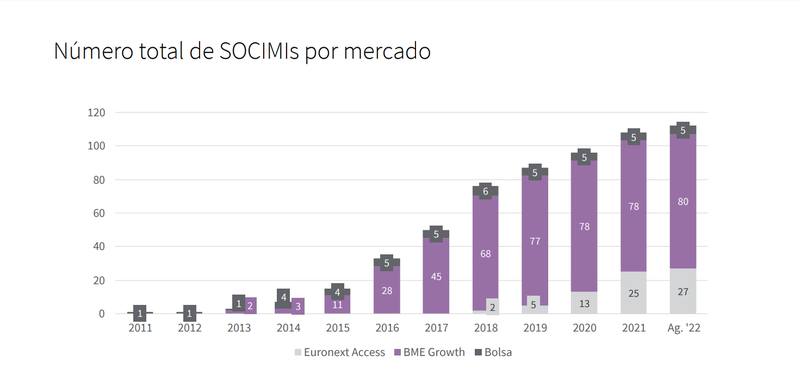

The Spanish market for listed real estate investment trusts (SOCIMIs) has experienced significant growth and development since its inception a decade ago and has contributed to the dynamisation and professionalisation of the real estate market. At the end of September 2022, 112 SOCIMIs were listed on the stock exchange, compared to only three in 2013, according to the report 'SOCIMIs: ten years since their creation' prepared by JLL.

At the end of September 2022, the combined stock market value of the 112 Spanish listed real estate investment trusts (Sociedades Anónimas Cotizadas de Inversión Inmobiliaria) stood at 23,520 million euros. This figure represents a reduction of 1.4% compared to 2021, when Spanish investment vehicles closed with an aggregate value of €23,858 million. Moreover, since the end of 2019, SOCIMIs have reduced their capitalisation by nearly €1.36 billion.

Total number of Socimis by market - BME, JLL data

The report, which analyses the performance of Spanish SOCIMIs, highlights that the worsening macroeconomic outlook - due to rising inflation and the restrictive policies activated by central banks - is the fundamental cause of the decline in the stock market value of these vehicles.

However, the loss of stock market value is not accompanied by a decline in the Gross Asset Value (GAV) managed by Spanish SOCIMIs. Thus, between 2020 and 2021, the aggregate GAV of the 112 Spanish vehicles has grown by nearly one billion euros; from 53,118 million euros in 2020 to 54,074 million euros at the end of 2021.

This increase is due to the incorporation of new vehicles to the market and not to the revaluation of the portfolios managed by the companies analysed. The study reveals that the volume of net acquisitions in 2021 came close to surpassing pre-pandemic levels, standing at almost 900 million euros.

Silvia Damiano, Director of Valuations at JLL Spain, explained: "The SOCIMI market has developed significantly in recent years, however, the expected economic slowdown raises certain questions. These include refinancing in an environment of rising interest rates, inflation and its impact on rents and income statements; as well as the heterogeneity in the size of the vehicles, which raises the possibility that, in the interests of efficiency, consolidation movements may occur in the sector".

Lower EBITDA and higher volatility in the continuous market

The report highlights that the EBITDA of Spanish SOCIMIs has been suffering since 2019. In total, operating profit before deducting depreciation and amortisation of investment vehicles fell from €1,461 million in 2019 to €1,217 million in 2021. However, the total revenues received by the companies analysed have remained at similar levels between 2019 and 2021, despite the impact of the pandemic.

However, disparities are observed across listing segments. Continuous market SOCIMIs have increased their revenues from €913 million in 2020 to €934 million in 2021, driven by their larger scale, diversification and bargaining power with clients and tenants. The same trend is observed for SOCIMIs listed on Euronext Access. They increased their turnover from 82 million in 2020 to 315 million in 2021: a growth of close to 250% driven by the increase in the number of companies listed on this market under the SOCIMI regime. Meanwhile, the vehicles listed in the BME Growth segment reduced their turnover by around €187 million: from €1,006 million in 2020 to €819 million in 2021.

Despite the growth in revenue of the continuous market vehicles, the higher liquidity and high exposure to changes in investor sentiment have reduced their weight in the aggregate capitalisation of all SOCIMIs. At the end of September 2022, the total value of the companies listed on the continuous market was 7,802 million euros. This figure represents 33.2% of the total of 23,520 million euros capitalised by the 112 Spanish vehicles.

Sectorial specialisation

The analysis details that, as in other comparable countries, the Spanish market has developed a progressive sectorial specialisation of real estate investment companies, which allows operational efficiency to be generated and offers a greater possibility of diversification to potential investors.

By segment, residential SOCIMIs are the majority, grouping together 30 companies dedicated to this sector. They are closely followed by the 26 mixed vehicles, focused on the exploitation of assets of different types. The podium closes with the 16 SOCIMIs dedicated to investing in High Street assets (commercial premises in prime areas). Another relevant segment is that of offices, which concentrates 14 SOCIMIs specialised in this type of asset. On the other hand, 25 additional vehicles operate in the hotel, logistics and healthcare sectors. It is worth noting that in the domestic market only one SOCIMI focuses on investing in other real estate investment companies.

Even so, there has not yet been full specialisation by asset type, as can be seen from the high number of multi-segment companies in the Spanish market.