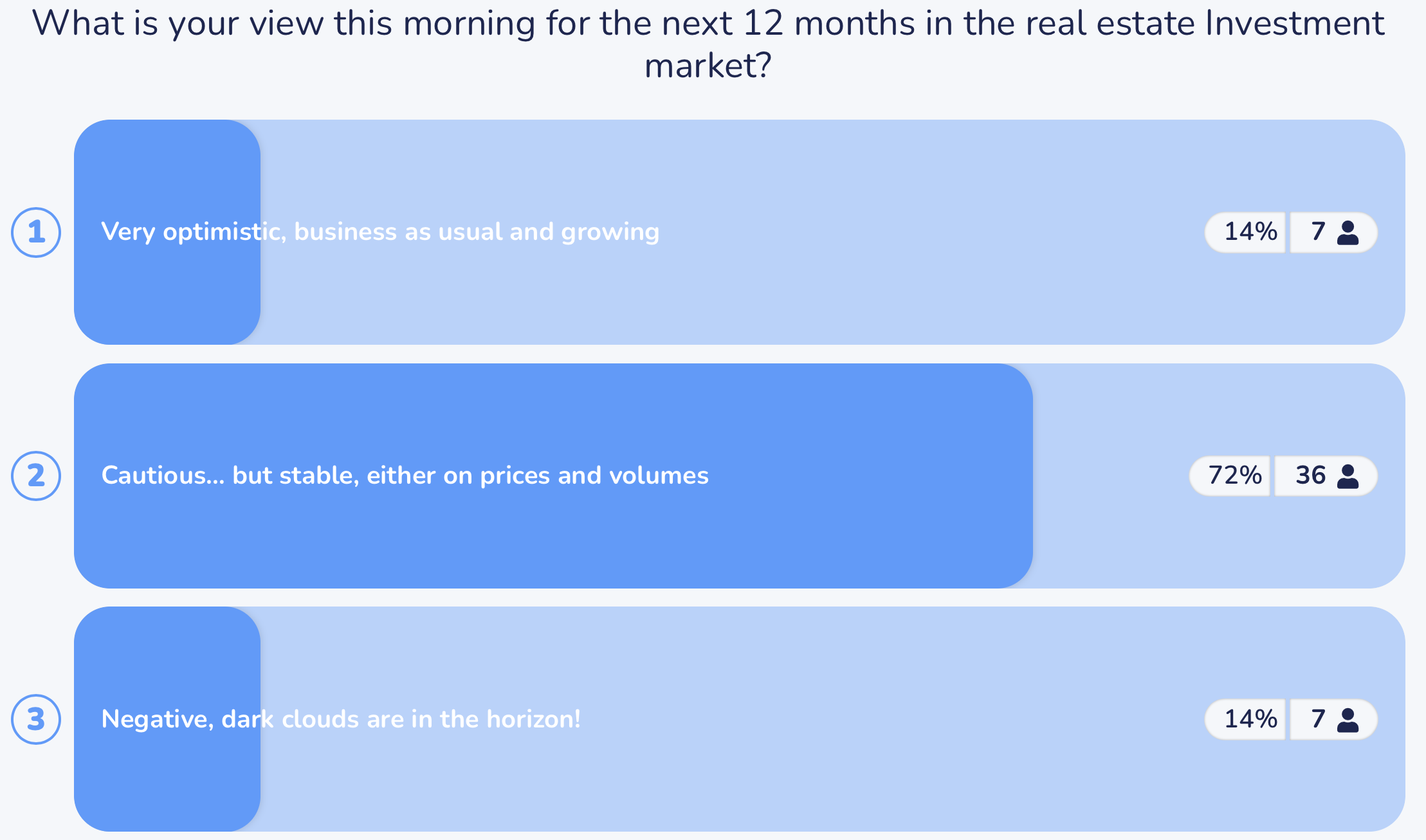

Launching the first round-table discussion of the IV Iberian REIT & Listed Conference, Antonio Gil Machado, director of Iberian Property, began to sense what was the general feeling of the audience for the next 12 months in the real estate investment market, to which most participants – through an online voting platform – have positioned themselves in a cautious perspective, although stable both in prices and volumes.

As for the panel of experts composed by: Miguel Pereda, Chairman, Grupo Lar & Vice Chairman, Lar España; Ismael Clemente, CEO, Merlin Properties; Pere Viñolas, CEO, Colonial; and David Martínez, CEO, AEDAS Homes; Antonio Gil Machado, moderator of the session, had another question reserved – specifically, what was the strategy followed in the last two years, and whether it remains the same for the future.

Pere Viñolas, CEO of Colonial, who this coming April will be the new president of the European association of real estate investment companies EPRA, shared with the audience that that “there was no big recession in real estate; there are above all changes in the way of seeing work. And to adapt ourselves we focused on prime, that in our understanding is not only location, but also sustainability, efficiency, and the experience we can provide…basically everything that makes a person want to go to the office.” According to the CEO of Colonial, the listed real estate has shown great strength, because even though the economy has fallen by 10%, the companies have shown themselves stable, almost only affecting their share price. Colonial proceeds now to be attentive to what happens with rents, and to see if inflation growth remains as high as the current one persists.

For his part, Miguel Pereda, Vice President of Lar España, shared the same opinion regarding the resilience of the industry, and regarding the retail sector he assured that “retail sales are now higher than in 2019”. The vice president of Lar España recalled that the greatest impact of the pandemic was in shopping centres and, in his own words, “our goal now is for people to return to these spaces safely." One of the factors of main concern for the company is now regarding energy, as “energy is 16 percent of the expenses of a shopping centre and if it doubles, as it is happening, the expenses rise in the same proportion." Despite everything, Miguel Pereda considered the impact still limited.

Residential development turned out to be one of the winners of the last 2 years, and as David Martínez, CEO of AEDAS Homes, explained “covid-19 affected demand at the beginning, but after two months it recovered and has risen again, for example, in high-quality housing”. The last two years have brought new opportunities such as Build to rent, senior housing or affordable housing, and in its own words “there is a bright future”.

Construction costs increased 12%

Inflation and its impact on the recovery

For the time being, David Martínez share that there are some concerns being one of them the construction costs growth, which increased 12%. “We have transferred the increase in prices, but I am concerned if inflation continues or grows”.

Additionally, the delay that is going to occur in the projects was presented as “more serious” and “the effect that it will have in the projects that are being produced now is something to have in mind”. Right now, less than 70,000 units are built when the natural number would be 100,000.

Ismael Clemente, CEO of Merlin Properties, has stated that "we continue to believe that 2022 will be positive, but if the war in Ukraine continues it will affect us and perhaps the greater growth that we expected will be delayed to 2023 or 2024". In his opinion, “the outlook for the year is good, with high levels of profitability in the retail sector”. As explained by the CEO of Merlin Properties, there are no tensions in the valuation of assets in the short term, and “retail has proven to be more resilient and interesting than anyone expected”. Besides that, Ismael Clemente also recalled that “you can transfer inflation if you raise rents” and the forecast for investment volume is positive for retail in 2022 - in France some important transactions have already been closed, and in Spain there has already been one, but soon there will be others.

Opportunity for offices to pay off on green investments

Pere Viñolas, CEO of Colonial, defends that ESG is going to be a must, and it will very soon start paying off in different ways, being the most obvious the premium on the valuations of the assets, which is right around the corner. Another fundamental aspect is the lower cost of capital, and Pere Viñolas shares that Colonial has the clear goal to transform its debt, namely through the issue of green bonds – last month, the socimi became the first Ibex-35 company to have all of its bonds classified as "green", and its intention is that the bonds that are issued in the future be made under the reference framework of green financing.

Prospects for investing in Portugal

Ismael Clemente, CEO of Merlin Properties, defended the importance of the Iberian market and closed the round-table discussion with a strong economic statement – Spain and Portugal should be an integrated real estate market. “The slight differences between the two countries are the same as those between the autonomous communities in Spain and investing in Portugal is relatively easy for Merlin”.

Offices make 25% of property-related pollution in urban areas, second only to the residential sector

Green and sustainable perspective

The conference also analysed the real estate sector from a green and sustainable perspective, and for the leaders present at the IV Iberian REIT & Listed Conference, real estate represents one of the sectors with the greatest potential for reducing carbon emissions. Increasing energy efficiency is an important achievement for caring for the environment in cities. In this sense, experts have highlighted that energy efficiency and adaptation to environmental and sustainable governance (ESG) entail an additional cost increase for companies, but these investments will achieve greater profitability in the future.

Peter Papadakos, Head of European Research, Green Street, presentation shown that offices can make 25% of property-related pollution in urban areas, second only to the residential sector, but although residential is a bigger contributor to Greenhouse Gas (GHC) Emissions, Peter Papadakos explains that “greening office is ‘easier’ politically”.

The Head of European Research at Green Street, shared that the chase for modern and energy efficient office space, coupled with the rising WFH trend, is widening the high vs. average quality gap; and the main conclusion is that Class-A office market rents are likely to bounce back from the pandemic faster than the overall market.

When put in a greater European context, Risk-adjusted returns for Offices (Class-A) provide average returns despite the risk. On the other hand, prospective returns of offer from average quality office assets (Class-B) are dragged down by higher Capex requirements, weak rental prospects, and risk of obsolesce, despite increased defensive “green” Capex considerations.

Sergiy Lesyk, Director, Research and Analytics, FTSE Russell, agreed on the fact that the real estate sector faces material climate risk, inherent to the long-lived, energy-intensive fixed assets within, as buildings account for 28% of global carbon emissions and over half of global electricity usage. And, the regulatory pressure will continue to increase as policy makers look to accelerate low carbon transition.

Sergiy Lesyk believes that Data gaps are still a primary roadblock, and in that sense the FTSE EPRA Nareit Green Indexes intend to provide investors with coverage of real estate companies that exhibit strong sustainability characteristics.

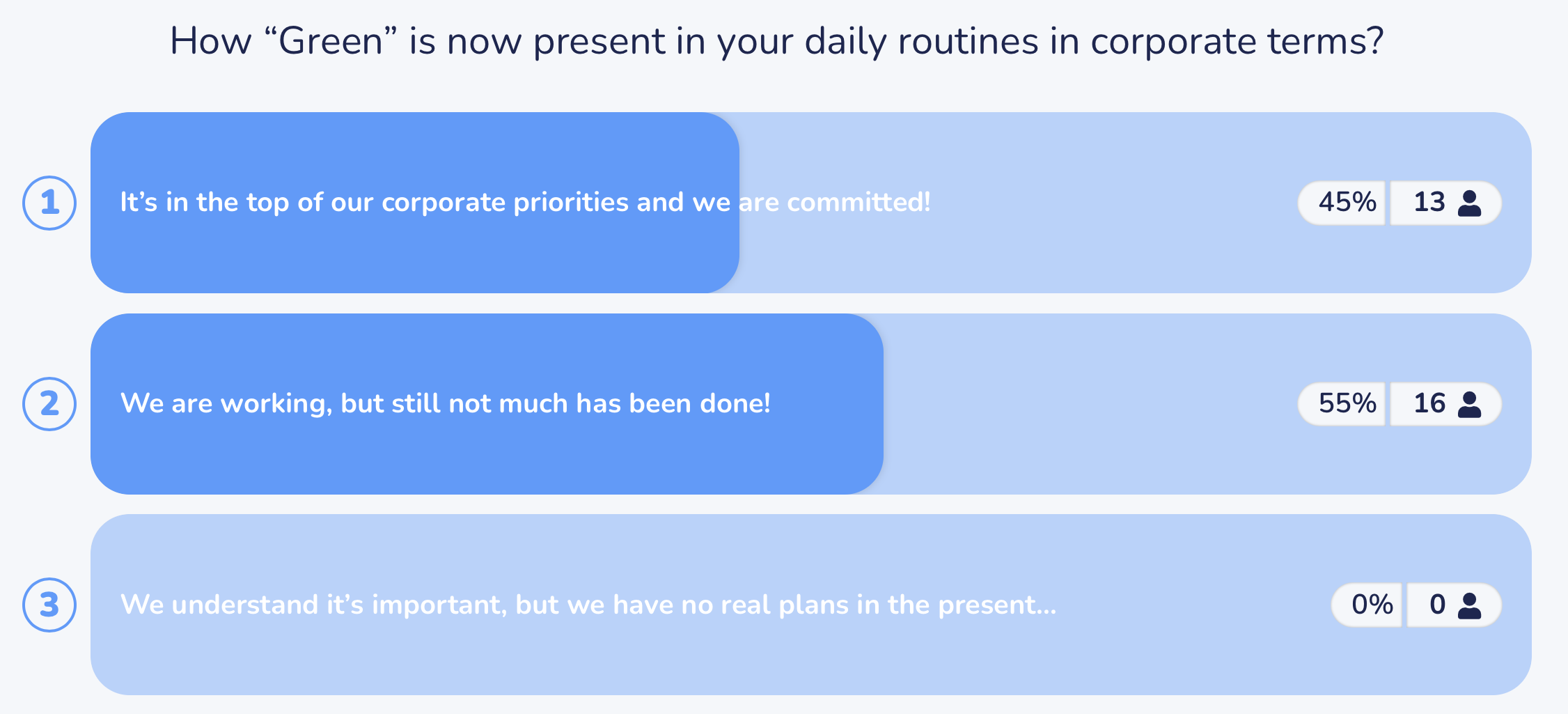

Richard Betts, Director, Real Asset Media, moderated the session round-table discussion that followed, in which the audience was once again asked to share their vision, this time to answer how “Green” is present in their daily routines, in corporate terms. 45% of the voters affirmed that it is already in the top of their corporate priorities.

ESG and Green Investment criteria in a financing decision

Alicia Alvarez, Managing Director, Head of Real Estate Finance Spain. PBB, Deutsche Pfandbriefbank AG, identified the struggle in offering all the data requested to evaluate how green real estate is, specifically in Germany.

Alicia Alvarez commented that “it is essential to understand the building and what we want from the property; we are not only concerned with cash flow but with property”.

For green loans, Deutsche PBB has its own valuation systems – one of the pillars is a certificate of sustainability (20% of the points); 50% of the score is related to energy consumption or energy reduction potential; and the remaining 30% include other issues such as public transport, materials, the heating system, etc. Spain is still a bit behind other countries due to the difficulty of obtaining all the metrics.

Being “Green” is mainly on an asset level? Or is it beyond?

Fernando Ramírez, Director, Merlin Properties, stated that Merlin has already started the path to net zero. “We must see the carbon footprint and the measures that can be taken. It is a thing of each individual asset. We asset managers must include sustainability in our daily activities”. Fernando Ramírez further noted that “the liquidity and appetite for green bonds from institutional funds is very high, but we are still in its infancy, and this will grow exponentially in the coming months”.

David Peña, Investor Relations Director, AEDAS Homes, shares that AEDAS has an ESG plan with 27 concrete actions in the short and long term. It is like a Green Book, which is an internal document to go one step further than is strictly necessary. “People are willing to pay more for more sustainable housing, and the percentage is growing as they see that it is an investment of the future.

According to the Investor relations Director of AEDAS, in 2023 all the houses will have modern construction formulas totally or partially. “New forms bring more quality and customer satisfaction; waste is minimized; the factories of these modules can be a way to end depopulation in the areas where they are implanted; and it can also increase the participation of women in the construction sector”.

Regarding the compliance for a real estate asset deal, Rui de Oliveira Neves, Partner, Morais Leitão, sees ESG as a vital issue to operate and a result of the pressure on regulation in Europe, based on the Green Deal, on issues of the supply chain, and on the value of these large companies. In his opinion, “it is easier to trust the certificate of an independent third party that advises and assesses the ability of a building to be more resistant and consume less energy and water; with regard to materials, they are another of the issues that must be analyzed the most”.

Value, Price and Governance. The challenge for the real estate listed world

Alex Moss, professor at Bayes University in London and director of research at EPRA, initiated the last session of the day arguing that “we are at a historical moment in which the stock market is discounting way too high the real value of the real estate assets in which the Socimis invest”. Although this has happened in the past, the reality is that real estate assets have shown great resilience and have defended their value better than what the markets say, making it a good time to invest in this type of company.

How does the asset valuation compare to the stock market valuation?

According to Alex Moss, history provides us a good vision in terms of stock pricing evolution, and in terms of the differences between countries, type of companies, type of investors and how often does the valuation divergence occur, and how does it remedy itself. But there is one another fundamental question that history by itself cannot properly answer: is NAV the right metric for all companies in the listed sector?

Back in 1989-1990 the share price and the NAV for the EPRA European REIT index presented a clear correlation before the global financial crisis which caused a huge premium (and then the decline), but up till 2015, it was very closely correlated. Over a three-year period, 80% of the returns are driven by the returns of the underlying assets. However, in 2015/2016 it started to decouple.

Firstly, because the listed sector was looking at the outlook of e-commerce in this impact upon shopping centres since the equity market is always looking two years ahead and they started to mark down the valuations of shopping centre companies probably two and a half to three years ahead of the valuations being written down by the property values. At that stage shopping centres represented a significant percentage of the output index, so the impact on the index was enormous.

The second reason for the decoupling was domestic issues such as Brexit which saw a divergence - at the time of the unexpected EU referendum the share price of the best companies in the UK were off over 30% overnight, when in reality the direct market continued to boom; so we can see how the pricing of these things can be very different, and the equity market is not always right about this.

Typically, when the gap between the two prices gets too great, we get what Alex Moss called “public to private”, and that means that private companies stop biding for public assets and they acquire instead stakes in listed companies, because they are trading at a huge discount.

“Fundamentally it's not the sector players who are setting the prices at the moment, hence the disconnect”

Alex Moss highlighted that not all people who invest in listed real estate are property investors. In his view, there are three different types of investors in listed real estate, and they have different impacts on the price.

The first are productive companies, or “active real estate specialists” – they are very concerned about performance relative to a benchmark, a protected company or private company, and very concerned about the relative value the listed company has versus the assets.

Also important for price setting, the second group is made by “active generalists” – those could be legal and general prudential general selective funds who come into this sector for periods of time and then go out of the sector.

And, the third group of investors, is called “passive funds” – these other people have ETFs and they have been by far the biggest growth area in terms of assets under management.

Important to note that of those three groups it's only the first one that's acutely concerned with the pricing relative to the underlying assets. The following example was presented: “if you want to get into the logistics market, and you were to see a company trading at a discount to NAV in logistics you could buy that, as opposed to buying in the market for an active fund manager. So, Alex Moss reinforced that “fundamentally it's not the sector players who are setting the prices at the moment, hence the disconnect”.

Antonio Gil Machado questioned the director of research at EPRA whether the daily news, like the war in Ukraine, are affecting way too much the shares pricing in real estate, or in other words if there is an increased disconnecting alpha of each sector.

Alex Moss, understands that the correlation with the equity market is very high in the short-term, and he comments that we are absolutely affected by geopolitical issues, general market issues, covid, etc. However, “in the longer term, it is down to the selection of the companies, it is down to the alpha generation of the management teams, and the returns will be very much correlated to the underlying asset returns”.

Alex Moss went further and explained that “it was almost impossible for a shopping centre company to have an outperforming share price from 2016 onwards, because the value of the assets was defining; the opposite applies to any logistics company, it was almost impossible to have underperformed because the value of logistics was going up magically”. In the end, over three years’ time economics are always beating the financial data.

PRESENTATIONS (pdf):

- Dominique Moerenhout, CEO of EPRA (European Public Real Estate Association)

- Benjamín Gómez, Director of Capital Markets at BNP Paribas Real Estate

- Peter Papadakos, Head of European Research at Green Street

- Sergiy Lesyk, Director of Research and Analytics at FTSE Russell

- Alex Moss, Chair of the EPRA Research Committee